Answered step by step

Verified Expert Solution

Question

1 Approved Answer

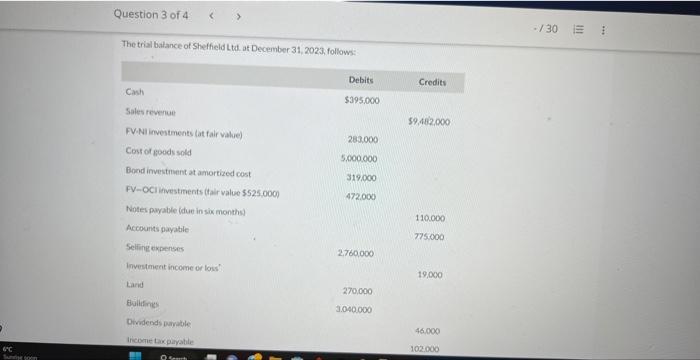

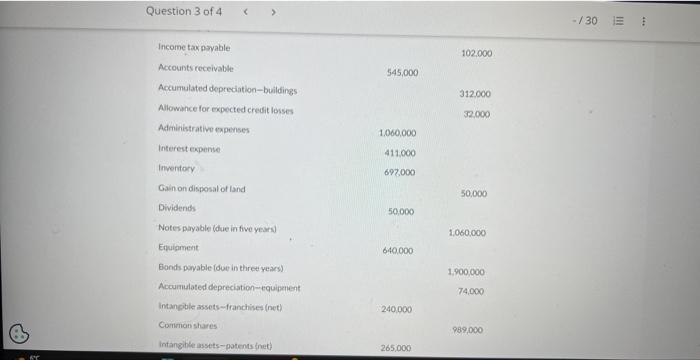

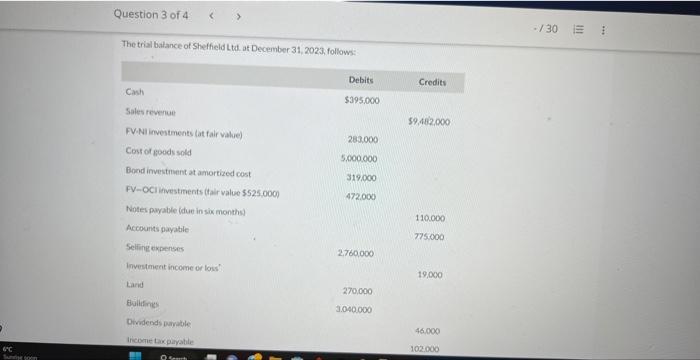

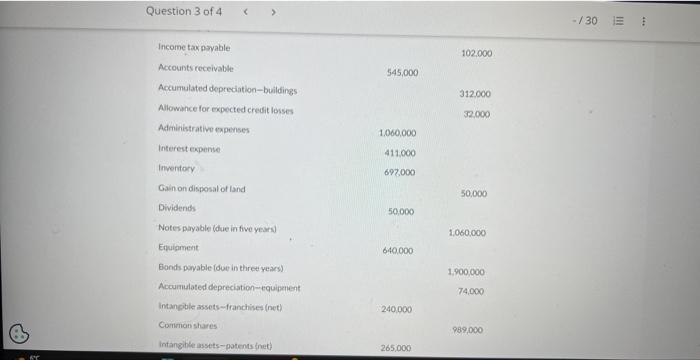

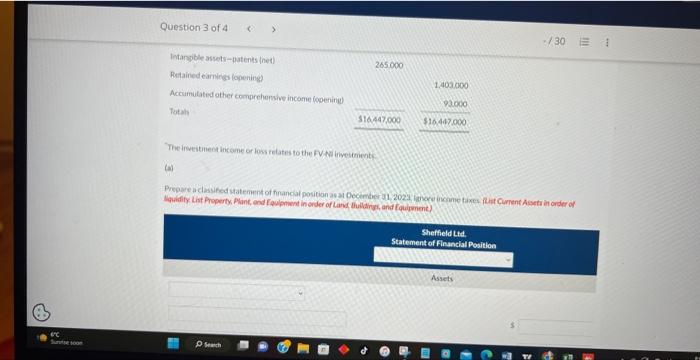

q3f The trial batance of She field Ltat at December 31, 2023, follows: Question 3 of 4 Income tox psvable Accounts receivable 102,000 Accumulated depreciation-buildings

