Answered step by step

Verified Expert Solution

Question

1 Approved Answer

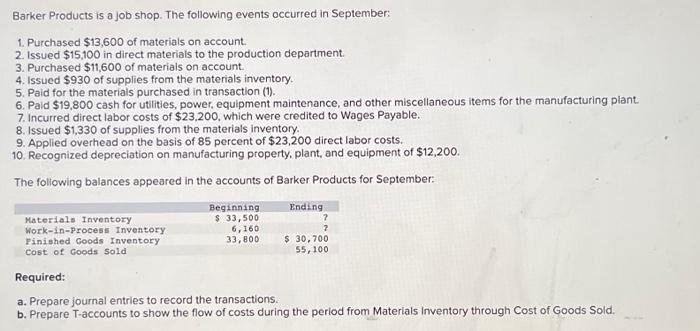

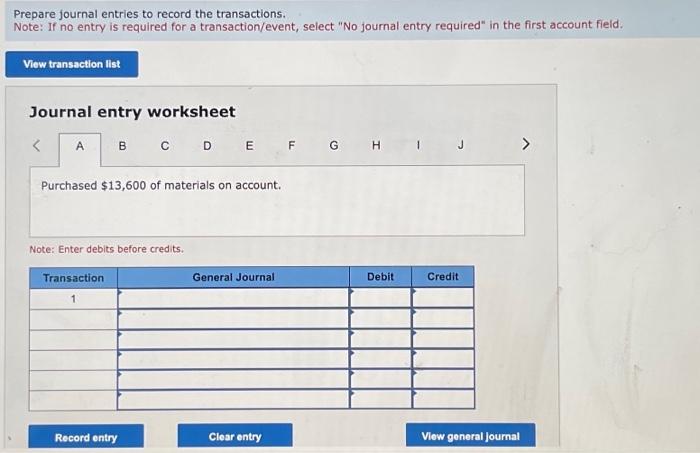

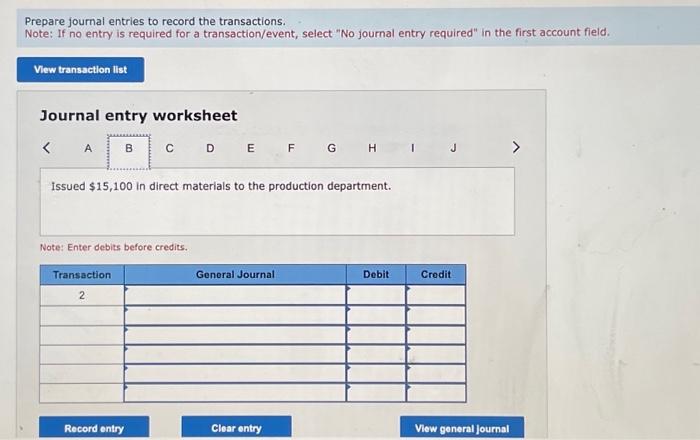

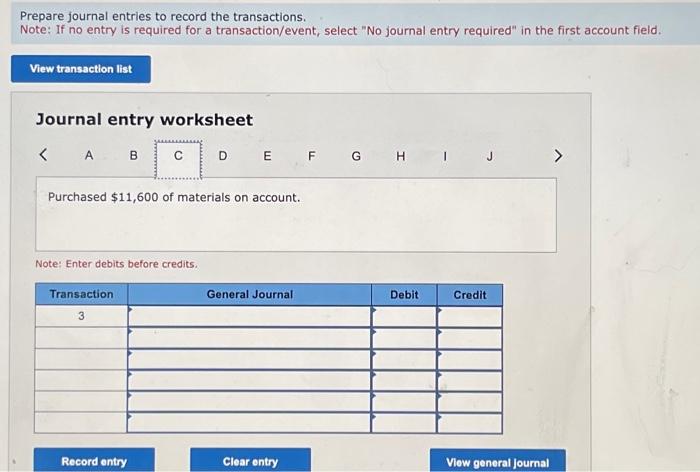

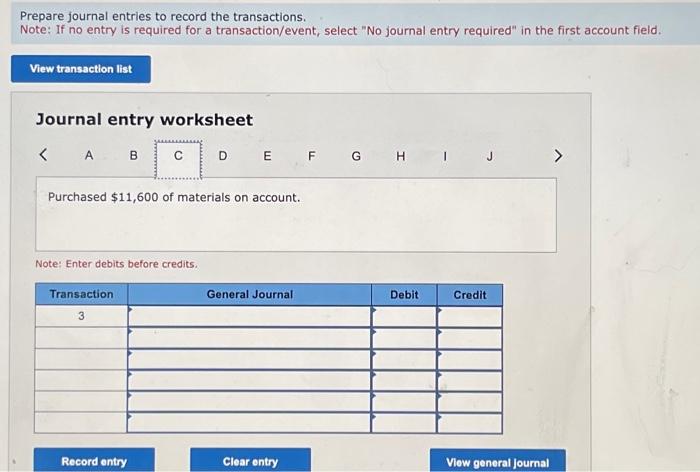

Q7Q3 Barker Products is a job shop. The following events occurred in September: 1. Purchased $13,600 of materials on account. 2. Issued $15,100 in direct

