Answered step by step

Verified Expert Solution

Question

1 Approved Answer

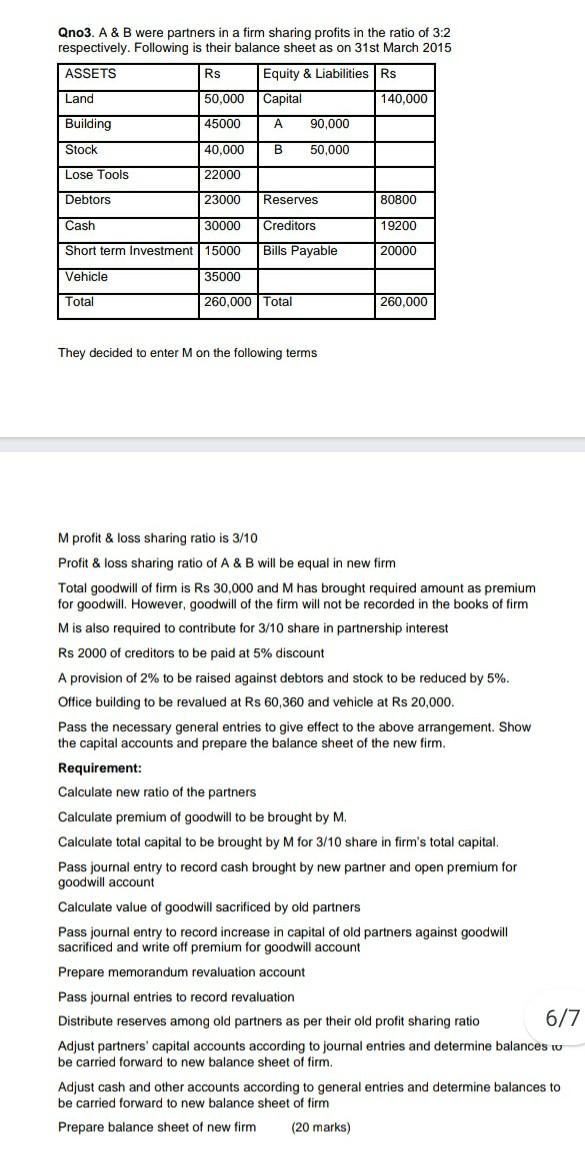

Qno3. A & B were partners in a firm sharing profits in the ratio of 3:2 respectively. Following is their balance sheet as on 31st

Qno3. A & B were partners in a firm sharing profits in the ratio of 3:2 respectively. Following is their balance sheet as on 31st March 2015 ASSETS Rs Equity & Liabilities Rs Land 50,000 Capital 140,000 Building 45000 90,000 Stock 40,000 B 50,000 Lose Tools 22000 Debtors 23000 Reserves 80800 Cash 30000 Creditors 19200 Short term Investment 15000 Bills Payable 20000 Vehicle 35000 Total 260.000 Total 260,000 They decided to enter M on the following terms M profit & loss sharing ratio is 3/10 Profit & loss sharing ratio of A & B will be equal in new firm Total goodwill of firm is Rs 30,000 and M has brought required amount as premium for goodwill. However, goodwill of the firm will not be recorded in the books of firm M is also required to contribute for 3/10 share in partnership interest Rs 2000 of creditors to be paid at 5% discount A provision of 2% to be raised against debtors and stock to be reduced by 5%. Office building to be revalued at Rs 60,360 and vehicle at Rs 20,000. Pass the necessary general entries to give effect to the above arrangement. Show the capital accounts and prepare the balance sheet of the new firm. Requirement: Calculate new ratio of the partners Calculate premium of goodwill to be brought by M. Calculate total capital to be brought by M for 3/10 share in firm's total capital Pass journal entry to record cash brought by new partner and open premium for goodwill account Calculate value of goodwill sacrificed by old partners Pass journal entry to record increase in capital of old partners against goodwill sacrificed and write off premium for goodwill account Prepare memorandum revaluation account Pass journal entries to record revaluation Distribute reserves among old partners as per their old profit sharing ratio 6/7 Adjust partners' capital accounts according to journal entries and determine balances to be carried forward to new balance sheet of firm. Adjust cash and other accounts according to general entries and determine balances to be carried forward to new balance sheet of firm Prepare balance sheet of new firm (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started