q3f

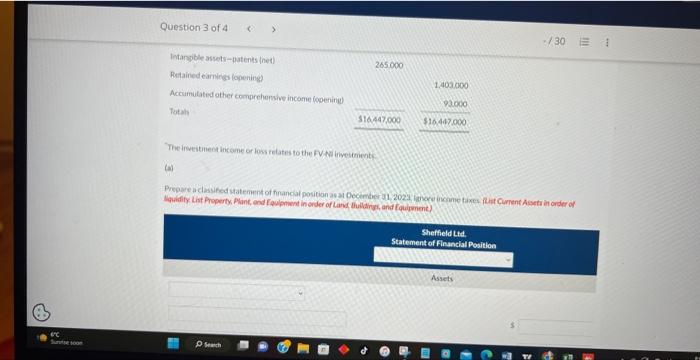

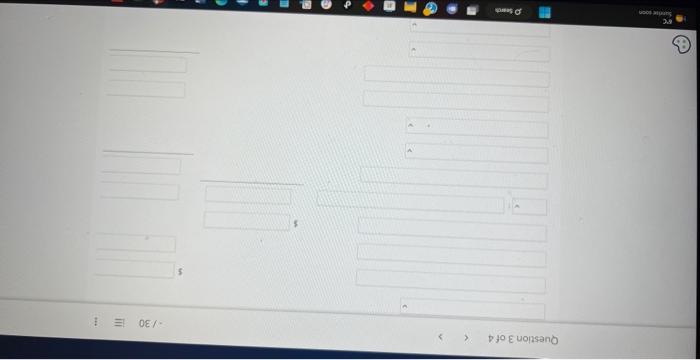

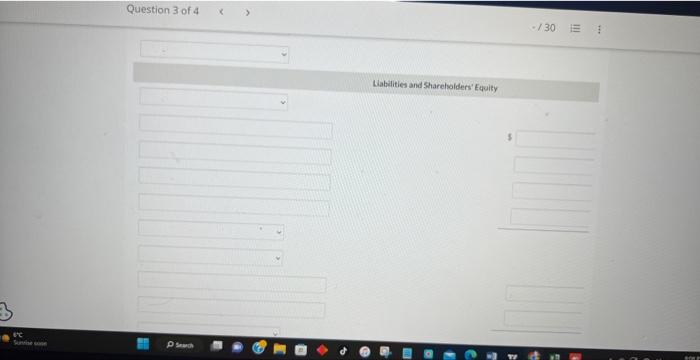

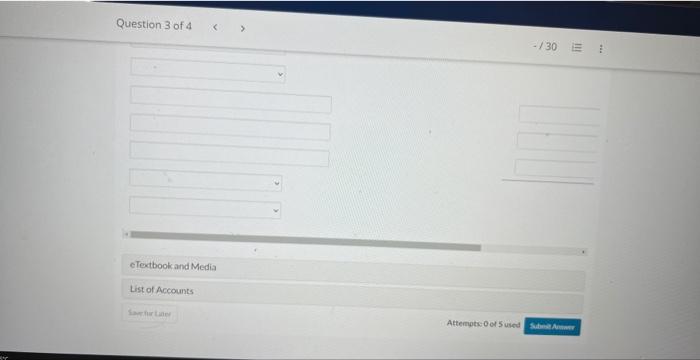

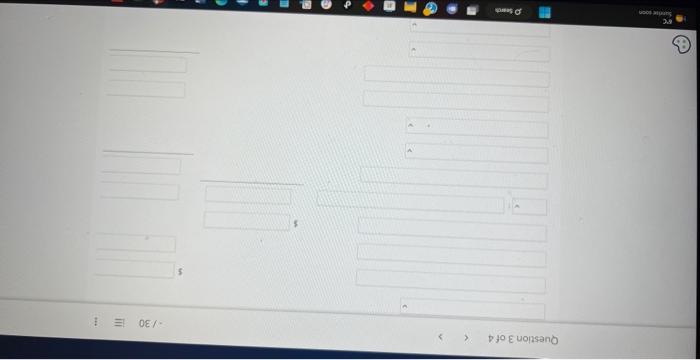

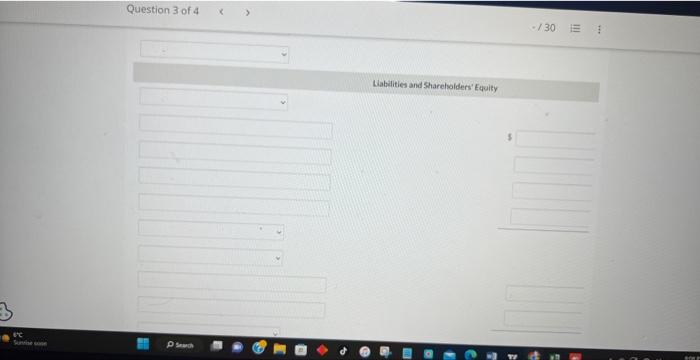

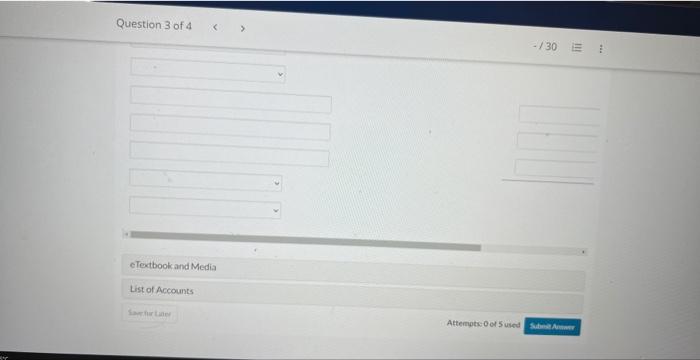

The trial batance of She field Ltat at December 31, 2023, follows: Question 3 of 4 Income tox psvable Accounts receivable 102,000 Accumulated depreciation-buildings 545,000 Alowance for expected credit losses Administrative expenses Interest expense Inventory Gain on disposal of land Dividends 50,000 Notes paryable (due in five years) Equigment 1,060.000 411.000 692.000 130 Eonds payable (due in three years) Accumulated depreciation-equipenent 640.000 intancible assets-franchises (net) 240,000 Common shares 989,000 Intangihle assets-potents ined) 265,000 The ireseituent income or lons felates to the EVWi livoloment? (a) Hquidity, Lhe Property, Plant, and Fqulphient in order of Lane, thullaings, and fquigenene) Question 3 of 4 Liabelities and Shareholders' Equity tet Question 3 of 4 eTectbook and Media List of Accounts Aftemptse of 5 used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started