Q40-45

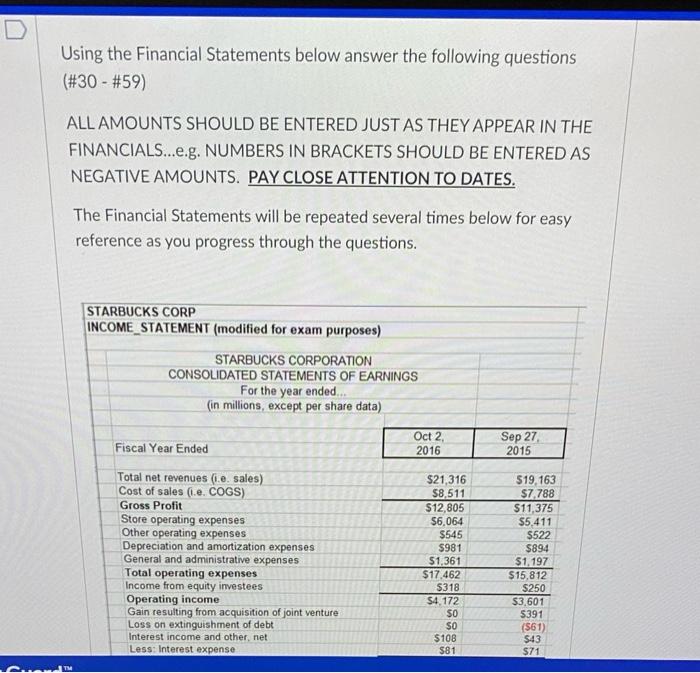

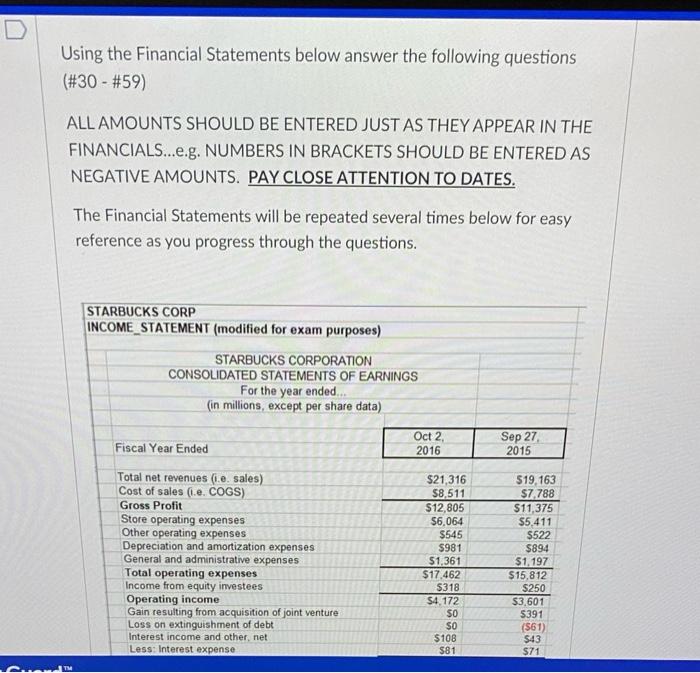

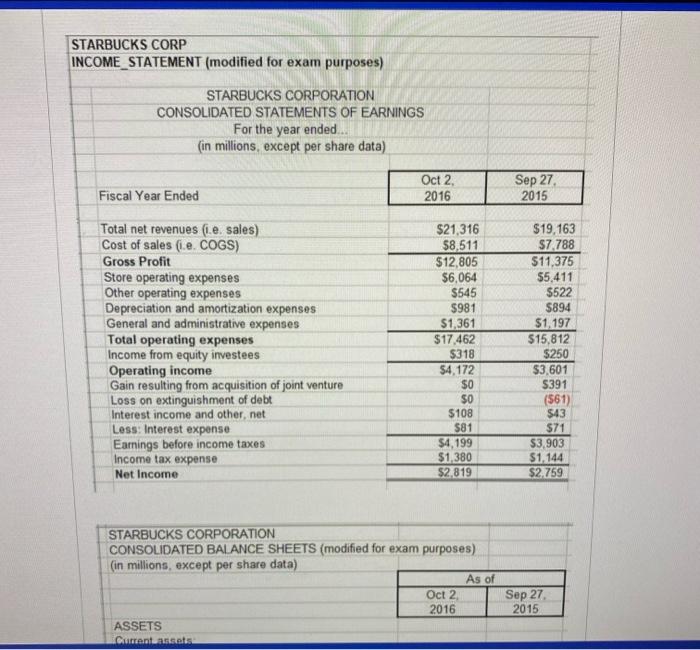

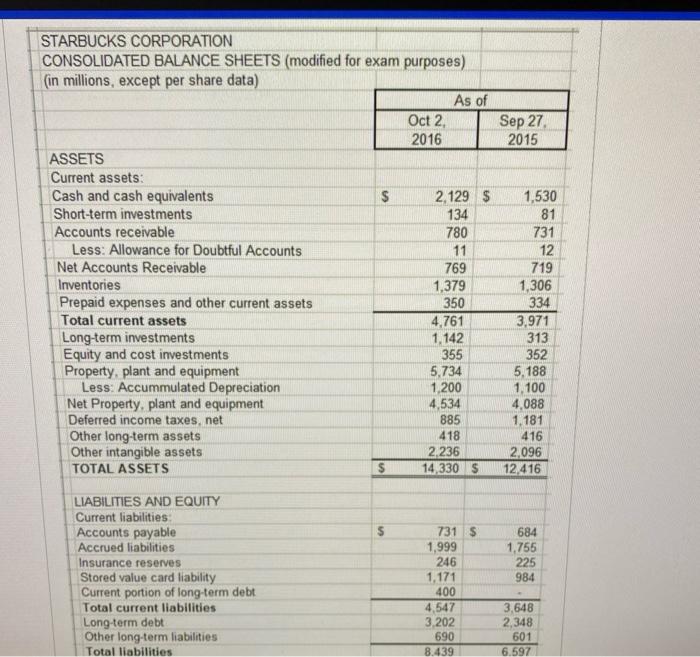

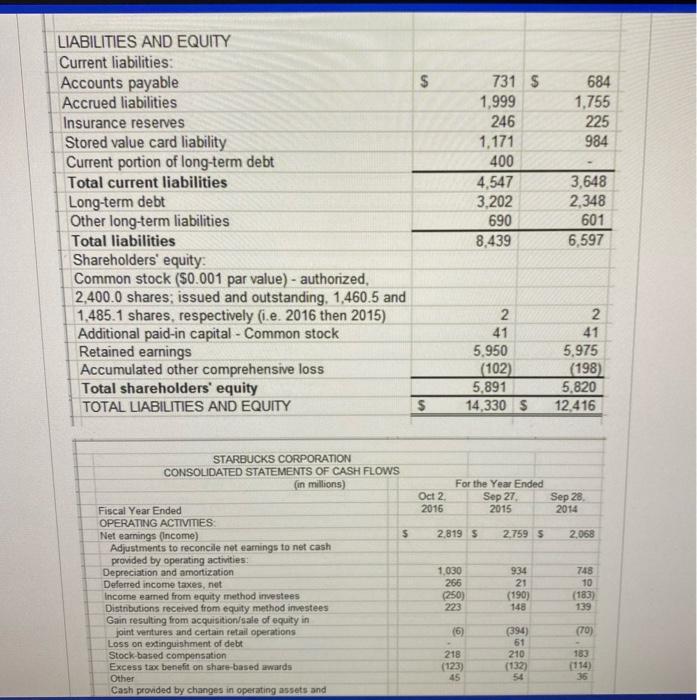

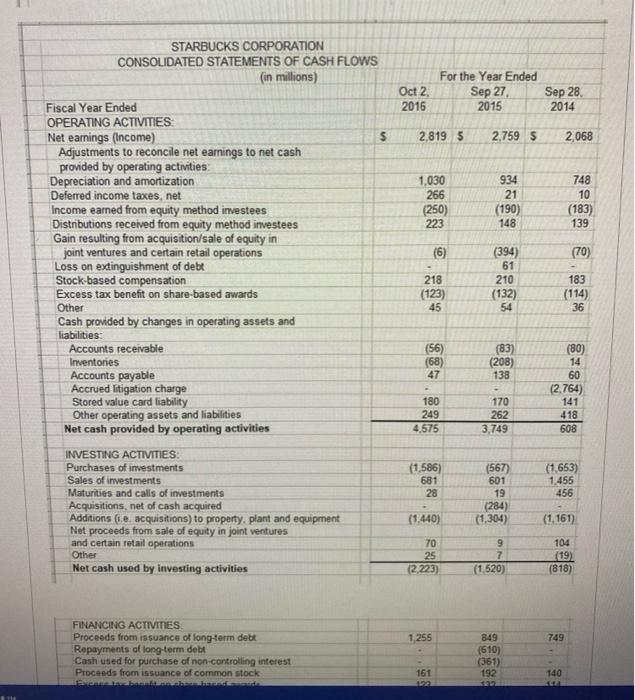

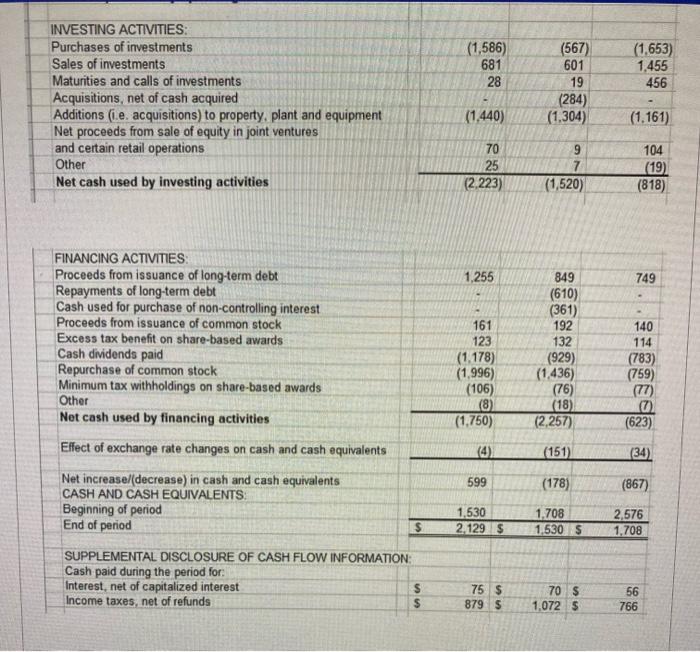

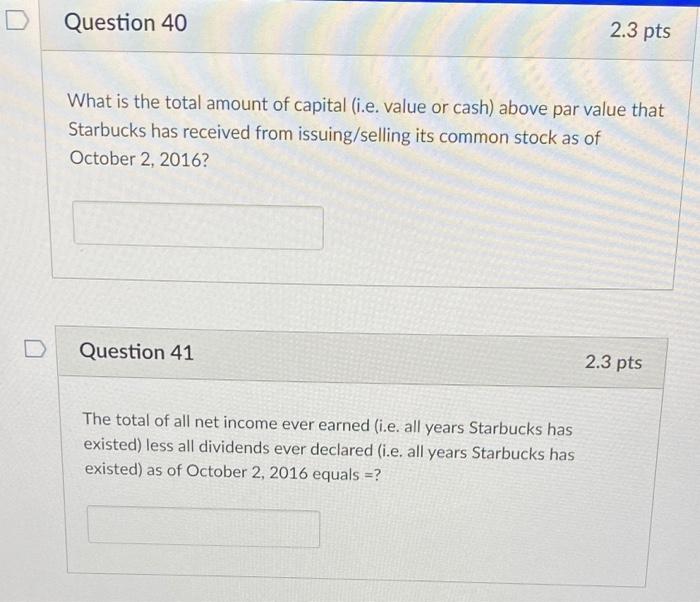

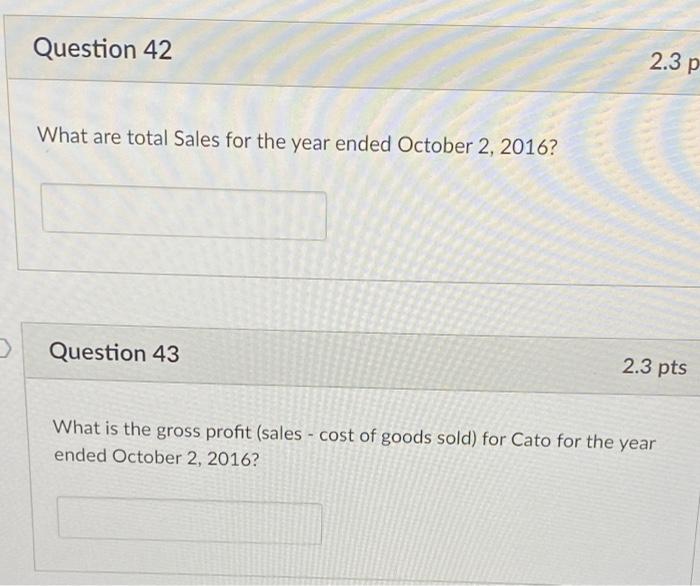

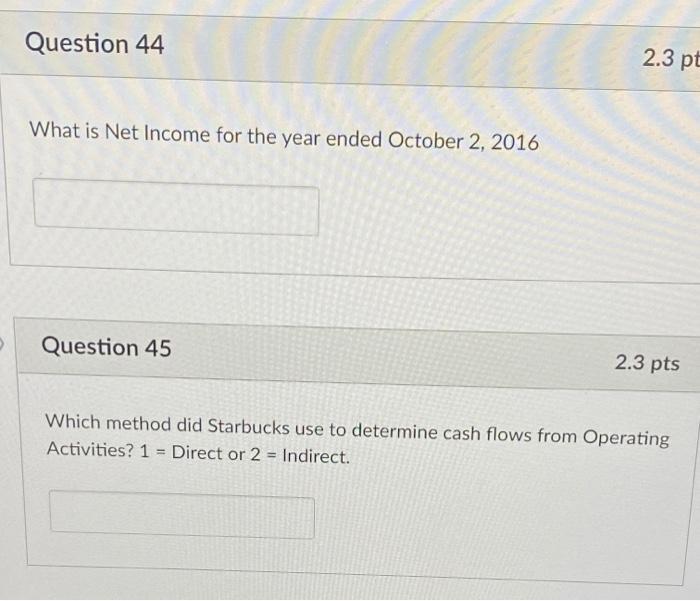

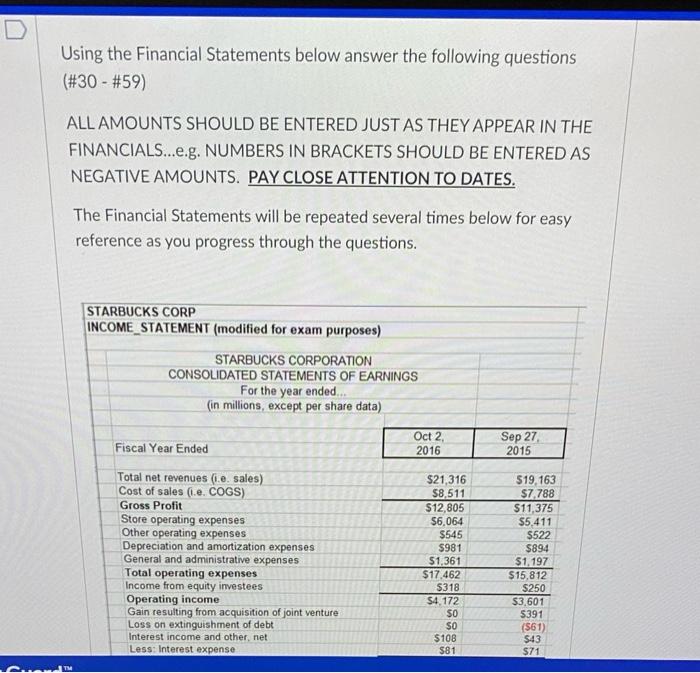

Using the Financial Statements below answer the following questions (#30 - #59) ALL AMOUNTS SHOULD BE ENTERED JUST AS THEY APPEAR IN THE FINANCIALS...e.g. NUMBERS IN BRACKETS SHOULD BE ENTERED AS NEGATIVE AMOUNTS. PAY CLOSE ATTENTION TO DATES. The Financial Statements will be repeated several times below for easy reference as you progress through the questions. STARBUCKS CORP INCOME_STATEMENT (modified for exam purposes) STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS For the year ended... (in millions, except per share data) Fiscal Year Ended Oct 2 2016 Sep 27 2015 Total net revenues (1.e. sales) Cost of sales (.e. COGS) Gross Profit Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Total operating expenses Income from equity investees Operating income Gain resulting from acquisition of joint venture Loss on extinguishment of debt Interest income and other net Less: Interest expense $21,316 $8,511 $12,805 $6.064 $545 $981 $1,361 $17.462 $318 $4.172 SO $0 $108 $81 $19.163 $7,788 $11,375 $5,411 S522 $894 $1.197 $15,812 $250 $3,601 S391 (561) $43 $71 STARBUCKS CORP INCOME STATEMENT (modified for exam purposes) STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS For the year ended.. (in Millions, except per share data) Oct 2, 2016 Sep 27 2015 Fiscal Year Ended Total net revenues (.e. sales) Cost of sales (.e. COGS) Gross Profit Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Total operating expenses Income from equity investees Operating income Gain resulting from acquisition of joint venture Loss on extinguishment of debt Interest income and other net Less: Interest expense Earnings before income taxes Income tax expense Net Income $21,316 $8,511 $12,805 $6,064 $545 $981 $1,361 $17.462 $318 $4,172 $0 $0 $108 $81 $4,199 $1,380 $2,819 $19,163 $7.788 $11,375 $5,411 $522 $894 $1,197 $15,812 $250 $3,601 $391 (561) $43 $71 $3,903 $1,144 $2.759 STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (modified for exam purposes) (in millions, except per share data) As of Oct 2 2016 ASSETS Comentaras Sep 27 2015 Sep 27 2015 STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (modified for exam purposes) (in millions, except per share data) As of Oct 2 2016 ASSETS Current assets: Cash and cash equivalents $ 2.129 $ Short-term investments 134 Accounts receivable 780 Less: Allowance for Doubtful Accounts 11 Net Accounts Receivable 769 Inventories 1,379 Prepaid expenses and other current assets 350 Total current assets 4,761 Long-term investments 1.142 Equity and cost investments 355 Property, plant