Quantity Revenue Master Budget (For July) Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin Fixed manufacturing cost Fixed Selling, General and

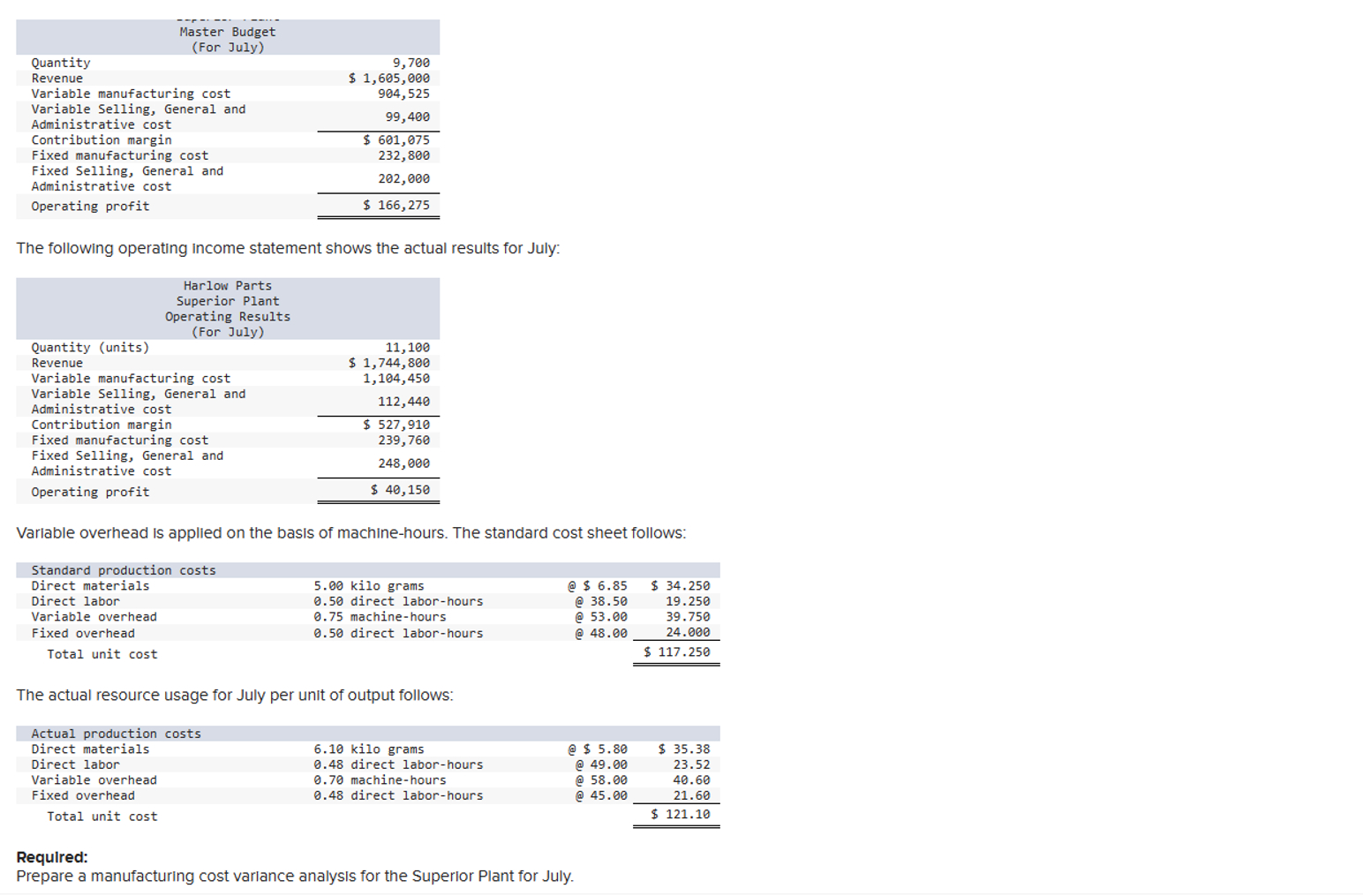

Quantity Revenue Master Budget (For July) Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin Fixed manufacturing cost Fixed Selling, General and Administrative cost Operating profit 9,700 $ 1,605,000 904,525 99,400 $ 601,075 232,800 202,000 $ 166,275 The following operating income statement shows the actual results for July: Quantity (units) Revenue Harlow Parts Superior Plant Operating Results (For July) Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin Fixed manufacturing cost Fixed Selling, General and Administrative cost Operating profit 11,100 $ 1,744,800 1,104,450 112,440 $ 527,910 239,760 248,000 $ 40,150 Variable overhead is applied on the basis of machine-hours. The standard cost sheet follows: Standard production costs Direct materials Direct labor Fixed overhead Variable overhead Total unit cost 5.00 kilo grams 0.50 direct labor-hours 0.75 machine-hours 0.50 direct labor-hours @ 53.00 @ $ 6.85 @38.50 $ 34.250 19.250 39.750 @ 48.00 24.000 $ 117.250 The actual resource usage for July per unit of output follows: Actual production costs Direct materials Direct labor Variable overhead Fixed overhead Total unit cost 6.10 kilo grams $ 5.80 0.48 direct labor-hours @ 49.00 $ 35.38 23.52 0.70 machine-hours @ 58.00 40.60 0.48 direct labor-hours @ 45.00 21.60 $ 121.10 Required: Prepare a manufacturing cost variance analysis for the Superior Plant for July.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started