Question

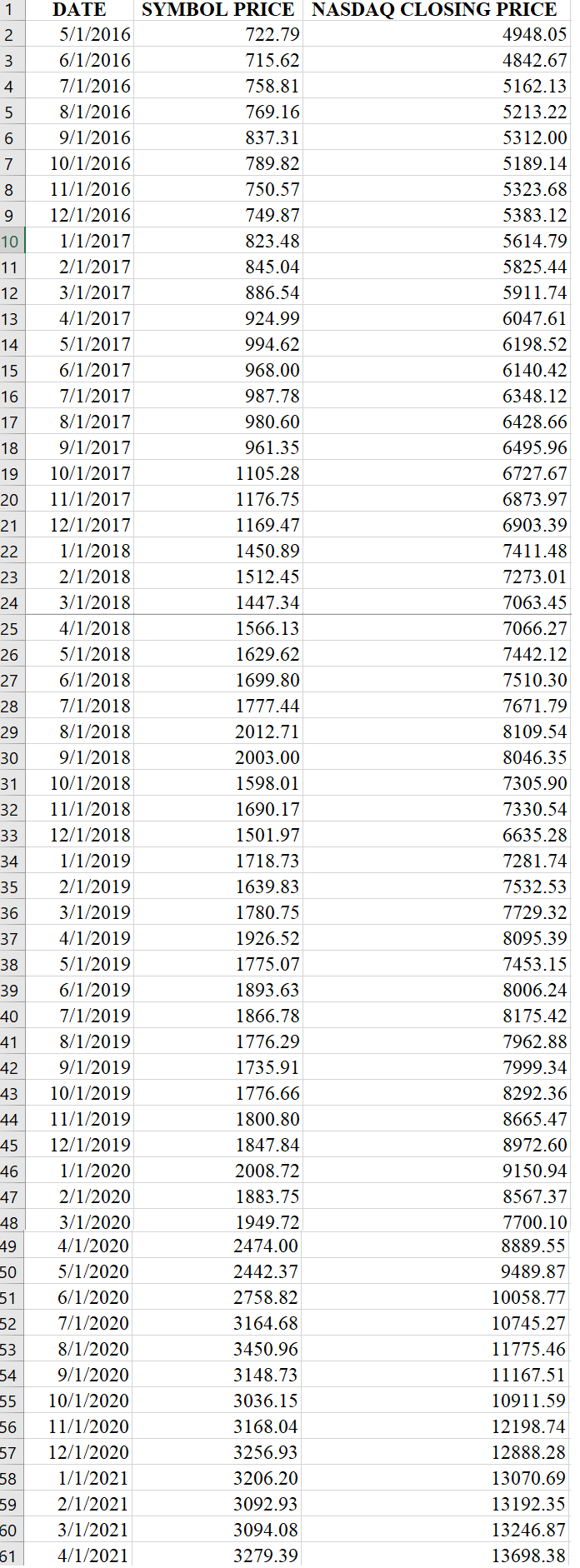

Query: You need to find the returns first before running a linear regression (C.L., 2022). (A) Find the monthly return of SYMBOL PRICE and NASDAQ

Query: "You need to find the returns first before running a linear regression" (C.L., 2022).

(A) Find the monthly return of "SYMBOL" PRICE and NASDAQ CLOSING PRICE.

(B) Elaborate HOW TO "run a liner regression" to estimate beta of "SYMBOL" PRICE.

(C) Use CORREL ("SYMBOL" return, NASDAQ return) x STDEV(Standard deviation of "SYMBOL" return)/ STDEV (standard deviation of NASDAQ return) to find beta of "SYMBOL".

(D) Use the security market line or capital asset pricing model to find the required rate of return of "SYMBOL", assuming market return is 12% and risk free rate is 3%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started