and equipment 5,734 Less: Accummulated Depreciation 1,200 Net Property, plant and equipment 4,534 Deferred income taxes net 885 Other long-term assets 418 Other intangible assets 2.236 TOTAL ASSETS $ 14,330 $ 1,530 81 731 12 719 1,306 334 3,971 313 352 5.188 1,100 4,088 1.181 416 2.096 12,416 CA LIABILITIES AND EQUITY Current liabilities: Accounts payable Accrued liabilities Insurance reserves Stored value card liability Current portion of long-term debt Total current liabilities Long-term debt Other long-term liabilities Total liabilities 684 1,755 225 984 731 $ 1,999 246 1,171 400 4,547 3,202 690 8.439 3,648 2,348 601 6.597 $ 684 1,755 225 984 LIABILITIES AND EQUITY Current liabilities: Accounts payable Accrued liabilities Insurance reserves Stored value card liability Current portion of long-term debt Total current liabilities Long-term debt Other long-term liabilities Total liabilities Shareholders' equity: Common stock ($0.001 par value) - authorized 2,400.0 shares, issued and outstanding, 1,460.5 and 1,485.1 shares, respectively (i.e. 2016 then 2015) Additional paid-in capital - Common stock Retained earnings Accumulated other comprehensive loss Total shareholders' equity TOTAL LIABILITIES AND EQUITY 731 $ 1,999 246 1,171 400 4,547 3,202 690 8,439 3,648 2,348 601 6,597 2 41 5.950 (102) 5,891 14,330 $ 2 41 5,975 (198) 5,820 12.416 $ STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Oct 2 2016 For the Year Ended Sep 27 Sep 28 2015 2014 $ 2.819 $ 2.759 5 2,068 Fiscal Year