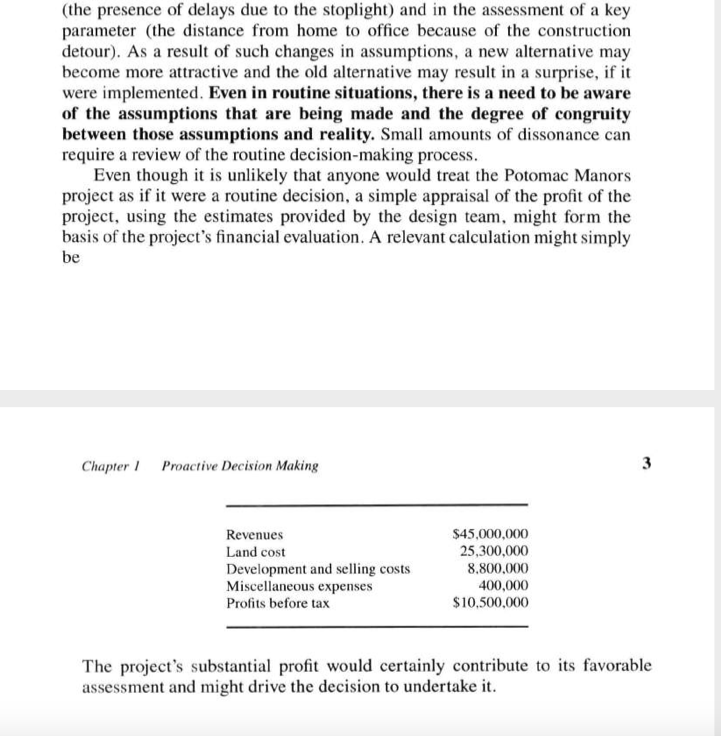

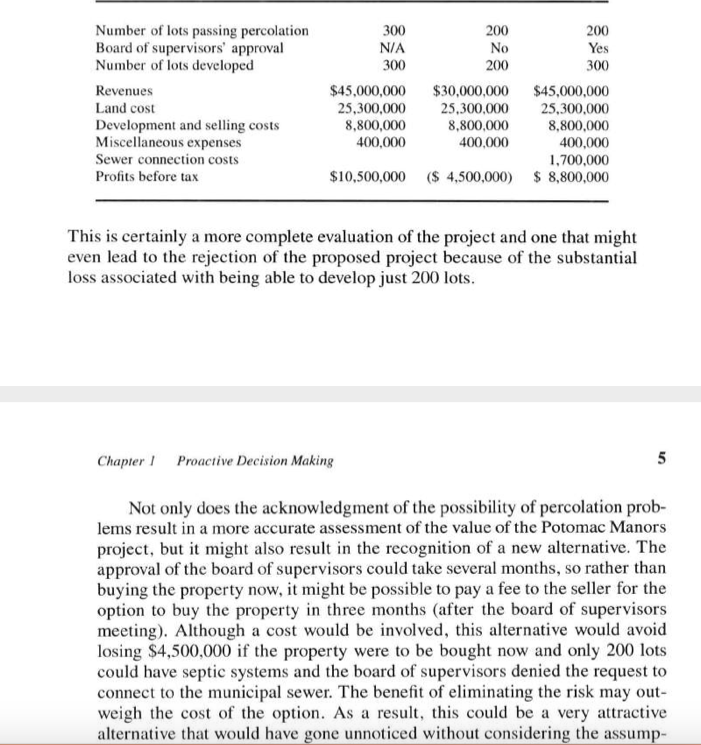

Quantitative_Business_Analysis Text and Cases.pdf (7169: 12/ Chapter 1 Proactive Decision Making 1 Routine Decisions 2 The Challenges of Proactive Decision Making 3 Alternatives 3 Assumptions-Structure 4 Assumptions-Assessments 5 Performance 6 Summary 7 Chapter 2 Alternatives 9 Small Number of Alternatives 9 Sequential Decisions 11 A Single Decision Quantity 12 Two or More Decision Quantities 17 Decision Rules 17 Summary 18Quantitativeusinesinalysis Text and Cases.pdf (BEE: 1?;355} DECISION MAKING A couple oi\" weeks ago a real estate broker with whom you had previously worked approached you. inquiring of your interest in a Li 00vacre tract of gently rolling woodlands on the perimeter of the Washington. D.C.. metropolitan area. The site was ideal for the development of a mid- to upscale residential commu- nity. and the timing of the query was ideal. Your firm. which specializes in residential land development. was just completing a moderately sized project and was seeking a new venture to take its place. particularly a project that would enhance the rm's reputation. Preliminary investigations of Potomac Manors. as the site had become known within the rm. were encouraging. The site was zoned R3 for low density residential housing. The zoning stipulated a minimum lot size of three acres and spelled out. among other things. specic requirements for lot dimen- sions. roads. septic systems. and public spaces. Your design team had arrived at a preliminary plan that carved out 300 threeacre lots. each with at least one very attractive marketing feature. The 200 acres that were not being used for lots were devoted to roads and public space. it was estimated that the lots would sell for an average price of 5150.000. It was also estimated that the development and selling costs would be $8,000 per acre and miscellaneous expenses. such as permits and legal fees. would total $400000. The property was being offered at 523.000 per acre. The broker had al- lowed you two weeks to explore the opportunity and was expecting a response within the next few days. Is Potomac Manors a protable project? Should you put forward the required $250,000 in earnest money to secure the property or let it go back on the open market? 2 Quantitative Business Aaaiyrls: liar and Cases The Potomac Manors decision is stereotypical of the decisions managers must make. There are alternatives (to buy the property or not}; there is a performance measure (prots): and there are assumptions (the linkages among the selling price. the costs. and prots: the estimation of the average seliing price and the costs). In addition. the decision must he made in a timely fashion and carutot he procrastinated. for as the maxim says. \"Not to decide is to decide." This chapter will explore the various aspects of situations that make proactive decision making challenging and that make analysis valuable. Routine Decisions Many decisions in our lives are routinewhich route to take from home to the ofce. where to invest excess money in the short term. what foods to buy at the supermarket. In each of these instances. we may quickly consider several alternatives. evaluate a measure of performance for each alternative. and make a choice. All of this is done in our head in a split second Without an explicit consideration of our assumptions. Even more simply. we may apply a well-established rule of thu mh or just do what we have always done. without even thinking about alternatives. Generally we are comfortable with such simplied decision processes because the consequences of the decisions are often not very signicant and because over time we have implicitly consid- ered (or experienced) the linkages between the alternatives and the perfor- mance measure and we do not feel the need to explicitly acknowledge them. Sometims. however. even routine decisions need more careful consider- ation. Changes in the situation can invalidate the tried-and-true decision rules. A new stoplight may he installed or a construction project begun on the route from home to ofce; the hank may impose minimum balance requirements for checking accounts: the supermarket may buy its fresh pro- duce from a different supplier. These changes in the environment disrupt the assumptions that we have made regarding the relationship between alternative and performance. The change may he manifest in the structure of the linkages {the presence of delays due to the stoplight} and in the assessment of a key (the presence of delays due to the stoplight) and in the assessment of a key parameter (the distance from home to office because of the construction detour). As a result of such changes in assumptions, a new alternative may become more attractive and the old alternative may result in a surprise, if it were implemented. Even in routine situations, there is a need to be aware of the assumptions that are being made and the