Answered step by step

Verified Expert Solution

Question

1 Approved Answer

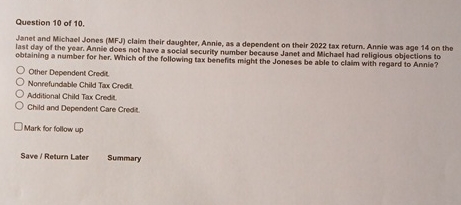

Question 1 0 of 1 0 . Janet and Michael Jones ( MFJ ) claim their daughter, Annie, as a dependent on their 2 0

Question of

Janet and Michael Jones MFJ claim their daughter, Annie, as a dependent on their tax return. Annie was age on the

last day of the year. Annie does not have a social security number because Janet and Michael had religious objections to

obtaining a number for her. Which of the following tax benefits might the Joneses be able to claim with regard to Annie?

Other Dependent Credt

Nonrefundable Child Tax Credit.

Additional Child Tax Credt.

Child and Dependent Care Credt.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started