Ended OPERATING ACTIVITIES Net earnings (Income) Adjustments to reconcile net earings to net cash provided by operating activities: Depreciation and amortization Deferred income taxes, net Income earned from equity method investees Distributions received from equity method investees Gain resulting from acquisition/sale of equity in joint ventures and certain retail operations Loss on extinguishment of debt Stock-based compensation Excess tax benefit on share-based awards Other Cash provided by changes in operating assets and 1.030 266 (250) 223 934 21 (190) 148 748 10 (183) 139 (5 (70) 218 (123) 45 (394) 61 210 (132) 54 183 (114) 35 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Oct 2 2015 For the Year Ended Sep 27 Sep 28 2015 2014 2,8195 2,759 $ 2,068 1,030 266 934 21 (190) 148 748 10 (183) 139 (250) 223 (6) (70) 218 (123) 45 (394) 61 210 (132) 54 183 (114) 36 Fiscal Year Ended OPERATING ACTIVITIES: Net earnings (Income) Adjustments to reconcile net earnings to net cash provided by operating activities Depreciation and amortization Deferred income taxes, net Income earned from equity method investees Distributions received from equity method investees Gain resulting from acquisition/sale of equity in joint ventures and certain retail operations Loss on extinguishment of debt Stock-based compensation Excess tax benefit on share-based awards Other Cash provided by changes in operating assets and liabilities: Accounts receivable Inventories Accounts payable Accrued litigation charge