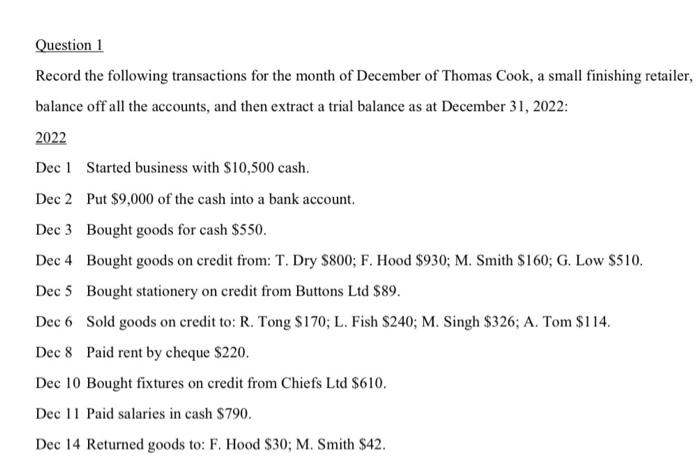

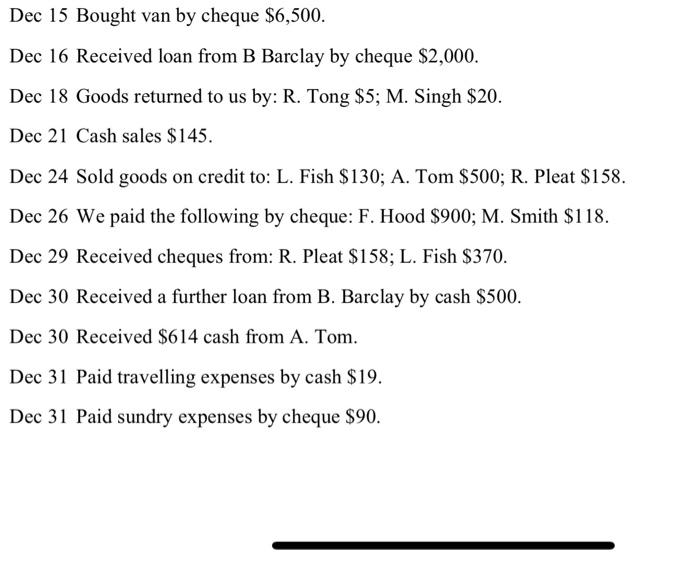

Quention I Record the following trancactions for the month of Docmber of Thomas Cook a small fiaking totailer. balance off all the ackouns, and then exiract a trial balanct as at Decemher 31. 202z: 2022 Dec 1 Staned trusiness with 510.400 cach. Dee 2 Pat $9.000 of the cash inte a bank account. Dec 3 Bought goods foe cask $580 Doc 4 Bought goods an credit fromt T. Dry 5800, F. Hood S93e, M. Smith Ste0, G. Low 5510 Dec 5 Bought itationcty on crodit from Buttons Les 389 . Doe 6 Sold pords an credit toc R. Tong 5170, L. Fiah S240, M. Sengh S3S, A. Toen 5114. Dec 8 Paid teat by cheque 3220 . Dec 10 Bought fixaser on cedit foum Chiefs Lat $610. Dec 1I Paid salaries in cath 5790. Dec 14 Keturned goods so: F. Hood 530, M. Senith SA2. Dec 15 Bought van by choque 56.500 . Dee 16 Received foan from B Barilay by cheque 52,000 . Dee 18 Giood returned to as by: R. Tote 55; M. Singh 520. Dec 21 Cish sales $145. Dec 24 Sold goods on crodit tec: L. Fith $130,A. Tem 5400, R. Pleat 5158 . Dec 26 We paid the following by choqe: P. Hood 5000 , M. Smith $11k Dec 29 Received sheques froen: R. Pleat 5158; L. Fish 5370 Dec 30 Received a further loan from B. Bacclay by cail 5900 . Dee 30 Received 5614 cash from A. Tom. Dec 31 Paid travelling expenes by cach 519 Dee 31 Paid sundry expenses by cheqse $90. Question 2 Using the Trial Balance you got in Assignnent 1 with a cloning inventary of 52,365 an December 31,2022 . you are required to pecpare the: a) Incotne Statement. b) Statement of Changes in Ouner's Equity. c) Balance Shert. Question 1 Record the following transactions for the month of December of Thomas Cook, a small finishing retaile balance off all the accounts, and then extract a trial balance as at December 31, 2022: 2022 Dec 1 Started business with $10,500 cash. Dec 2 Put $9,000 of the cash into a bank account. Dec 3 Bought goods for cash $550. Dec 4 Bought goods on credit from: T. Dry $800; F. Hood $930; M. Smith $160; G. Low $510. Dec 5 Bought stationery on credit from Buttons Ltd $89. Dec 6 Sold goods on credit to: R. Tong \$170; L. Fish \$240; M. Singh \$326; A. Tom $114. Dec 8 Paid rent by cheque $220. Dec 10 Bought fixtures on credit from Chiefs Ltd $610. Dec 11 Paid salaries in cash $790. Dec 14 Returned goods to: F. Hood $30; M. Smith $42. Dec 15 Bought van by cheque $6,500. Dec 16 Received loan from B Barclay by cheque $2,000. Dec 18 Goods returned to us by: R. Tong $5; M. Singh $20. Dec 21 Cash sales $145. Dec 24 Sold goods on credit to: L. Fish $130; A. Tom $500; R. Pleat $158. Dec 26 We paid the following by cheque: F. Hood $900; M. Smith $118. Dec 29 Received cheques from: R. Pleat $158; L. Fish $370. Dec 30 Received a further loan from B. Barclay by cash $500. Dec 30 Received $614 cash from A. Tom. Dec 31 Paid travelling expenses by cash $19. Dec 31 Paid sundry expenses by cheque $90. Using the Trial Balance you got in Assignment 1 with a closing inventory of $2,386 on December 31,2022 , you are required to prepare the: a) Income Statement. b) Statement of Changes in Owner's Equity. c) Balance Sheet