Q7Q3

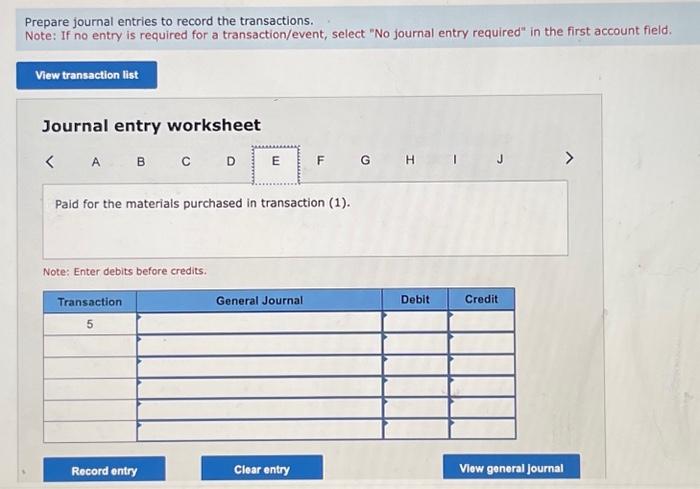

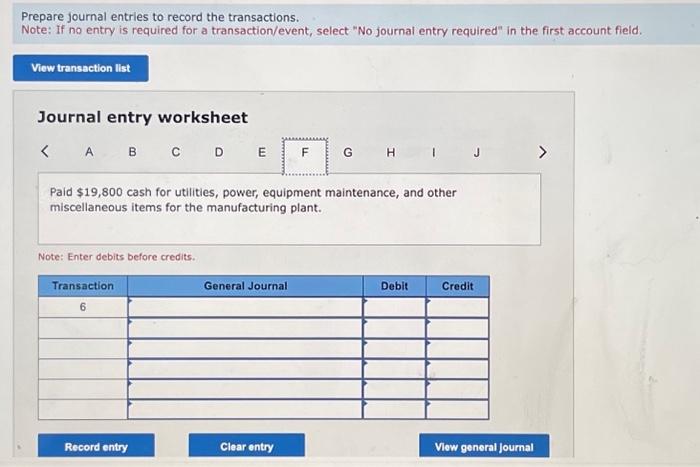

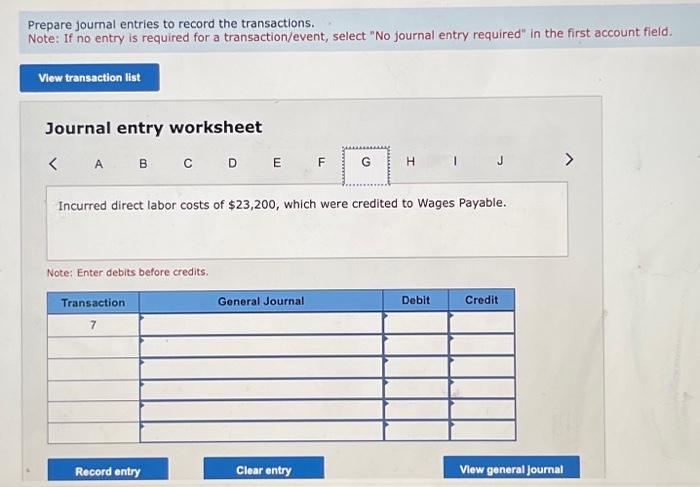

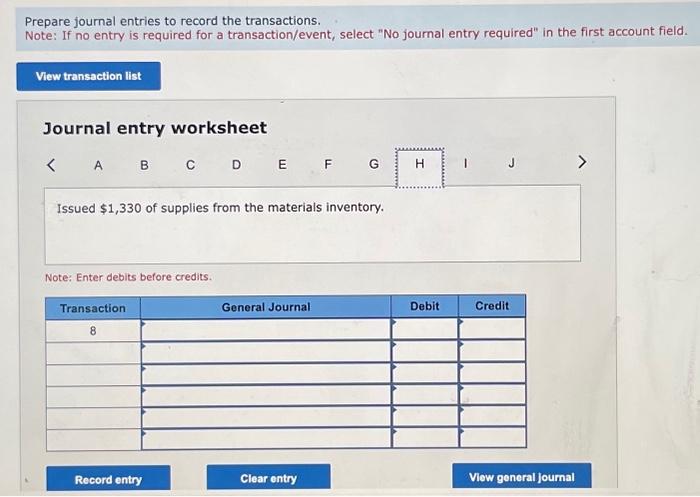

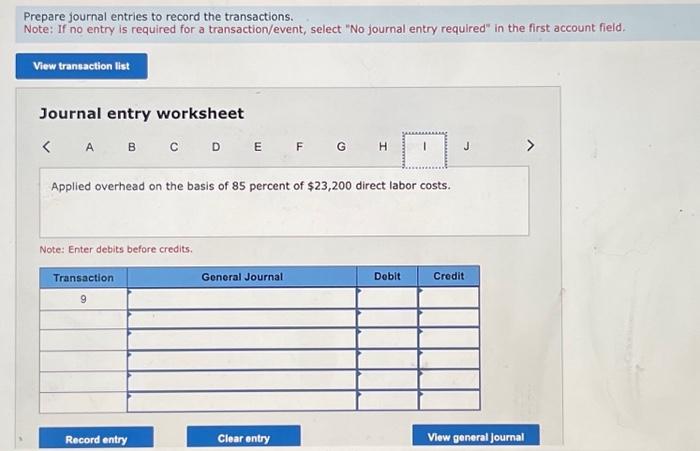

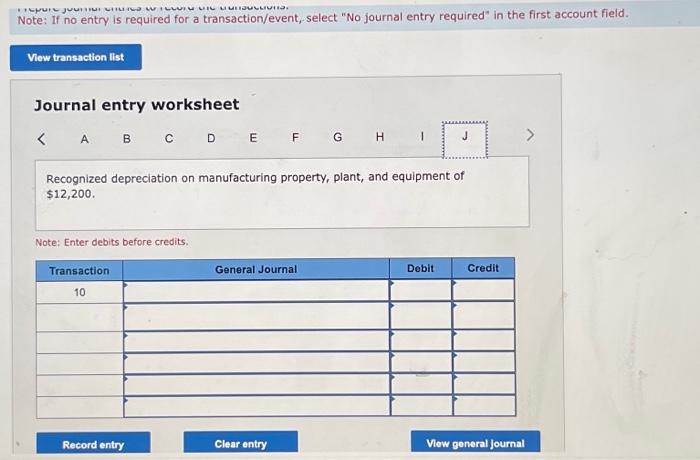

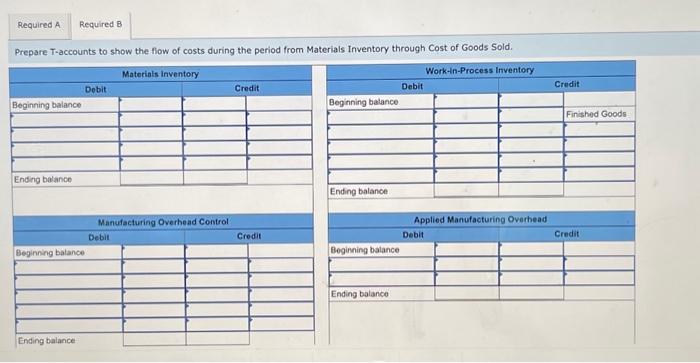

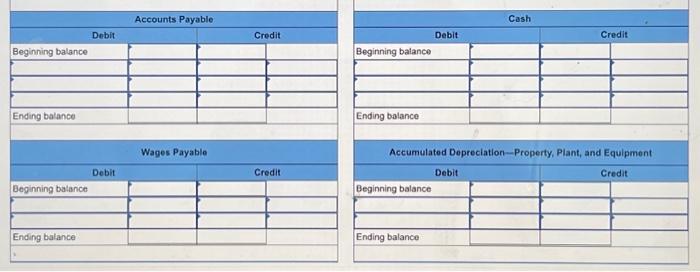

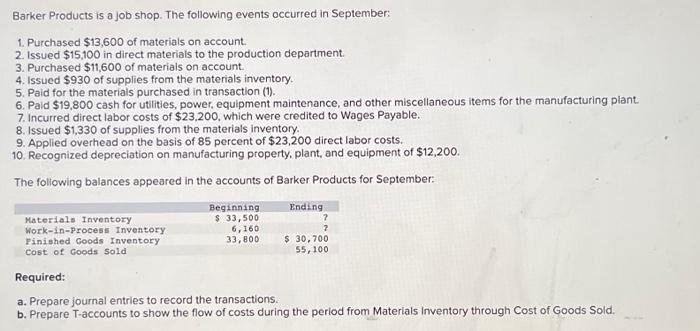

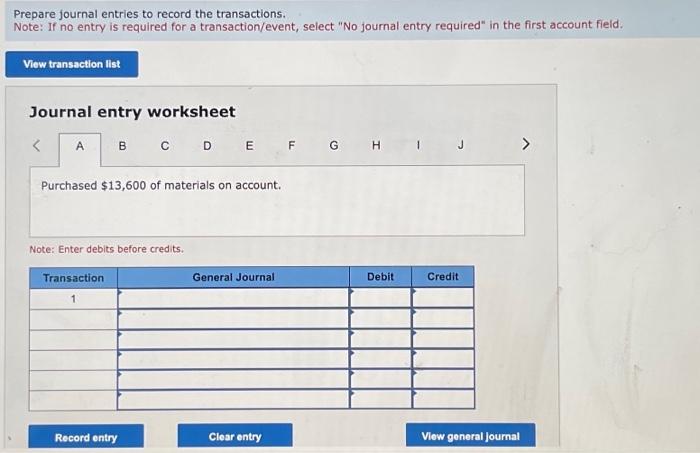

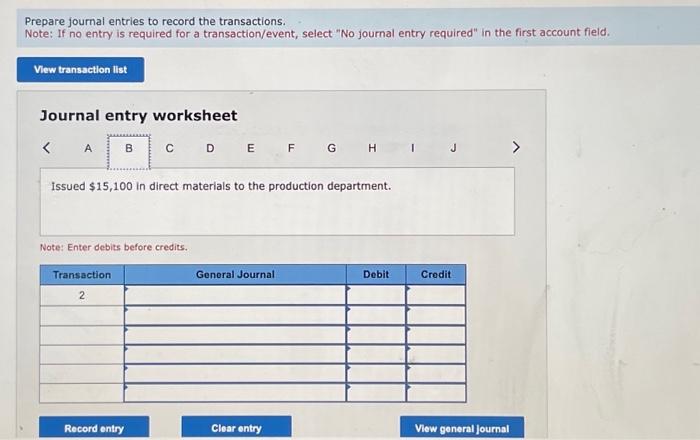

