Quantitative Decision Making

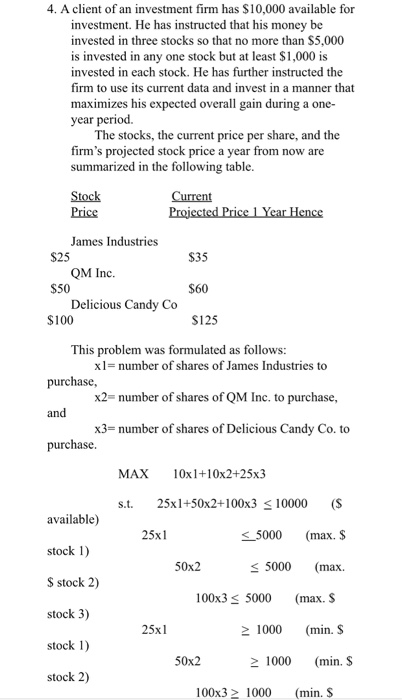

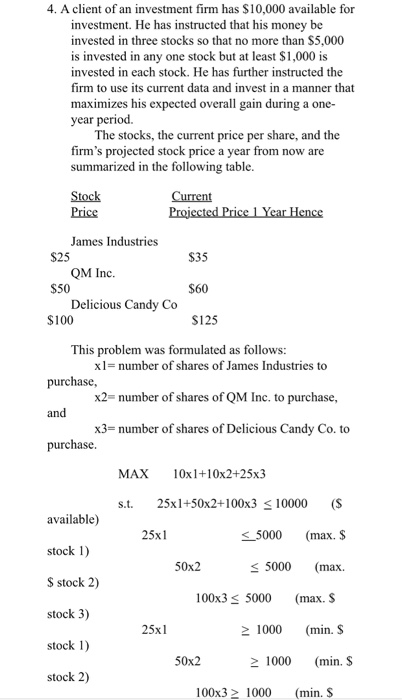

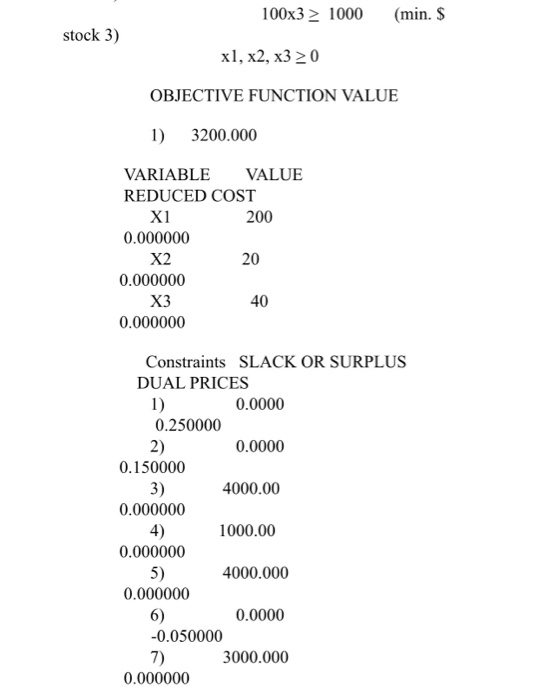

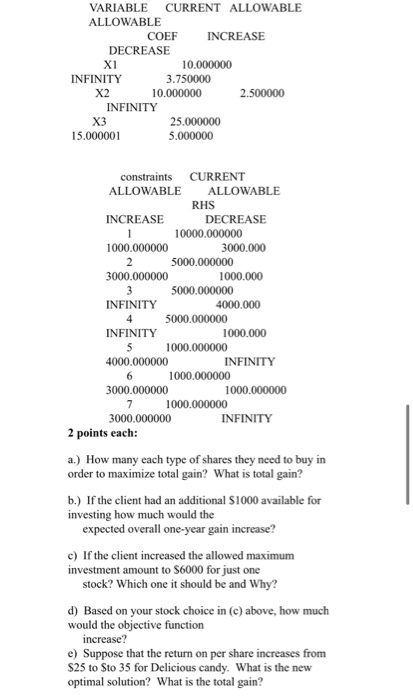

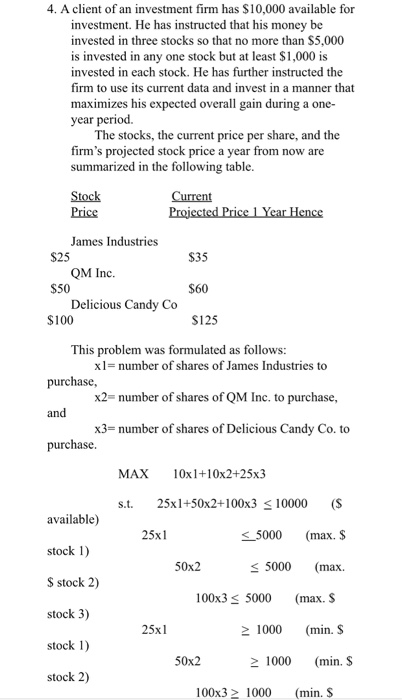

4. A client of an investment firm has $10,000 available for investment. He has instructed that his money be invested in three stocks so that no more than $5,000 is invested in any one stock but at least $1,000 is invested in each stock. He has further instructed the firm to use its current data and invest in a manner that maximizes his expected overall gain during a one- year period. The stocks, the current price per share, and the firm's projected stock price a year from now are summarized in the following table. Stock Price Current Projected Price 1 Year Hence $35 James Industries $25 QM Inc. $50 Delicious Candy Co $100 $60 $125 This problem was formulated as follows: xl-number of shares of James Industries to purchase, x2= number of shares of QM Inc. to purchase, and x3= number of shares of Delicious Candy Co. to purchase. MAX 10x1+10x2+25x3 s.t. available) 25xl+50x2+100x3 1000 (min. $ stock 1) 50x2 > 1000 (min. $ stock 2) 100x3 > 1000 (min. $ 100x3 > 1000 (min. $ stock 3) x1, x2, x320 OBJECTIVE FUNCTION VALUE 1) 3200.000 VARIABLE VALUE REDUCED COST X1 200 0.000000 X2 0.000000 X3 0.000000 Constraints SLACK OR SURPLUS DUAL PRICES 1) 0.0000 0.250000 0.0000 0.150000 4000.00 0.000000 1000.00 0.000000 5) 4000.000 0.000000 0.0000 -0.050000 3000.000 0.000000 VARIABLE CURRENT ALLOWABLE ALLOWABLE COEF INCREASE DECREASE X1 1 0.000000 INFINITY 3.750000 X2 1 0.000000 2.500000 INFINITY X3 25.000000 15.000001 5.000000 constraints CURRENT ALLOWABLE ALLOWABLE RHS INCREASE DECREASE 10000.000000 1000.000000 3000.000 5000.000000 3000.000000 1000.000 3 5000.000000 INFINITY 4000.000 4 5000.000000 INFINITY 1000.000 5 1000.000000 4000.000000 INFINITY 6 1000.000000 3000.000000 1000.000000 7 1000.000000 3000.000000 INFINITY 2 points each: a.) How many each type of shares they need to buy in order to maximize total gain? What is total gain? b.) If the client had an additional $1000 available for investing how much would the expected overall one-year gain increase? c) If the client increased the allowed maximum investment amount to S6000 for just one stock? Which one it should be and Why? d) Based on your stock choice in (c) above, how much would the objective function increase? e) Suppose that the return