Answered step by step

Verified Expert Solution

Question

1 Approved Answer

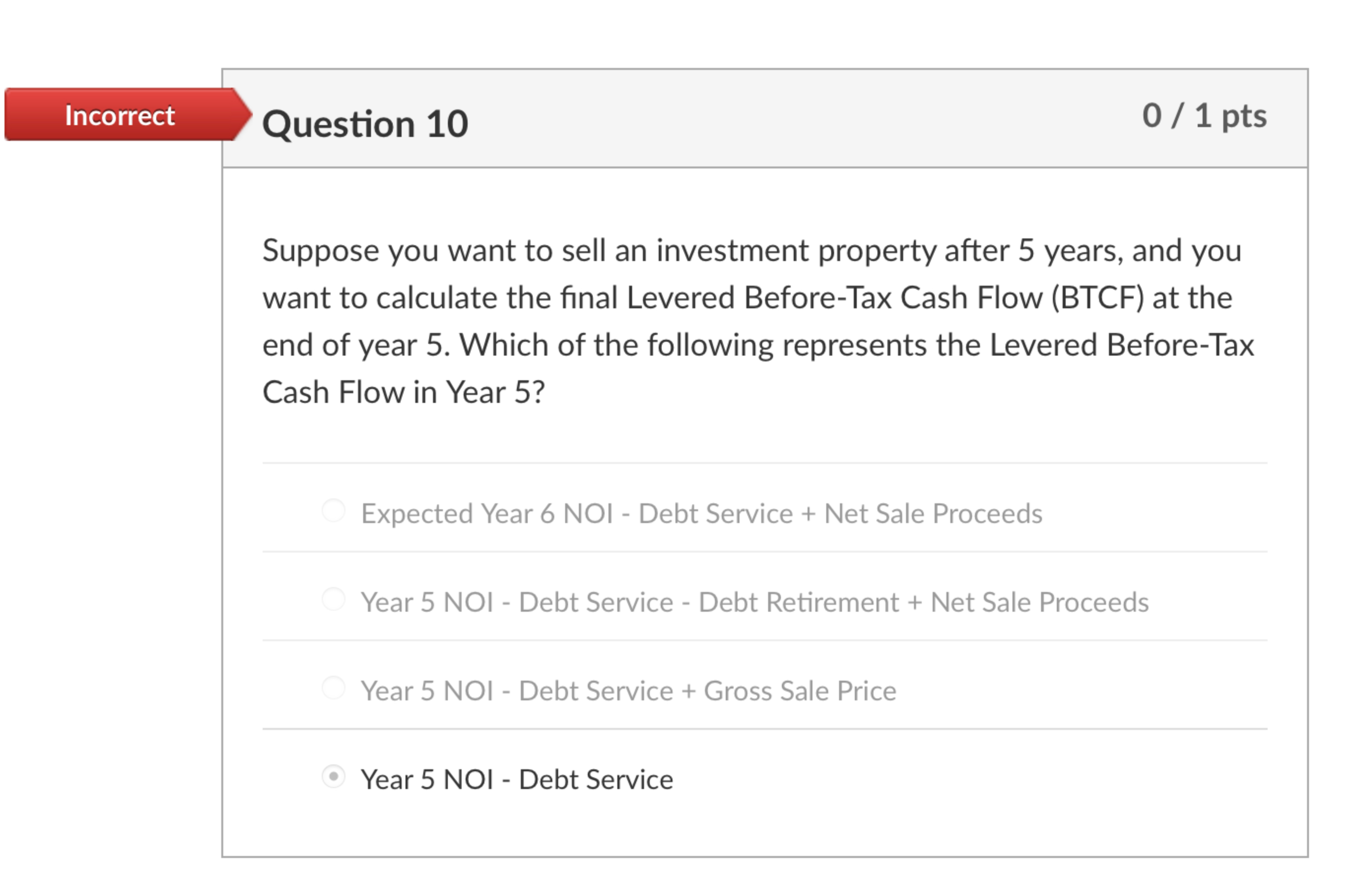

Question 1 0 Suppose you want to sell an investment property after 5 years, and you want to calculate the final Levered Before - Tax

Question

Suppose you want to sell an investment property after years, and you

want to calculate the final Levered BeforeTax Cash Flow BTCF at the

end of year Which of the following represents the Levered BeforeTax

Cash Flow in Year

Expected Year NOI Debt Service Net Sale Proceeds

Year NOI Debt Service Debt Retirement Net Sale Proceeds

Year NOI Debt Service Gross Sale Price

Year NOI Debt Service

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started