Answered step by step

Verified Expert Solution

Question

1 Approved Answer

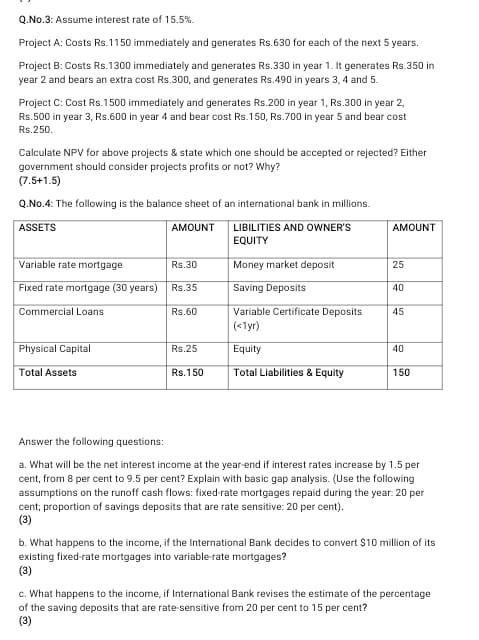

Q.No.3: Assume interest rate of 15.5% Project A: Costs Rs. 1150 immediately and generates Rs.630 for each of the next 5 years. Project B: Costs

Q.No.3: Assume interest rate of 15.5% Project A: Costs Rs. 1150 immediately and generates Rs.630 for each of the next 5 years. Project B: Costs Rs.1300 immediately and generates Rs.330 in year 1. It generates Rs 350 in year 2 and bears an extra cost Rs.300, and generates Rs.490 in years 3, 4 and 5. Project C: Cost Rs. 1500 immediately and generates Rs 200 in year 1, Rs.300 in year 2 Rs.500 in year 3, Rs.600 in year 4 and bear cost Rs.150, Rs.700 in year 5 and bear cost Rs.250 Calculate NPV for above projects & state which one should be accepted or rejected? Either government should consider projects profits or not? Why? (7.5+1.5) Q.No.4: The following is the balance sheet of an international bank in millions ASSETS AMOUNT LIBILITIES AND OWNER'S AMOUNT EQUITY Variable rate mortgage Money market deposit 25 Fixed rate mortgage (30 years) Saving Deposits Commercial Loans Rs.60 Variable Certificate Deposits 45 (styr) Physical Capital Rs.25 Equity 40 Total Assets Rs. 150 Total Liabilities & Equity 150 Rs.30 Rs.35 40 Answer the following questions: a. What will be the net interest income at the year end if interest rates increase by 1,5 per cent, from 8 per cent to 9.5 per cent? Explain with basic gap analysis. (Use the following assumptions on the runoff cash flows: fixed rate mortgages repaid during the year. 20 per cent, proportion of savings deposits that are rate sensitive: 20 per cent). (3) b. What happens to the income, if the International Bank decides to convert $10 million of its existing fixed-rate mortgages into variable rate mortgages? (3) c. What happens to the income, if International Bank revises the estimate of the percentage of the saving deposits that are rate sensitive from 20 per cent to 15 per cent? (3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started