on per share increases from $25 to Sto 35 for Delicious candy. What is the new optimal solution? What is the total gain? 4. A client of an investment firm has $10,000 available for investment. He has instructed that his money be invested in three stocks so that no more than $5,000 is invested in any one stock but at least $1,000 is invested in each stock. He has further instructed the firm to use its current data and invest in a manner that maximizes his expected overall gain during a one- year period. The stocks, the current price per share, and the firm's projected stock price a year from now are summarized in the following table. Stock Price Current Projected Price 1 Year Hence $35 James Industries $25 QM Inc. $50 Delicious Candy Co $100 $60 $125 This problem was formulated as follows: xl-number of shares of James Industries to purchase, x2= number of shares of QM Inc. to purchase, and x3= number of shares of Delicious Candy Co. to purchase. MAX 10x1+10x2+25x3 s.t. available) 25xl+50x2+100x3 1000 (min. $ stock 1) 50x2 > 1000 (min. $ stock 2) 100x3 > 1000 (min. $ 100x3 > 1000 (min. $ stock 3) x1, x2, x320 OBJECTIVE FUNCTION VALUE 1) 3200.000 VARIABLE VALUE REDUCED COST X1 200 0.000000 X2 0.000000 X3 0.000000 Constraints SLACK OR SURPLUS DUAL PRICES 1) 0.0000 0.250000 0.0000 0.150000 4000.00 0.000000 1000.00 0.000000 5) 4000.000 0.000000 0.0000 -0.050000 3000.000 0.000000 VARIABLE CURRENT ALLOWABLE ALLOWABLE COEF INCREASE DECREASE X1 1 0.000000 INFINITY 3.750000 X2 1 0.000000 2.500000 INFINITY X3 25.000000 15.000001 5.000000 constraints CURRENT ALLOWABLE ALLOWABLE RHS INCREASE DECREASE 10000.000000 1000.000000 3000.000 5000.000000 3000.000000 1000.000 3 5000.000000 INFINITY 4000.000 4 5000.000000 INFINITY 1000.000 5 1000.000000 4000.000000 INFINITY 6 1000.000000 3000.000000 1000.000000 7 1000.000000 3000.000000 INFINITY 2 points each: a.) How many each type of shares they need to buy in order to maximize total gain? What is total gain? b.) If the client had an additional $1000 available for investing how much would the expected overall one-year gain increase? c) If the client increased the allowed maximum investment amount to S6000 for just one stock? Which one it should be and Why? d) Based on your stock choice in (c) above, how much would the objective function increase? e) Suppose that the return on per share increases from $25 to Sto 35 for Delicious candy. What is the new optimal solution? What is the total gain