degree of congruity between those assumptions and reality. Small amounts of dissonance can require a review of the routine decision-making process. Even though it is unlikely that anyone would treat the Potomac Manors project as if it were a routine decision, a simple appraisal of the profit of the project, using the estimates provided by the design team, might form the basis of the project's financial evaluation. A relevant calculation might simply be Chapter 1 Proactive Decision Making Revenues $45,000,000 Land cost 25,300,000 Development and selling costs 8.800.000 Miscellaneous expenses 400,000 Profits before tax $10,500,000 The project's substantial profit would certainly contribute to its favorable assessment and might drive the decision to undertake it.The Challenges of Proactive Decision Making A proactive decision maker looks beyond the routine by {I} seeking a richer set of alternatives than those that are initially presented or traditionally con- sidered. {2i questioning assumptions that are made regarding the structure of the relationships between alternatives and performance. (3) questioning assumptions regarding the assessment of important parameters that can po- tentially drive the decision. and (4} considering diverse measures of perfotv mance that incorporate the perspectives of the various stakeholders in the decision. Alternatives In the Potomac Manors project. the design team proposed a preliminary plan that carved out 300 three-acre lots that were expected to sell at an average price of 51150.0(\" per lot. This preliminary design may be anchored by the minimum lot size demanded of the property's R3 zoning and may be driven by a desire to maximize the number of the lots that could be developed. Anchors are a common phenomenon that can severely limit the development of alternatives because they constrain the decision maker's scope. Although the notion of maximizing the number of lots may seem to be a reasonable rule of thumb. it also may limit the consideration of alternatives that could result in greater prots. A more proactive consideration of alternatives could lead to the possibi] - ity of dividing the property into larger lots that might command a substan- tially greater price per acre. One possibility would be a plan with a standard lot size of four acres. A better alternative might be a mixture or three-. four-. and vehacre lots. A mixture of lot sizes not only might make more efcient use of the property. but also might increase the market value of all the lots because the larger lots could create the impression of an upscale development and the effect could trickle down to the smaller lots. The variety of lot sizes might also take advantage of a heterogeneous market allowing Potomac Manors to serve simultaneously several types of customers. Qua-n rimrl v1- Business Analysis.- TE ti and Cam Although the consideration of a richer set of alternatives makes the de cision more complex and more challenging. it also offers the possibility of achieving greater prots. AssamStructure An assumption implicit in the design team's plan for the Potomac Manors project was that all lots Would satisfy the septic percolation requirements of the R3 zoning. Often the enthusiasm for an exciting project or the inherent momentum of decision-making processor, lead to a supercial examination of assumptions or. even worse. to a climate in which the questioning of assump- tions is interpreted as disruptive. Such behavior prevents the consideration of different assumptions when the decision is being made and from the devel- opment of contingency plans for those occasions when reality deviates from assumption. As a result. the decision makers may be constantly reacting to changes and "putting out. res" or. in extreme situations. may face cattl- strophic surprises from which recovery is impossible. A proactive decision maker \"mold seek out and query assumptions regarding the fundamental linkages between alternative and performance. Suppose the assumption that all lots would meet the septic percolation requirements were queried and it was acknowledged that these was some possibility that a substantial portion of the Potomac Manors property might not meet the requirements. Now the calculation of the prots from the project would have to be made on the basis of the number of lots that would meet the requirements. This is a structural change in the linkage between the alterna- tive of developing the property and the performance measure of prots. If there were the possibility that the local board of supervisors would allow the affected portion of the development to be connected to the municipal sewer system {even though this violated the R3 zoning code]. there would be an additional structural change in the linkage between alternative and perfor- mance. Several possible prot calculations would be Number of lots passing percolation 300 200 200 Board of supervisors' approval N/A No Yes Number of lots developed 