Answered step by step

Verified Expert Solution

Question

1 Approved Answer

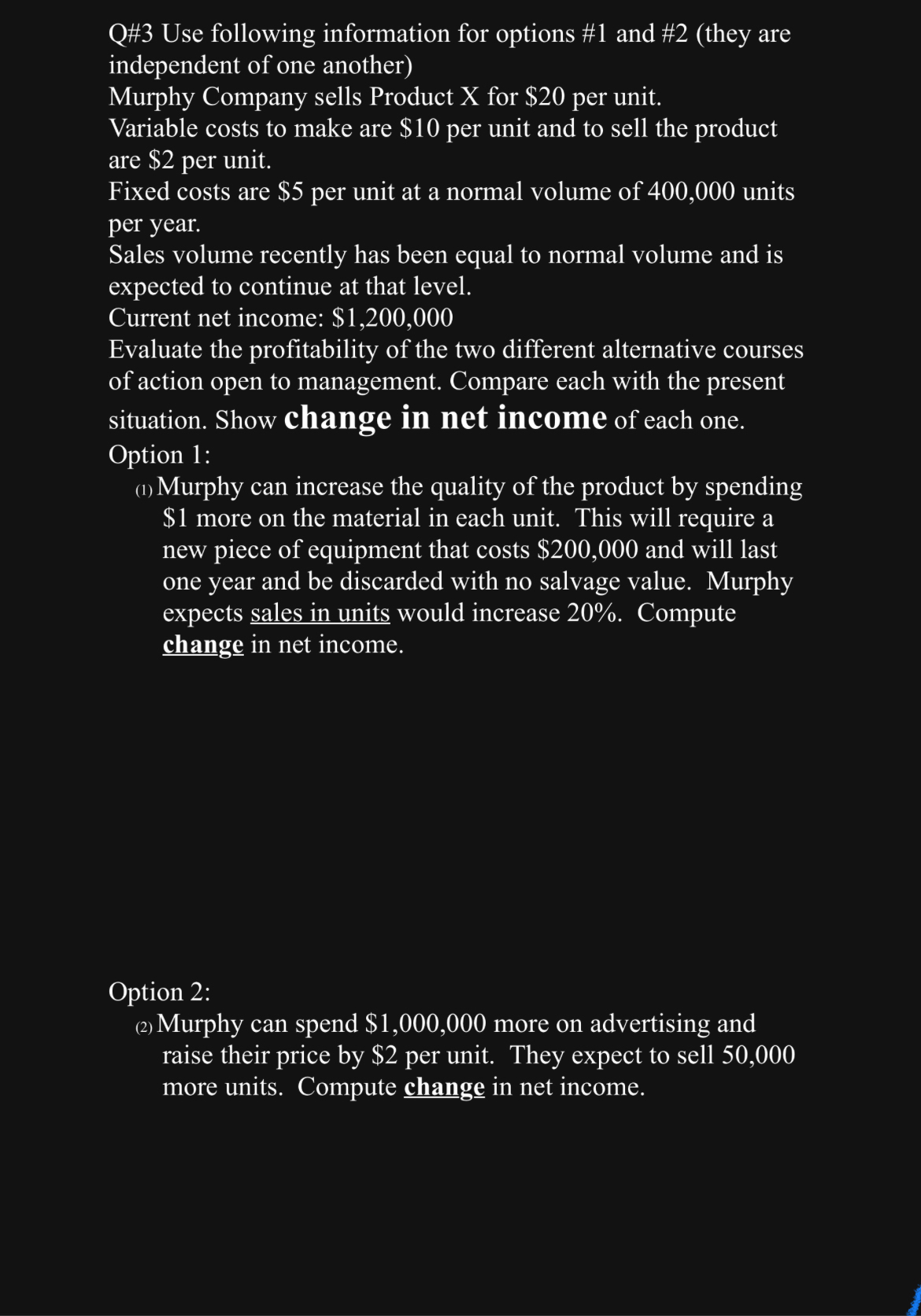

Q#3 Use following information for options #1 and #2 (they are independent of one another) Murphy Company sells Product X for $20 per unit.

Q#3 Use following information for options #1 and #2 (they are independent of one another) Murphy Company sells Product X for $20 per unit. Variable costs to make are $10 per unit and to sell the product are $2 per unit. Fixed costs are $5 per unit at a normal volume of 400,000 units per year. Sales volume recently has been equal to normal volume and is expected to continue at that level. Current net income: $1,200,000 Evaluate the profitability of the two different alternative courses of action open to management. Compare each with the present situation. Show change in net income of each one. Option 1: (1) Murphy can increase the quality of the product by spending $1 more on the material in each unit. This will require a new piece of equipment that costs $200,000 and will last one year and be discarded with no salvage value. Murphy expects sales in units would increase 20%. Compute change in net income. Option 2: (2) Murphy can spend $1,000,000 more on advertising and raise their price by $2 per unit. They expect to sell 50,000 more units. Compute change in net income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Option 1 Increased Quality with Material and Equipment Cost Current Situation per unit Selling price 20 Variable costs 10 manufacturing 2 selling 12 F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started