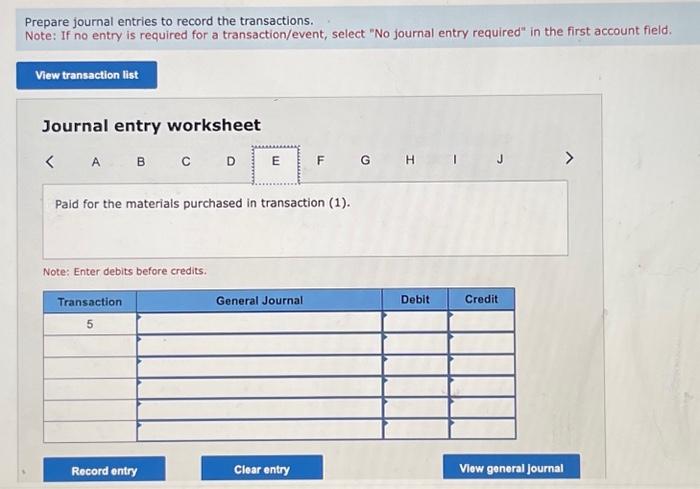

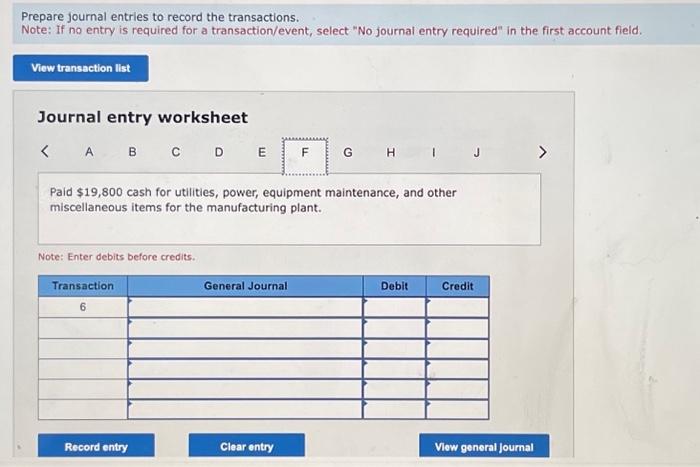

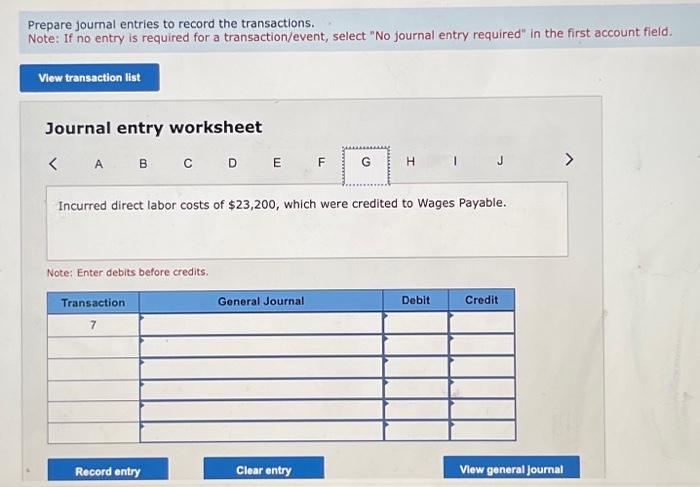

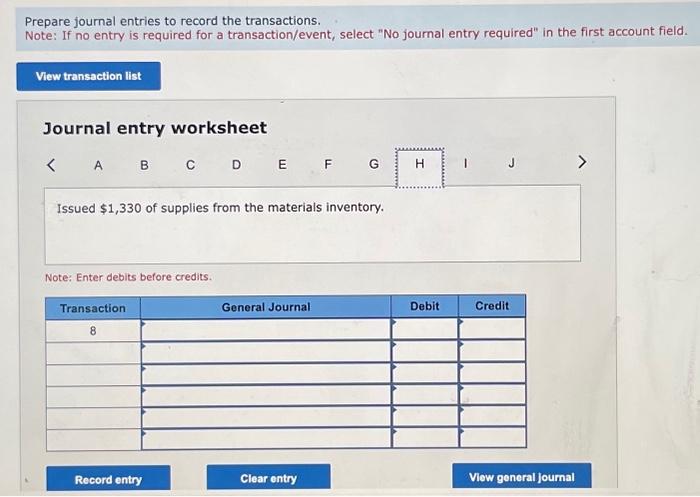

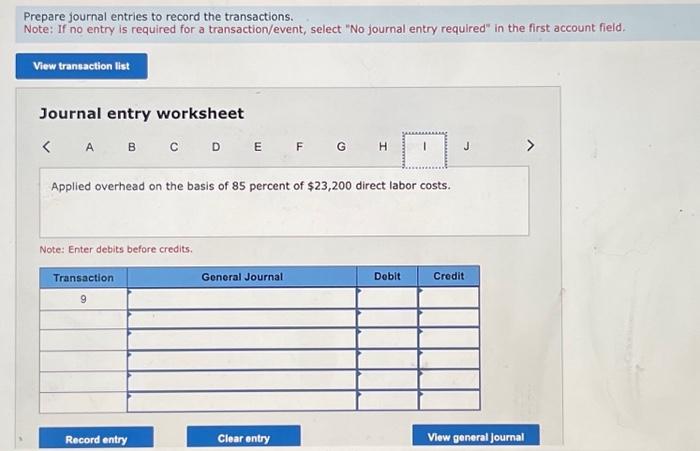

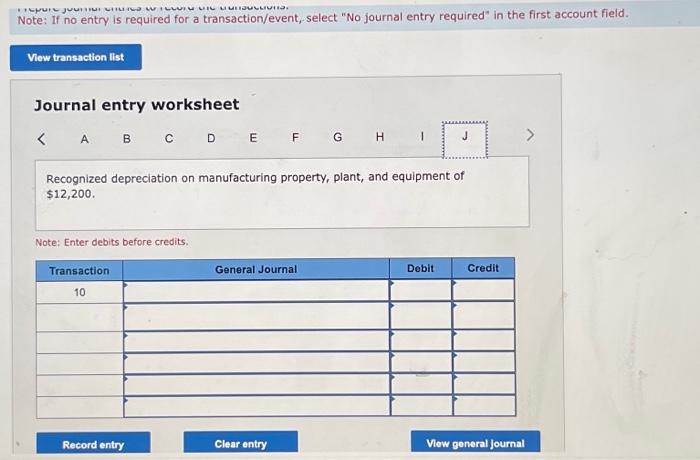

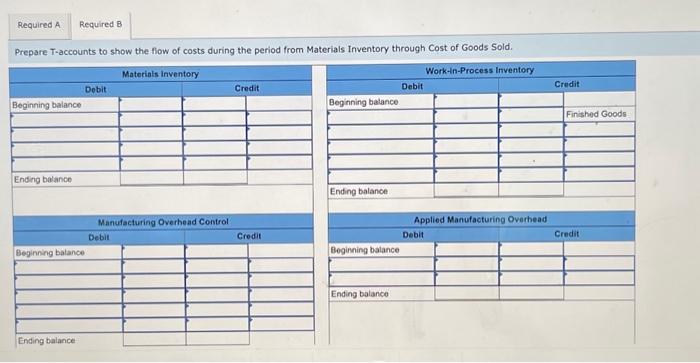

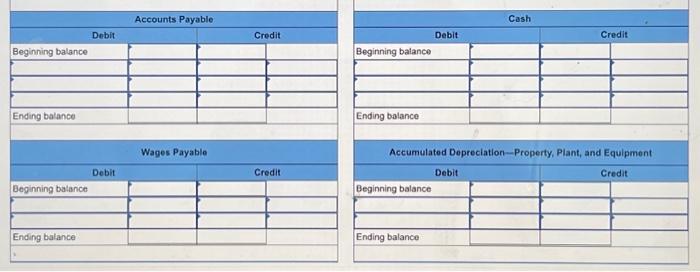

Barker Products is a job shop. The following events occurred in September: 1. Purchased $13,600 of materials on account. 2. Issued $15,100 in direct materials to the production department. 3. Purchased $11,600 of materials on account. 4. Issued $930 of supplies from the materials inventory. 5. Paid for the materials purchased in transaction (1). 6. Paid $19,800 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing plant 7. Incurred direct labor costs of $23,200, which were credited to Wages Payable. 8. Issued $1,330 of supplies from the materials inventory. 9. Applied overhead on the basis of 85 percent of $23,200 direct labor costs. 10. Recognized depreciation on manufacturing property, plant, and equipment of $12,200. The following balances appeared in the accounts of Barker Products for September: Required: a. Prepare journal entries to record the transactions. b. Prepare T-accounts to show the flow of costs during the period from Materials inventory through Cost of Goods Sold. Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: tnter aeoits berore creaiss. Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet issued $15,100 in direct materials to the production department. Note: Enter debits before credits. Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fieid. Journal entry worksheet Note: Enter debits before credits. Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet A B D H Paid $19,800 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing plant. Note: Enter debits before credits. Prepare joumal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started