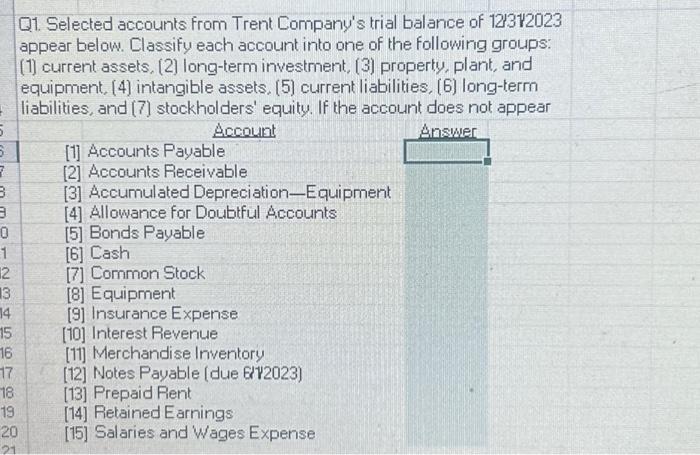

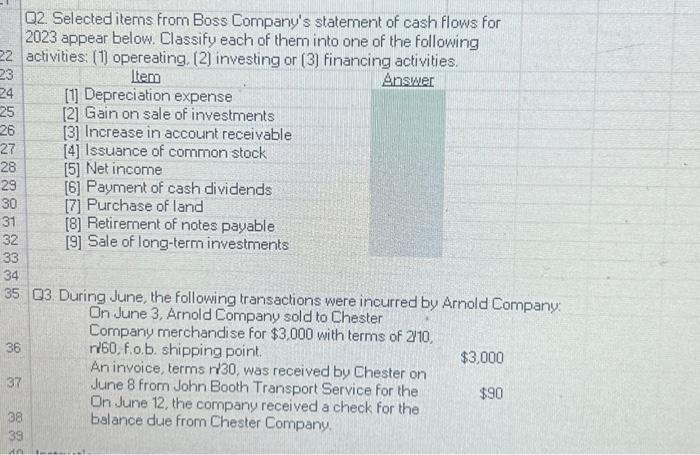

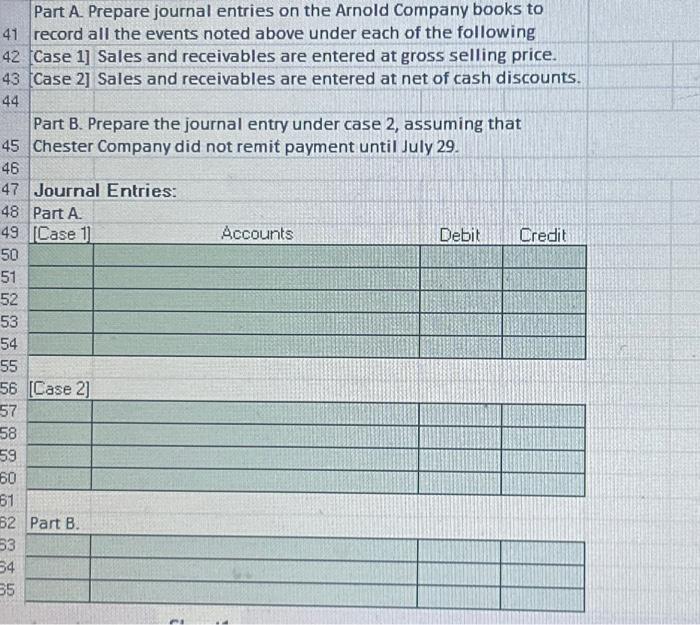

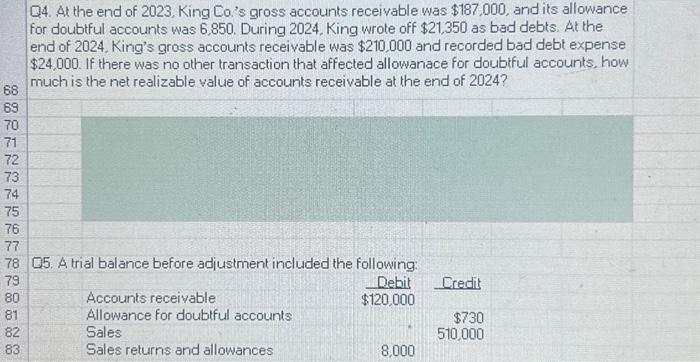

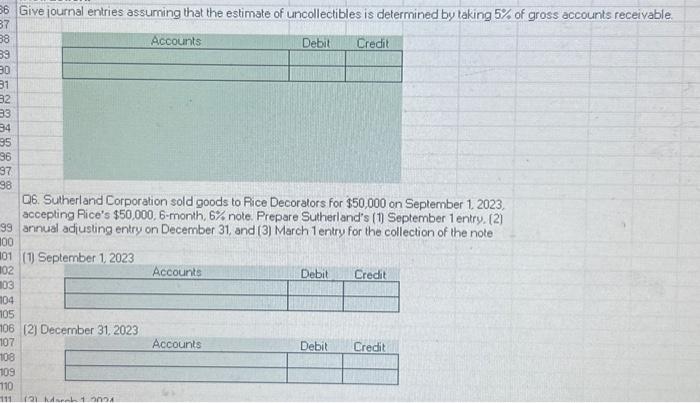

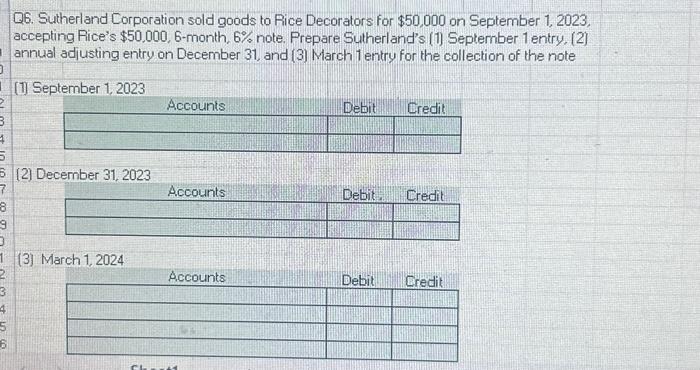

Q4. At the end of 2023 , King Co.'s gross accounts receivable was $187.000, and its allowance for doubtful accounts was 6,850 . During 2024 , King wrote off $21,350 as bad debts. At the end of 2024. King's gross accounts receivable was $210,000 and recorded bad debt expense $24,000. If there was no other transaction that affected allowanace for doubtful accounts, how much is the net realizable value of accounts receivable at the end of 2024 ? Q5. A trial balance before adjustment included the following Q6. Sutherland Corporation sold goods to Rice Decorators for $50,000 on September 1, 2023, accepting Fice's $50,000, 6-month, 6\% note. Prepare Sutherland's (1) September 1 entry. (2) annual adiusting entry on December 31 , and (3) March 1 entry for the collection of the note (1) September 1.2023 (2) December 31.2023 Q6. Sutherland Corporation sold goods to Rice Decorators for $50,000 on September 1,2023 , accepting Fice's $50,000,6-month, 6% note. Prepare Sutherland's (1) September 1 entry. (2) annual adjusting entry on December 31, and (3) March 1 entry for the collection of the note [1] Seftombar 1 anos (2) December 31,2023 (3) March 1, 2024 Q2. Selected items from Boss Company's statement of cash flows for 2023 appear below. Classify each of them into one of the following activities: (1) opereating. (2) investina or (3) financina activities. Q3. During June, the following transactions were incurred by Arnold Company: On June 3, Arnold Company sold to Chester Company merchandise for $3,000 with terms of 210 , r60, f.o.b. shipping point. An invoice, terms 130 , was received by Chester on June 8 from John Booth Transport Service for the On June 12, the company received a check for the $3,000 balance due from Chester Company. $90 Part A. Prepare journal entries on the Arnold Company books to 41 record all the events noted above under each of the following Case 1] Sales and receivables are entered at gross selling price. Case 2] Sales and receivables are entered at net of cash discounts. Part B. Prepare the journal entry under case 2, assuming that Chester Company did not remit payment until July 29. Journal Entries: Part A. [Case 1] Accounts Debit Credit [Case 2] \begin{tabular}{|l|l|l|l|l|} \hline & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & \\ \hline \end{tabular} Part B. \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Q1. Selected accounts from Trent Company's trial balance of 121312023 appear below. Classify each account into one of the following groups: (1) current assets, (2) long-term investment, (3) property, plant, and equipment, (4) intangible assets. (5) current liabilities, (6) long-term liabilities, and (7) stockholders' equity. If the account does not appear