Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q7Q6 All information is provided... Please answer required A-F The following partially complete T-accounts for the month of June along with additional information are from

Q7Q6

All information is provided... Please answer required A-F

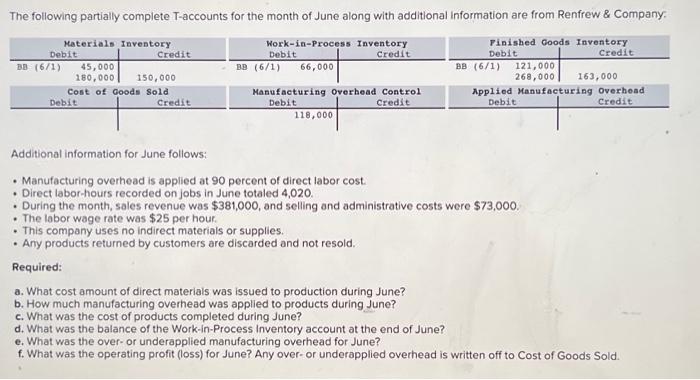

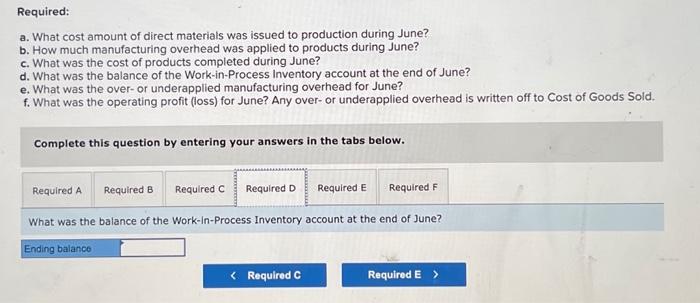

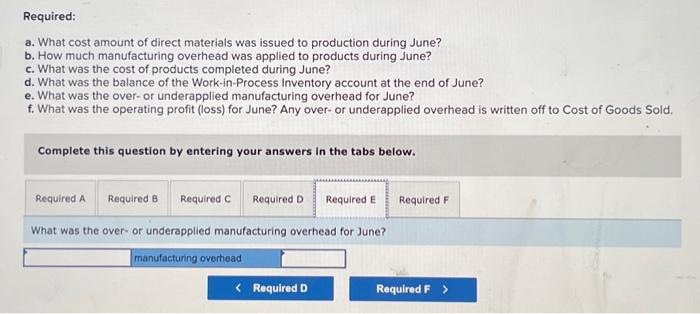

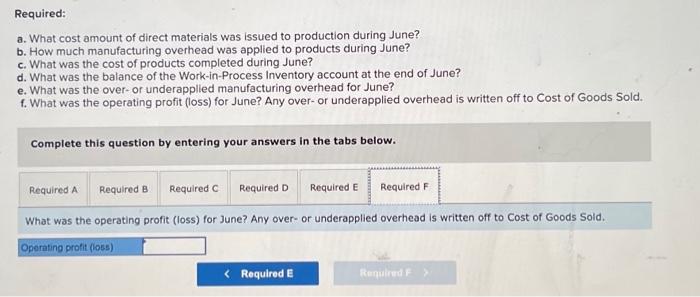

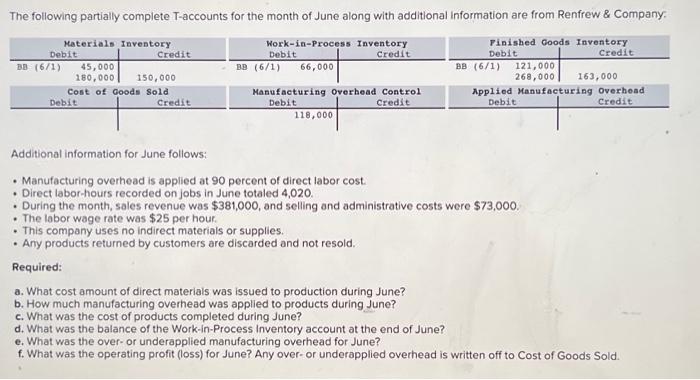

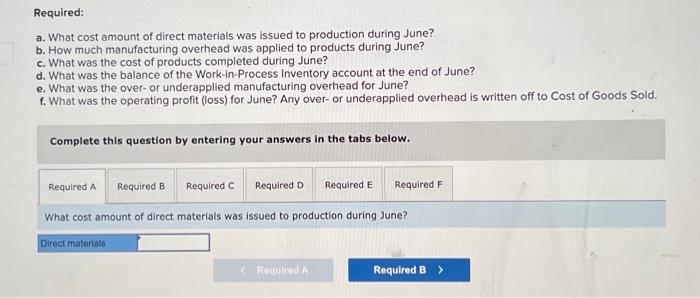

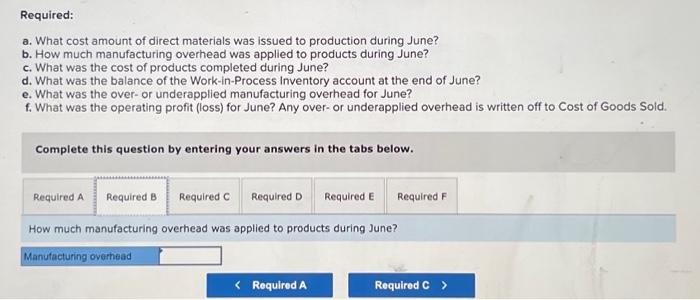

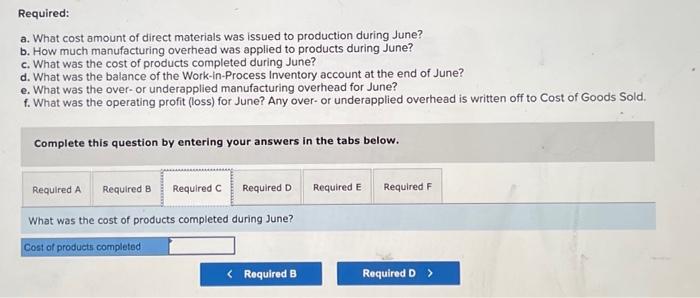

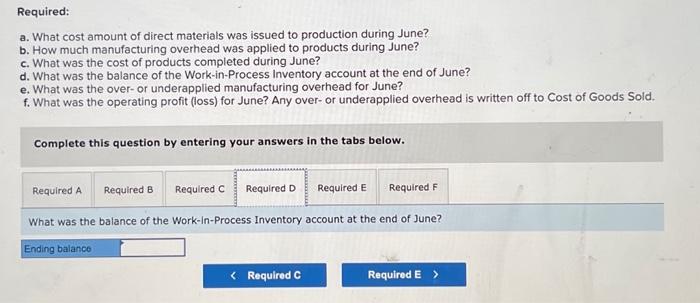

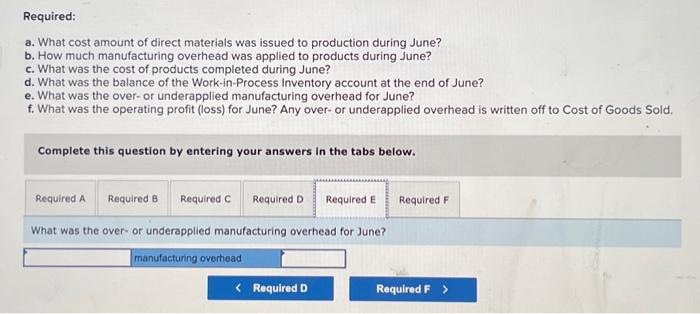

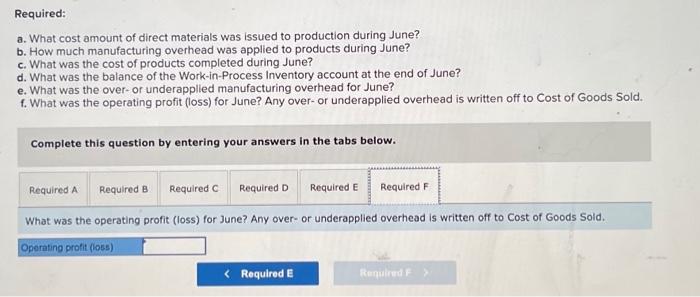

The following partially complete T-accounts for the month of June along with additional information are from Renfrew \& Company: Additional information for June follows: - Manufacturing overhead is applied at 90 percent of direct labor cost. - Direct labor-hours recorded on jobs in June totaled 4,020 . - During the month, sales revenue was $381,000, and selling and administrative costs were $73,000. - The labor wage rate was $25 per hour. - This company uses no indirect materials or supplies. - Any products returned by customers are discarded and not resold. Required: a. What cost amount of direct materials was issued to production during June? b. How much manufacturing overhead was applied to products during June? c. What was the cost of products completed during June? d. What was the balance of the Work-in-Process Inventory account at the end of June? e. What was the over- or underapplied manufacturing overhead for June? f. What was the operating profit (loss) for June? Any over-or underapplied overhead is written off to Cost of Goods Sold. a. What cost amount of direct materials was issued to production during June? b. How much manufacturing overhead was applied to products during June? c. What was the cost of products completed during June? d. What was the balance of the Work-in-Process Inventory account at the end of June? e. What was the over-or underapplied manufacturing overhead for June? f. What was the operating profit (loss) for June? Any over-or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. What cost amount of direct materials was issued to production during June? a. What cost amount of direct materials was issued to production during June? b. How much manufacturing overhead was applied to products during June? c. What was the cost of products completed during June? d. What was the balance of the Work-in-Process Inventory account at the end of June? e. What was the over-or underapplied manufacturing overhead for June? f. What was the operating profit (loss) for June? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. How much manufacturing overhead was applied to products during June? a. What cost amount of direct materials was issued to production during June? b. How much manufacturing overhead was applied to products during June? c. What was the cost of products completed during June? d. What was the balance of the Work-in-Process Inventory account at the end of June? e. What was the over-or underapplied manufacturing overhead for June? f. What was the operating profit (loss) for June? Any over-or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. What was the cost of products completed during June? Required: a. What cost amount of direct materials was issued to production during June? b. How much manufacturing overhead was applied to products during June? c. What was the cost of products completed during June? d. What was the balance of the Work-in-Process Inventory account at the end of June? e. What was the over-or underapplied manufacturing overhead for June? f. What was the operating profit (loss) for June? Any over-or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. What was the balance of the Work-in-Process Inventory account at the end of June? Required: a. What cost amount of direct materials was issued to production during June? b. How much manufacturing overhead was applied to products during June? c. What was the cost of products completed during June? d. What was the balance of the Work-in-Process Inventory account at the end of June? e. What was the over-or underapplied manufacturing overhead for June? f. What was the operating profit (loss) for June? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. What was the over- or underapplied manufacturing overhead for June? Required: a. What cost amount of direct materials was issued to production during June? b. How much manufacturing overhead was applied to products during June? c. What was the cost of products completed during June? d. What was the balance of the Work-in-Process Inventory account at the end of June? e. What was the over-or underapplied manufacturing overhead for June? f. What was the operating profit (loss) for June? Any over-or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. What was the operating profit (loss) for June? Any over- or underapplied overhead is written off to Cost of Goods Sold Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started