Stored value card liability Other operating assets and liabilities Net cash provided by operating activities INVESTING ACTIVITIES: Purchases of investments Sales of investments Maturities and calls of investments Acquisitions, net of cash acquired Additions (ie acquisitions) to property, plant and equipment Net proceeds from sale of equity in joint ventures and certain retail operations Other Net cash used by investing activities (56) (68) (83) (208) 138 47 (80) 14 60 (2.764) 141 418 608 180 249 4.575 170 262 3,749 (567) (1,586) 681 28 (1.653) 1,455 456 601 19 (284) (1.304) (1.440) (1.161) 70 25 (2.223) 9 7 (1 520) 104 (19) (818) 1.255 749 FINANCING ACTIVITIES Proceeds from issuance of long-term debt Repayments of long-term debit Cash used for purchase of non-controlling interest Proceeds from issuance of common stock hadde 849 (610) (361) 192 140 161 22 F (1,586) 681 28 INVESTING ACTIVITIES: Purchases of investments Sales of investments Maturities and calls of investments Acquisitions, net of cash acquired Additions (i.e. acquisitions) to property, plant and equipment Net proceeds from sale of equity in joint ventures and certain retail operations Other Net cash used by investing activities (567) 601 19 (284) (1.304) (1.653) 1,455 456 (1.440) (1.161) on 70 25 (2.223) 7 (1,520) 104 (19) (818) 1,255 749 FINANCING ACTIVITIES: Proceeds from issuance of long-term debt Repayments of long-term debt Cash used for purchase of non-controlling interest Proceeds from issuance of common stock Excess