Answered step by step

Verified Expert Solution

Question

1 Approved Answer

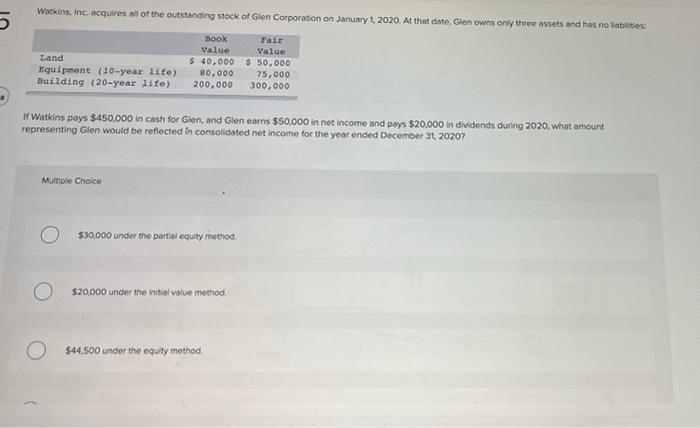

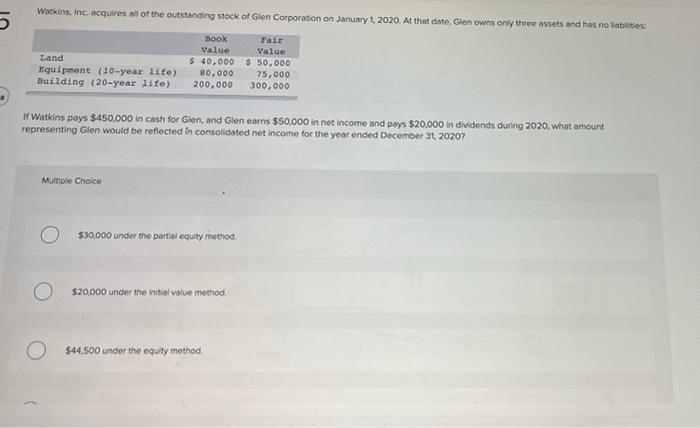

Q.35 Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and

Q.35

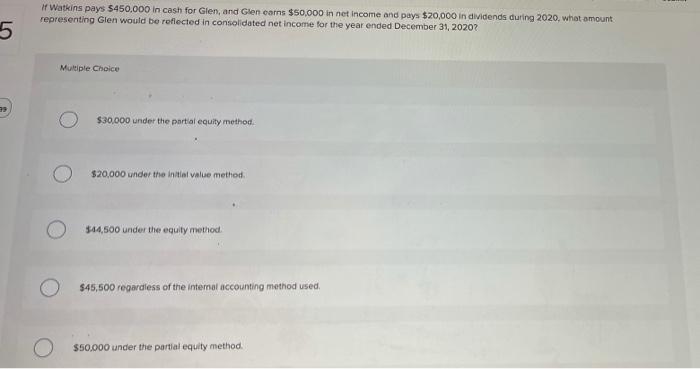

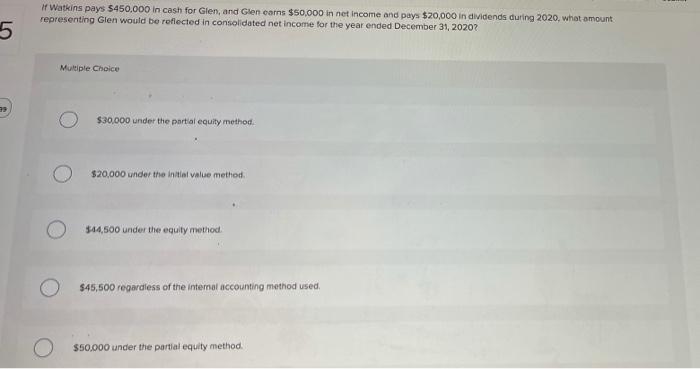

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and has no liabilities Book Yair Value Value Land $ 40,000 $50,000 Equipment (10-year life) 80,000 75,000 Building (20-year life) 200,000 300,000 I Watkins pays $450,000 in cash for Glen, and Glen earns $50,000 in net income and pays $20,000 in dividends during 2020, what amount representing Gion would be reflected in consolidated net income for the year ended December 31, 20207 Multiple Choice $30,000 under the partial equity method O $20,000 under the in tal value method. $44,500 under the equity method If Watkins pays $450,000 in cash for Glen, and Glen carns $50,000 in net income and pay $20,000 in dividends during 2020, what amount representing Glen would be reflected in consolidated net income for the year ended December 31, 2020? 5 Multiple Choice 39 $30,000 under the partial equity method. $20,000 under the initial value method O $44,500 under the equity method $45,500 regardless of the intemal accounting method used $50,000 under the partial equity method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started