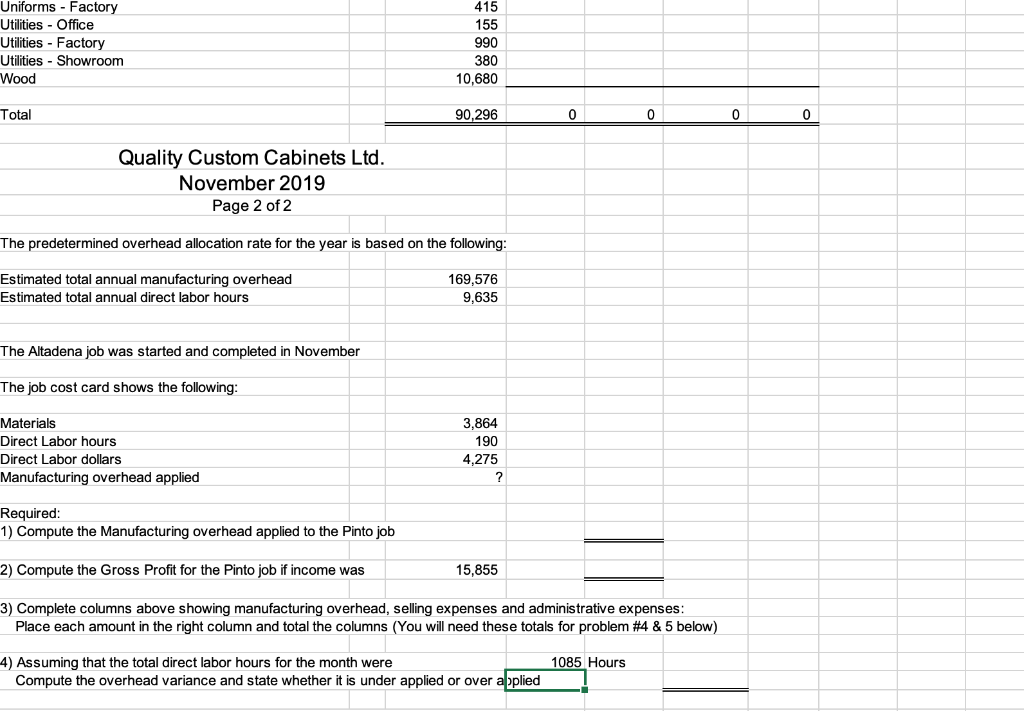

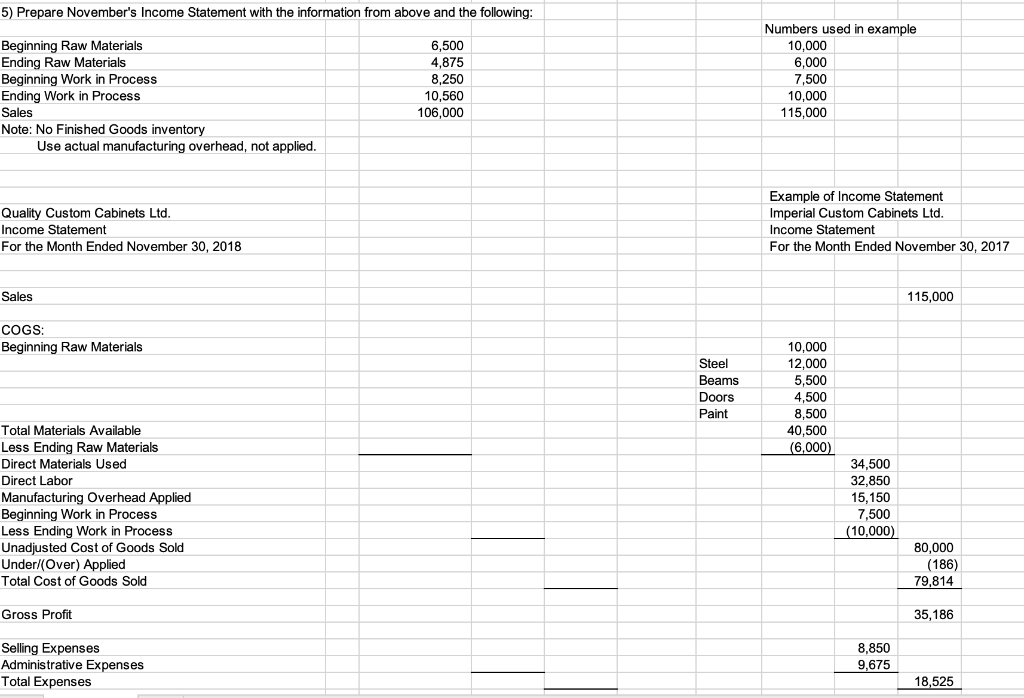

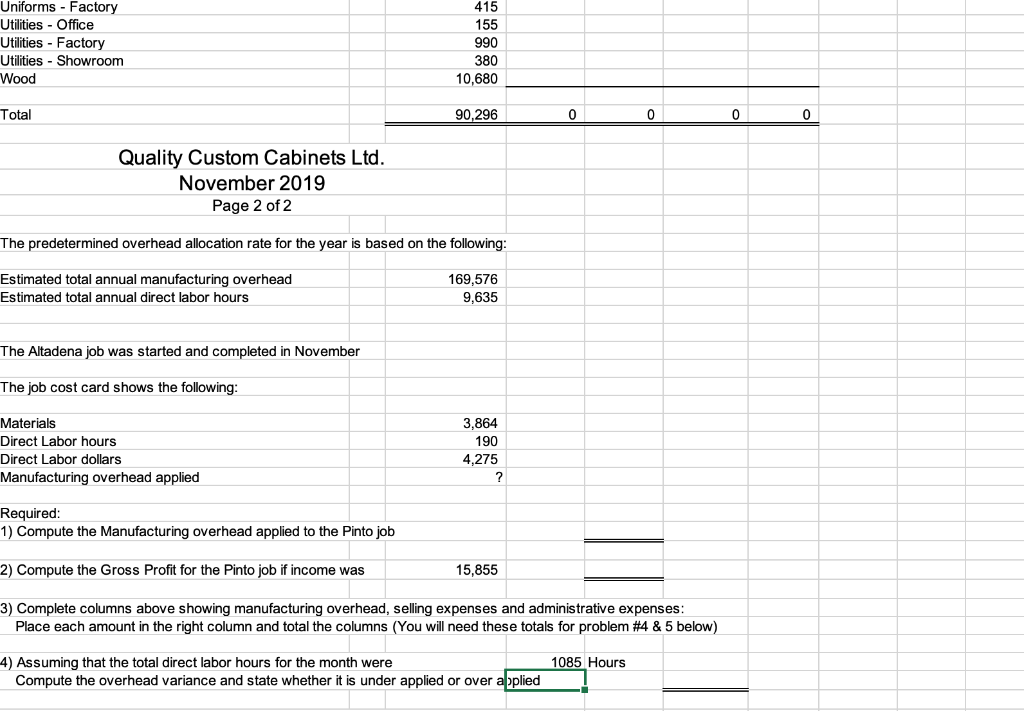

Quality was very busy during November of 2019 completing cabinets for their customers in time to be installed before Christmas. The following are expenses and costs incurred during the month: Mfg O/H Direct Expenses Selling Admin Expenses Expenses 450 1,180 5,235 3,240 1,260 460 245 1,155 850 500 810 325 2,925 4,180 236 2,830 670 Accounting and Legal Expense Advertising Cabinet Doors Cabinet Hardware Consumable Materials Depreciation - Delivery equipment Depreciation - Office equipment Depreciation - Factory equipment Depreciation - Showroom Donations Employee benefits - Administration Employee benefits - Sales Employee benefits - Factory Finish (Stain & Lacquer) Insurance - Office Insurance - Factory Insurance - Vehicles Interest Expense Labor - Administration Labor - Sales Labor - Factory Office Supplies Payroll taxes - Administration Payroll taxes - Sales Payroll taxes - Factory Rent - Office building Rent - Factory building Rent - Showroom Repairs & maintenance - Office Repairs & maintenance - Factory Repairs & maintenance - Showroom Factory Supplies Small Tools Expense Telephone Truck expense Uniforms - Factory 975 3,100 1.985 28,935 980 240 180 2,655 400 1,500 750 260 2.365 880 1,525 1,510 755 2,130 415 Uniforms - Factory Utilities - Office Utilities - Factory Utilities - Showroom Wood 415 155 990 380 10,680 Total 90,296 Quality Custom Cabinets Ltd. November 2019 Page 2 of 2 The predetermined overhead allocation rate for the year is based on the following: Estimated total annual manufacturing overhead Estimated total annual direct labor hours 169,576 9,635 The Altadena job was started and completed in November The job cost card shows the following: Materials Direct Labor hours Direct Labor dollars Manufacturing overhead applied 3,864 190 4,275 Required: 1) Compute the Manufacturing overhead applied to the Pinto job 2) Compute the Gross Profit for the Pinto job if income was 15,855 3) Complete columns above showing manufacturing overhead, selling expenses and administrative expenses: Place each amount in the right column and total the columns (You will need these totals for problem #4 & 5 below) 1085 Hours 4) Assuming that the total