tax benefit on share-based awards Cash dividends paid Repurchase of common stock Minimum tax withholdings on share-based awards Other Net cash used by financing activities Effect of exchange rate changes on cash and cash equivalents 161 123 (1.178) (1996) (106) (8) (1.750) 849 (610) (361) 192 132 (929) (1.436) (76) (18) (2,257) 140 114 (783) (759) (77) (623) (151) (34) 599 (178) (867) Net increase/(decrease) in cash and cash equivalents CASH AND CASH EQUIVALENTS: Beginning of period End of period 1,530 2.129S $ 1,708 1,530 5 2,576 1.708 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid during the period for: Interest, net of capitalized interest $ Income taxes, net of refunds $ 75 $ 879 S 70 $ 1,072 $ 56 766 Question 40 2.3 pts What is the total amount of capital (i.e. value or cash) above par value that Starbucks has received from issuing/selling its common stock as of October 2, 2016? D Question 41 2.3 pts The total of all net income ever earned (i.e. all years Starbucks has existed) less all dividends ever declared (i.e. all years Starbucks has existed) as of October 2, 2016 equals = ? Question 42 2.3 p What are total Sales for the year ended October 2, 2016? Question 43 2.3 pts What is the gross profit (sales - cost of goods sold) for Cato for the year ended October 2, 2016? Question 44 2.3 pt What is Net Income for the year ended October 2, 2016 Question 45 2.3 pts Which method did Starbucks use to determine cash flows from Operating Activities? 1 = Direct or 2 = Indirect