Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q4 part abc Rocky River Company is a price-taker and uses target pricing. Refer to the following information: Production volume 601,000 units per year Market

q4 part abc

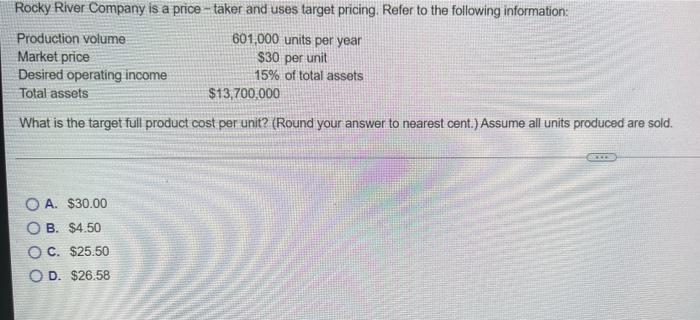

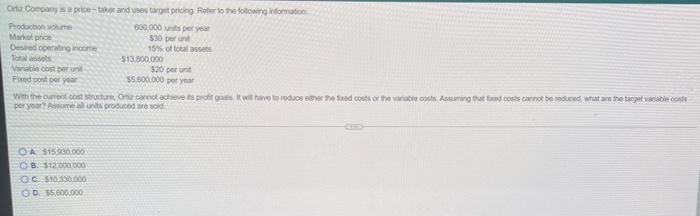

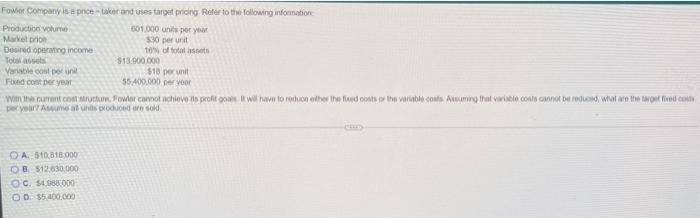

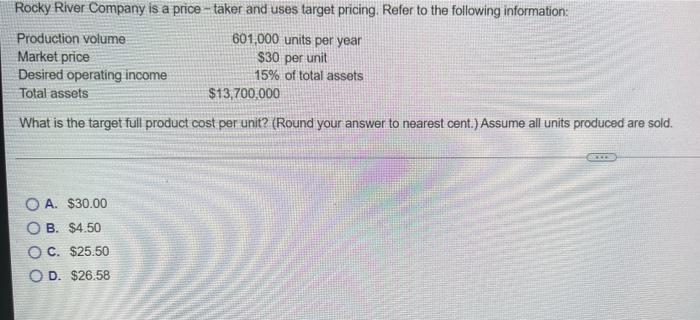

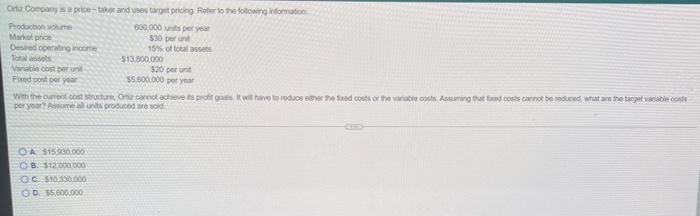

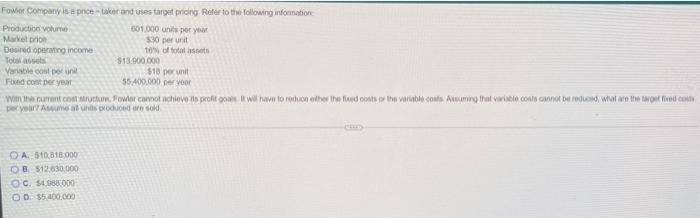

Rocky River Company is a price-taker and uses target pricing. Refer to the following information: Production volume 601,000 units per year Market price $30 per unit Desired operating income 15% of total assets Total assets $13,700.000 What is the target full product cost per unit? (Round your answer to nearest cent.) Assume all units produced are sold. O A. $30.00 O B. $4.50 O C. $25.50 OD. $26.58 Orta. Com price-taker and use to pricing Ploter to the following information Producho volume 600.000 per you Marketpro 530 per un Descopera income 15% of total assets Total 513.800.000 Variable cost per un $20 pont Pored ostry 55.600.000 per year With the current constructum, chiave its prolo it will have to reduce the red color thematics Assung con cannot be reduced what are the tape variable code peryan? A nis produced resold OA 515030,000 OB. 512.000.000 QC-510 330.000 OD 35.000.000 Fowler Company is a price-taker and uses target pricing Refer to the following information Production Volume 301 000 units per year -Market prion 330 per unit Desired operating income 10% of totalt To $13.000.000 Variable cost per un $18 per unit Fixed cost per year 55.400.000 per year We current coutum. Fowler cannot achieve to profit it will have to run the the dots the consuming that is connerodd wat are the two com Der Vorwah podudarnok A 510,818000 OB 512,630,000 C. SIDO OD 35.400,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started