300 200 300 Revenues $45,000,000 $30,000,000 $45,000,000 Land cost 25,300,000 25,300,000 25,300,000 Development and selling costs 8,800,000 8,800,000 8,800,000 Miscellaneous expenses 400,000 400,000 400,000 Sewer connection costs 1,700,000 Profits before tax $10,500,000 ($ 4,500,000) $ 8,800,000 This is certainly a more complete evaluation of the project and one that might even lead to the rejection of the proposed project because of the substantial loss associated with being able to develop just 200 lots. Chapter I Proactive Decision Making Not only does the acknowledgment of the possibility of percolation prob- lems result in a more accurate assessment of the value of the Potomac Manors project, but it might also result in the recognition of a new alternative. The approval of the board of supervisors could take several months, so rather than buying the property now, it might be possible to pay a fee to the seller for the option to buy the property in three months (after the board of supervisors meeting). Although a cost would be involved, this alternative would avoid losing $4,500,000 if the property were to be bought now and only 200 lots could have septic systems and the board of supervisors denied the request to connect to the municipal sewer. The benefit of eliminating the risk may out- weigh the cost of the option. As a result, this could be a very attractive alternative that would have gone unnoticed without considering the assump-alternative that would have gone unnoticed without considering the assump- tions underlying the initial assessment. AssumptionsAssessments The Potomac Manors design team estimated the average selling price of the lots would be 5150.000. Even if this best estimate were based on a careful examination of comparable properties. the ultimate average selling price may be substantially different. Many factors contribute to the marketability of a residential developmentsome specic to the development itself and some related to prevailing macroeconomic conditions. Each makes forecast- ing difcult and can result in considerable uncertainty in whatever estimate is made. It is natural. however. to forecast in terms of best estimates. The culture of forecasting encourages being right. and best estimates otter the best chances of being right. In addition. best estimates are single numbers and it is easy to think and to calculate in terms of single numbers. Single numbers. however. can be misleading in the complex world in which decisions are made today. By ignoring the spectrum of potential possibilities. alternatives can bc misevaluated and the potential risks of the alternatives overlooked. For ex- ample. two alternatives may result in the same best estimate of prots, but when the spectrum of possibilities is considered. one alternative can have a substantial upside potential with little downside esposure and the other can be just the opposite. These are hardly the equally attractive alternatives that a bestestimate evaluation would suggest. As in the previous section, ignoring the spectrum of possibilities can also inhibit development of new alternatives that reduce risk because the need for such alternatives is never recognised. For the Potomac Manors project. the average selling price per lot might be as low as $120.0ll [if economic conditions slump and if other develop- ments of a similar nature come on the market at the same time} or as high as $160300 (if the economy is strong and Potomac Manors becomes a trendy location}. The effects of this spectrum of potential average selling prices can be evaluated as follows for the scenario "percolation-problems-aud- supervisors-approve-scwcrconnection.\" Summary Many decisions can be addressed in a routine fashion. For those decision situations. rules of thumb emerge over time that very effectively address the needs of the situations and substantially streamline the decision process. There are. however. many important decisions that. because of the unique- ness of the situation or because of the magnitude of the potential conse- quences. cannot be appropriater dispatched on a routine basis with rules of thumb. Such decisions need to be addressed in a proactive manner. Many alternatives need to be explored; assumptions need to be reviewed from the Quantitative Business Analysis: \"Ext and Cases perspective of the structure of the relationships between alternatives and performance as well as from the perspective of the asseasments of important parameters; performance measures need to be considered that span the full spectrum of issues on which the decision will be made, as well as the per- spectives of the stakeholders in the decision. This book offers perspectives. languages. and tools that will facilitate one's development as a proactive decision makera decision maker who steps beyond the routine and addresses situations in a comprehensive but timelyr fashion using formal analytical tools that are guided by judgment and intuition