Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4 O Bot Get Add-ins D Table Recommended Table Illustrations My Add-ins - Recommended Pivot Tables Charts Tables Add-ins SIGN IN TO OFFICE It looks

Q4

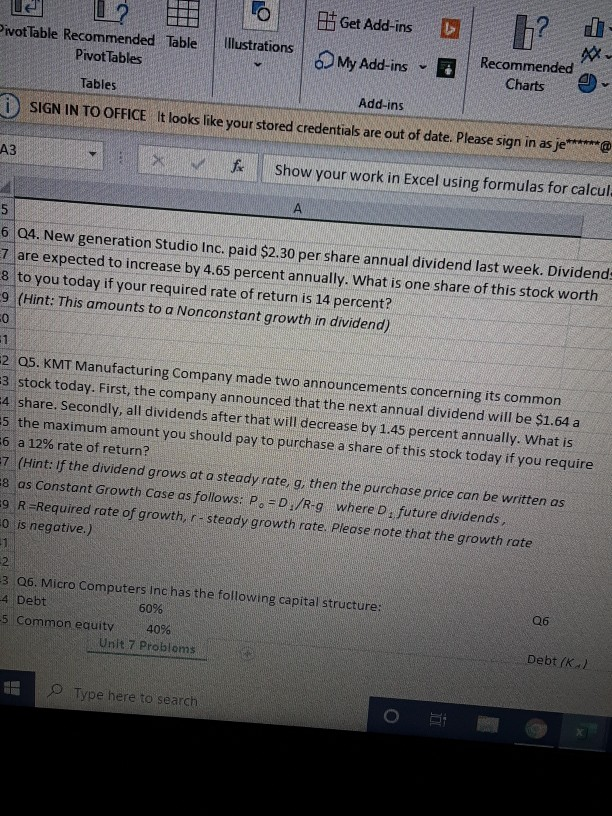

O Bot Get Add-ins D Table Recommended Table Illustrations My Add-ins - Recommended Pivot Tables Charts Tables Add-ins SIGN IN TO OFFICE It looks like your stored credentials are out of date. Please sign in as je******@ fix Show your work in Excel using formulas for calcul Q4. New generation Studio Inc. paid $2.30 per share annual dividend last week. Dividend are expected to increase by 4.65 percent annually. What is one share of this stock worth to you today if your required rate of return is 14 percent? (Hint: This amounts to a Nonconstant growth in dividend) 2 05. KMT Manufacturing Company made two announcements concerning its common 3 stock today. First, the company announced that the next annual dividend will be $1.64 a 4 share. Secondly, all dividends after that will decrease by 1.45 percent annually. What is 5 the maximum amount you should pay to purchase a share of this stock today if you require 6 a 12% rate of return? 7. (Hint: if the dividend grows at a steady rate, g, then the purchase price can be written as 8 as Constant Growth Case as follows: P.-D./R-9 where D, future dividends, 9. R=Required rate of growth, r- steady growth rate. Please note that the growth rate is negative.) Q6 3Q6. Micro Computers Inc has the following capital structure: Debt 60% 5 Common equity 40% Unit 7 Problems Debt /K/ Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started