Answered step by step

Verified Expert Solution

Question

1 Approved Answer

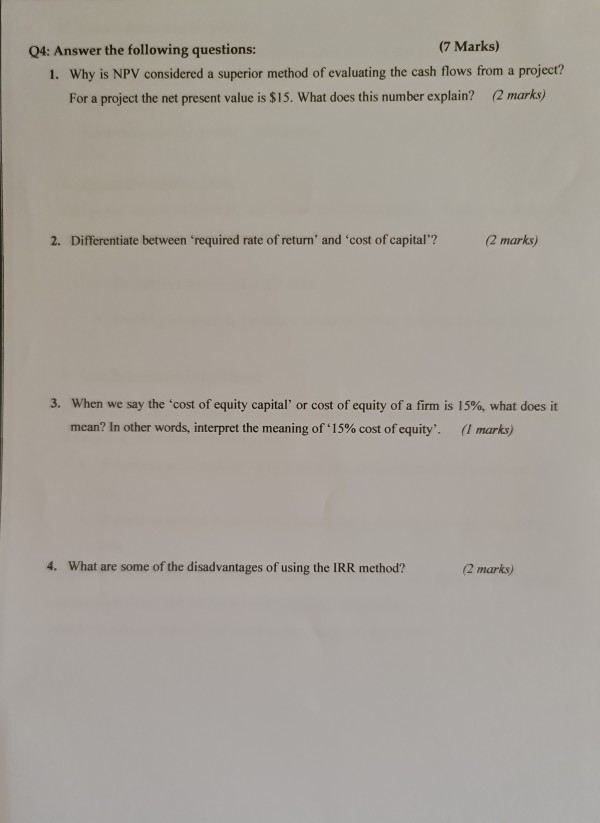

Q4: Answer the following questions: (7 Marks) 1. Why is NPV considered a superior method of evaluating the cash flows from a project? For a

Q4: Answer the following questions: (7 Marks) 1. Why is NPV considered a superior method of evaluating the cash flows from a project? For a project the net present value is $15. What does this number explain? (2 marks) 2. Differentiate between 'required rate of return' and 'cost of capital? (2 marks) 3. When we say the cost of equity capital or cost of equity of a firm is 15%, what does it mean? In other words, interpret the meaning of '15% cost of equity'. (1 marks) 4. What are some of the disadvantages of using the IRR method? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started