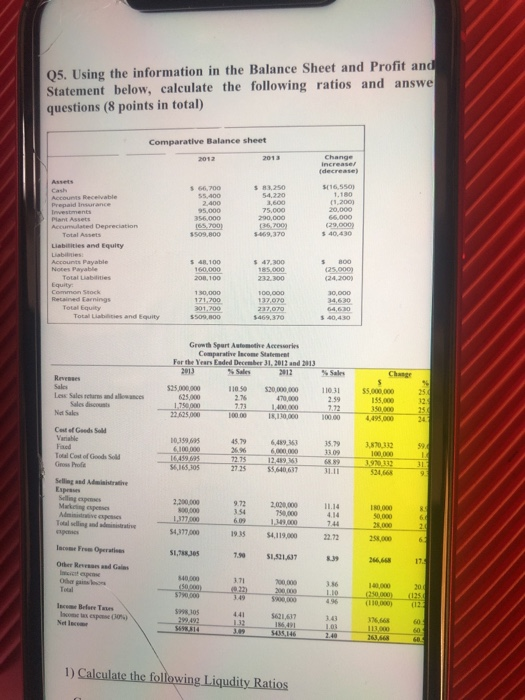

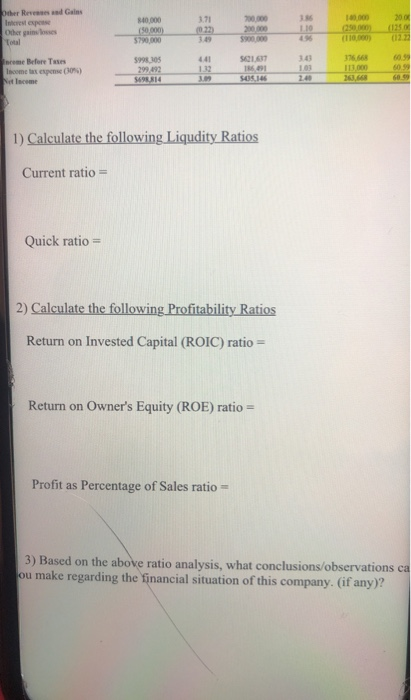

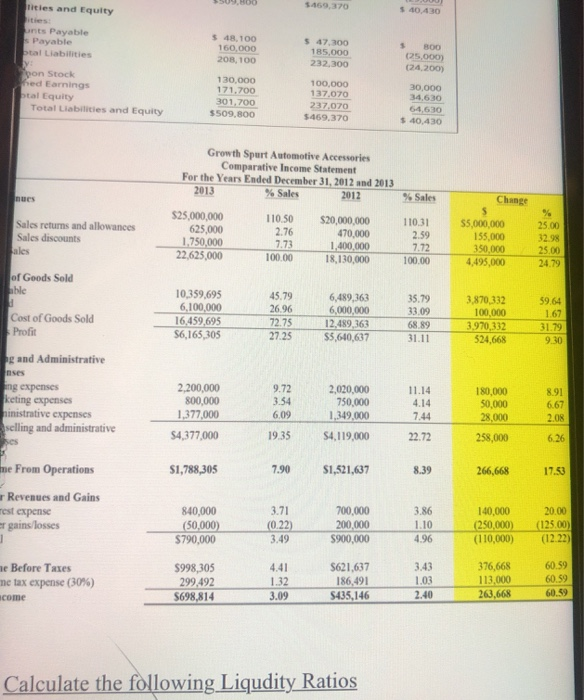

Q5. Using the information in the Balance Sheet and Profit and Statement below, calculate the following ratios and answe questions (8 points in total) Comparative Balance sheet 2012 5509.800 $40.430 232.300 100,000 171.200 301.700 5509,000 Totalbies and Equity 5469,370 Growth Sport Automotive Accessories Comparative Income Statement For the Years Eaded December 31, 2012 and 2013 2013 Sales 2012 Sales Change 110 50 $20,000,000 Less Sales retard ances $15.000.000 625.000 1,750,000 22.00 Net Sales 18130,000 350.000 4,495.000 45.79 Cost of Goods Sold Vanille Faed Total Cost of Good Sold Gross Profit 10.199695 6.100.000 16,459.695 56,165 305 3.820 112 35.79 33.00 6.459 1 6 000 000 12.489 361 $5,640 637 72.75 27.25 3.920132 530668 Selling and Martie 2.200.000 9.72 Maps M 2.020.000 750,000 414 180.000 50,000 2000 1,177.000 $4,177.000 609 AKAR 19.35 $4,119,000 22.72 25.000 Ice Fees S1,78.JOS $1,301.637 3 . Other Read Gas Incepe 840100 3.71 022) 100,000 (250,000) (110.000 Ince Before Twee Netice 376,665 5621,617 146,491 5435,146 IRIS B 1) Calculate the following Liqudity Ratios Other Red Gains 100.000 000 10000 5790.000 170 (022) 700.000 200.000 5900.000 200 (125 Other gains T10 (110.000 5998 e Before Teses Income tax expense (30%) Net Income 1766 113.000 SA 617 18691 $40 299,492 14 1) Calculate the following Liqudity Ratios Current ratio = Quick ratio = 2) Calculate the following Profitability Ratios Return on Invested Capital (ROIC) ratio = Return on Owner's Equity (ROE) ratio = Profit as Percentage of Sales ratio = 3) Based on the above ratio analysis, what conclusions/observations ca ou make regarding the financial situation of this company. (if any)? 5509.00 tities and Equity $469,370 $40.430 unts Payable Payable tal Liabilities $ 48,100 160.000 208,100 $ 47.300 185.000 232,300 pon Stock Kied Earnings tal Equity Total Liabilities and Equity 130,000 171.700 301,700 $509,800 100,000 137,070 237,070 $469.370 BOD 125.000) (24.2009 30.000 34,630 54,630 $40.430 Growth Spurt Automotive Accessories Comparative Income Statement For the Years Ended December 31, 2012 and 2013 2013 % Sales 2012 nues % Sales Change 110.31 Sales returns and allowances Sales discounts ales $25,000,000 625,000 1.750,000 22,625,000 110.50 2.76 7.73 100.00 $20,000,000 470,000 1,400,000 18,130,000 2.59 7.72 100.00 $5,000,000 155,000 350,000 4,495,000 25.00 32.98 25.00 24.79 of Goods Sold ahle 59.64 Cost of Goods Sold Profit 10,359,695 6,100,000 16,459,695 S6,165,305 45.79 26.96 72.75 27.25 6,489,363 6,000,000 12,489,363 $5,640,637 35.79 11 09 68.89 31.11 3,870,332 100,000 3.970,332 524.668 31.79 9.30 og and Administrative nses ing expenses keting expenses ministrative expenses selling and administrative 9.72 2,200,000 800,000 1,377,000 354 2,020,000 750,000 1,349,000 11.14 4.14 7.44 22.72 180,000 50,000 28,000 6.09 $4,377,000 19.35 $4,119,000 258,000 me From Operations $1,788,305 7.90 $1,521,637 8.39 266,668 Revenues and Gains Test expense er gains/losses 3.86 840,000 (50,000) $790,000 3.71 (0.223 3.49 700,000 200,000 $900,000 1.10 4.96 140,000 (250,000) (110,000) 20.00 (125.00) (1222) 441 3.43 ne Before Taxes me tax expense (30%) come $998,305 299,492 $698,814 $621,637 186,491 435,146 1.03 376,668 113,000 263,668 60.59 60.59 60.59 3.09 2.40 Calculate the following Liqudity Ratios