direct labor hours for the month were Compute the overhead variance and state whether it is under applied or over applied 5) Prepare November's Income Statement with the information from above and the following: Beginning Raw Materials Ending Raw Materials Beginning Work in Process Ending Work in Process Sales Note: No Finished Goods inventory Use actual manufacturing overhead, not applied. 6,500 4,875 8,250 10,560 106,000 Numbers used in example 10,000 6,000 7,500 10,000 115,000 Quality Custom Cabinets Ltd. Income Statement For the Month Ended November 30, 2018 Example of Income Statement Imperial Custom Cabinets Ltd. Income Statement For the Month Ended November 30, 2017 Sales 115,000 COGS: Beginning Raw Materials Steel Beams Doors Paint 10,000 12,000 5,500 4,500 8,500 40,500 (6,000) Total Materials Available Less Ending Raw Materials Direct Materials Used Direct Labor Manufacturing Overhead Applied Beginning Work in Process Less Ending Work in Process Unadjusted Cost of Goods Sold Under/(Over) Applied Total Cost of Goods Sold 34,500 32,850 15,150 7,500 (10,000) 80,000 (186) 79,814 Gross Profit 35,186 8,850 Selling Expenses Administrative Expenses Total Expenses 9,675 18,525 Net Income 16.661 Quality was very busy during November of 2019 completing cabinets for their customers in time to be installed before Christmas. The following are expenses and costs incurred during the month: Mfg O/H Direct Expenses Selling Admin Expenses Expenses 450 1,180 5,235 3,240 1,260 460 245 1,155 850 500 810 325 2,925 4,180 236 2,830 670 Accounting and Legal Expense Advertising Cabinet Doors Cabinet Hardware Consumable Materials Depreciation - Delivery equipment Depreciation - Office equipment Depreciation - Factory equipment Depreciation - Showroom Donations Employee benefits - Administration Employee benefits - Sales Employee benefits - Factory Finish (Stain & Lacquer) Insurance - Office Insurance - Factory Insurance - Vehicles Interest Expense Labor - Administration Labor - Sales Labor - Factory Office Supplies Payroll taxes - Administration Payroll taxes - Sales Payroll taxes - Factory Rent - Office building Rent - Factory building Rent - Showroom Repairs & maintenance - Office Repairs & maintenance - Factory Repairs & maintenance - Showroom Factory Supplies Small Tools Expense Telephone Truck expense Uniforms - Factory 975 3,100 1.985 28,935 980 240 180 2,655 400 1,500 750 260 2.365 880 1,525 1,510 755 2,130 415 Uniforms - Factory Utilities - Office Utilities - Factory Utilities - Showroom Wood 415 155 990 380 10,680 Total 90,296 Quality Custom Cabinets Ltd. November 2019 Page 2 of 2 The predetermined overhead allocation rate for the year is based on the following: Estimated total annual manufacturing overhead Estimated total annual direct labor hours 169,576 9,635 The Altadena job was started and completed in November The job cost card shows the following: Materials Direct Labor hours Direct Labor dollars Manufacturing overhead applied 3,864 190 4,275 Required: 1) Compute the Manufacturing overhead applied to the Pinto job 2) Compute the Gross Profit for the Pinto job if income was 15,855 3) Complete columns above showing manufacturing overhead, selling expenses and administrative expenses: Place each amount in the right column and total the columns (You will need these totals for problem #4 & 5 below) 1085 Hours 4) Assuming that the total direct labor hours for the month were Compute the overhead variance and state whether it is under applied or over applied 5) Prepare November's Income Statement with the information from above and the following: Beginning Raw Materials Ending Raw Materials Beginning Work in Process Ending Work in Process Sales Note: No Finished Goods inventory Use actual manufacturing overhead, not applied. 6,500 4,875 8,250 10,560 106,000 Numbers used in example 10,000 6,000 7,500 10,000 115,000 Quality Custom Cabinets Ltd. Income Statement For the Month Ended November 30, 2018 Example of Income Statement Imperial Custom Cabinets Ltd. Income Statement For the Month Ended November 30, 2017 Sales 115,000 COGS: Beginning Raw Materials Steel Beams Doors Paint 10,000 12,000 5,500 4,500 8,500 40,500 (6,000) Total Materials Available Less Ending Raw Materials Direct Materials Used Direct Labor Manufacturing Overhead Applied Beginning Work in Process Less Ending Work in Process Unadjusted Cost of Goods Sold Under/(Over) Applied Total Cost of Goods Sold 34,500 32,850 15,150 7,500 (10,000) 80,000 (186) 79,814 Gross Profit 35,186 8,850 Selling Expenses Administrative Expenses Total Expenses 9,675 18,525 Net Income 16.661