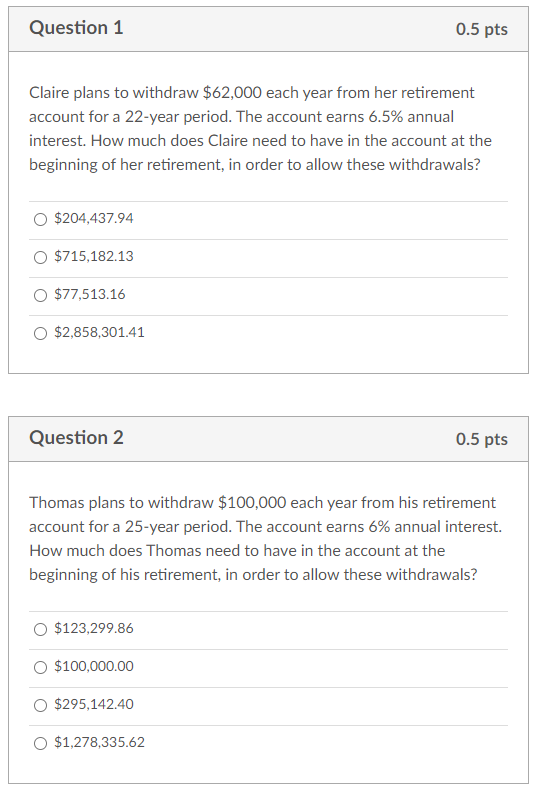

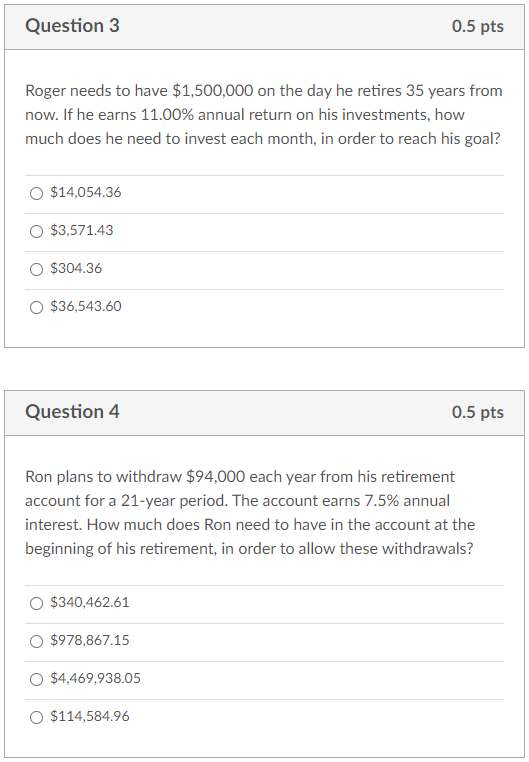

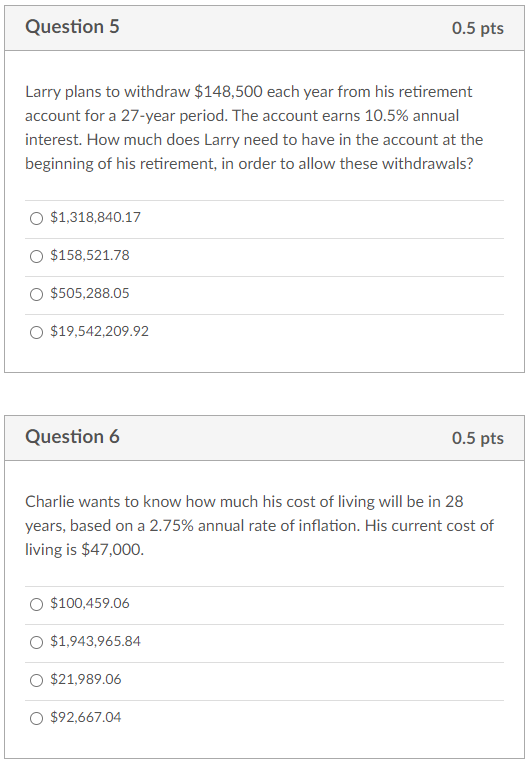

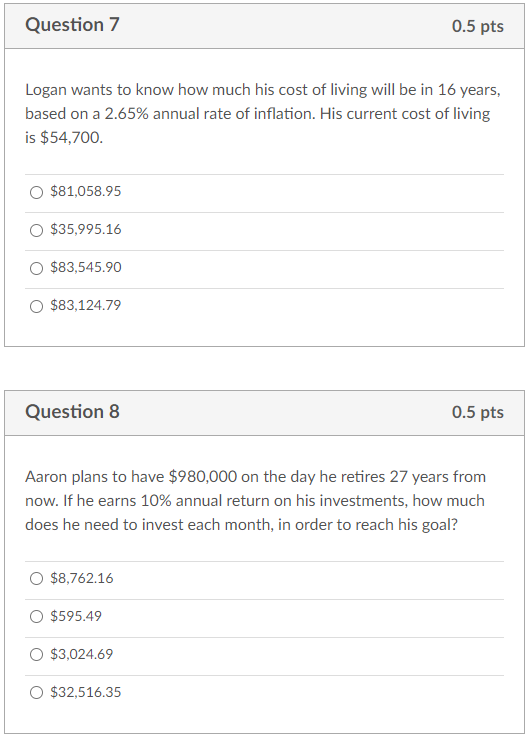

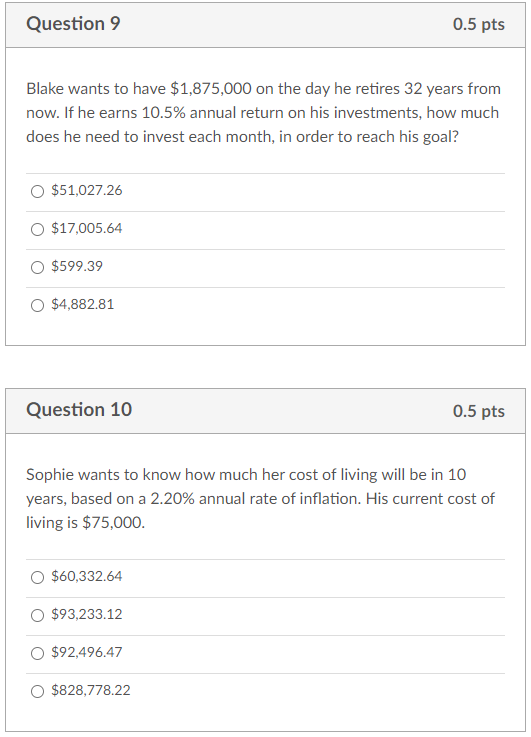

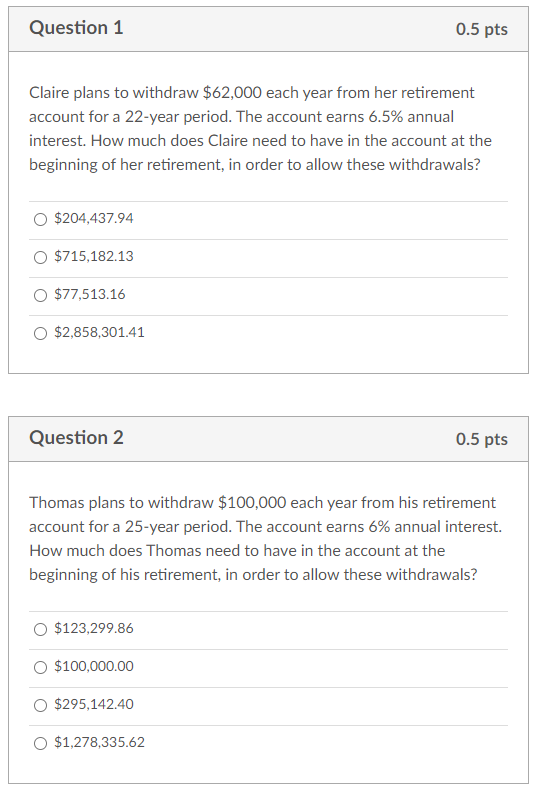

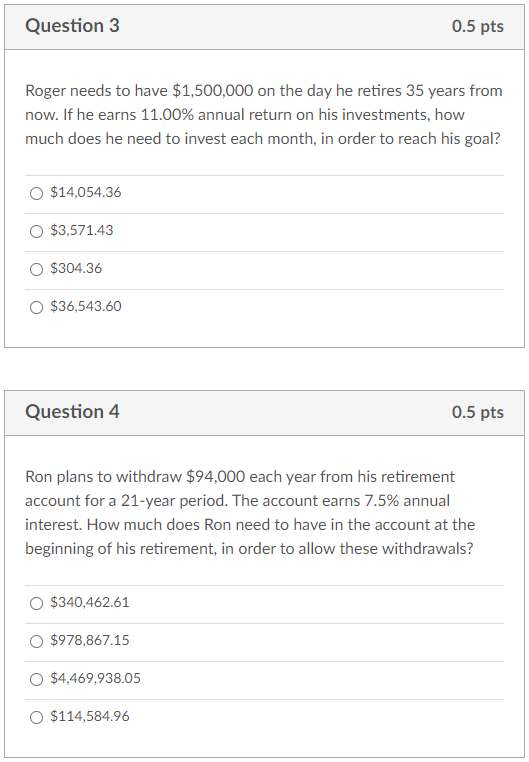

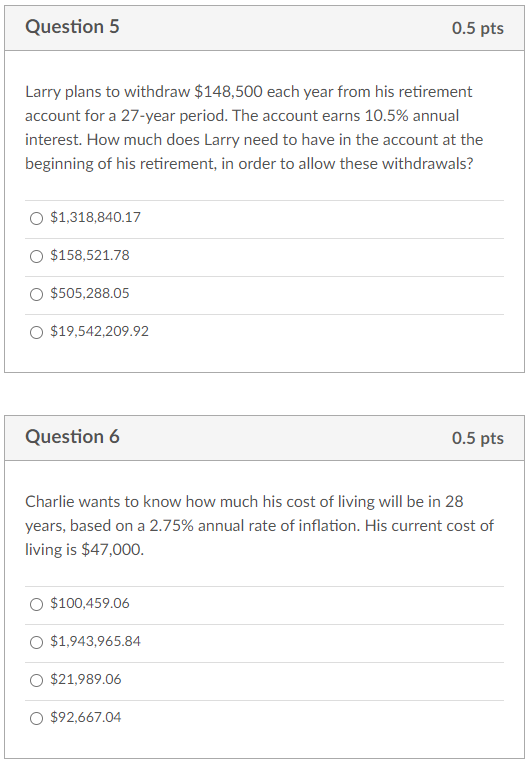

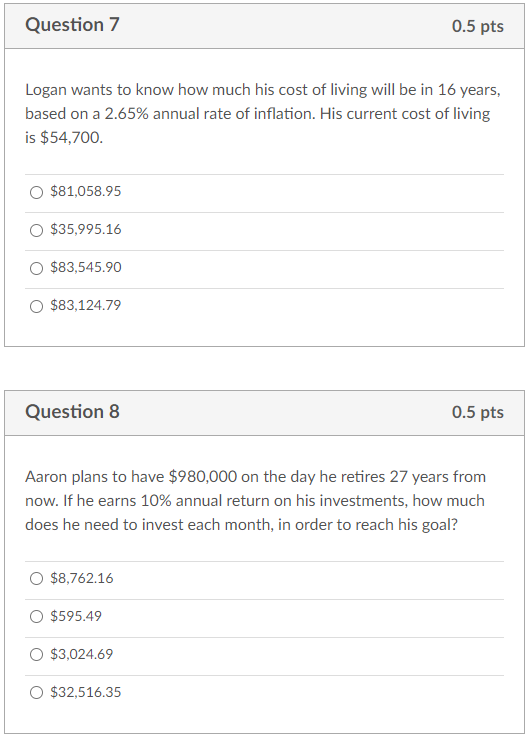

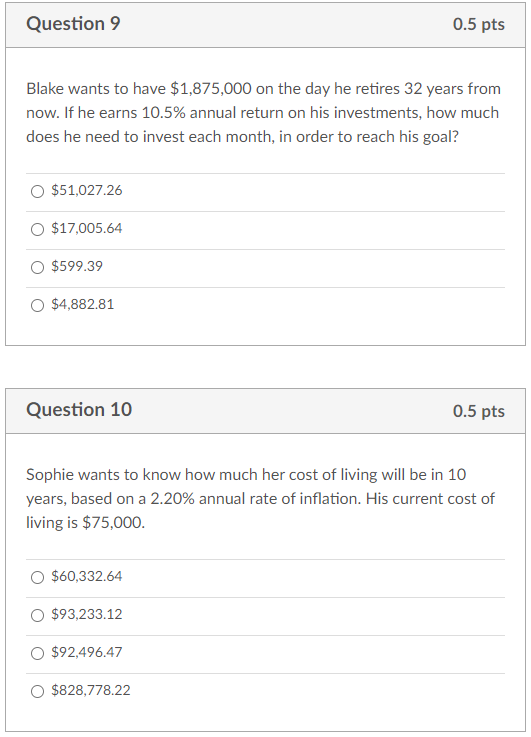

Question 1 0.5 pts Claire plans to withdraw $62,000 each year from her retirement account for a 22-year period. The account earns 6.5% annual interest. How much does Claire need to have in the account at the beginning of her retirement, in order to allow these withdrawals? $204,437.94 $715,182.13 $77,513.16 $2,858,301.41 Question 2 0.5 pts Thomas plans to withdraw $100,000 each year from his retirement account for a 25-year period. The account earns 6% annual interest. How much does Thomas need to have in the account at the beginning of his retirement, in order to allow these withdrawals? $123,299.86 $100,000.00 $295,142.40 O $1,278,335.62 Question 3 0.5 pts Roger needs to have $1,500,000 on the day he retires 35 years from now. If he earns 11.00% annual return on his investments, how much does he need to invest each month, in order to reach his goal? $14,054.36 $3,571.43 $304.36 O $36,543.60 Question 4 0.5 pts Ron plans to withdraw $94,000 each year from his retirement account for a 21-year period. The account earns 7.5% annual interest. How much does Ron need to have in the account at the beginning of his retirement, in order to allow these withdrawals? $340,462.61 O $978,867.15 $4,469,938.05 O $114,584.96 Question 5 0.5 pts Larry plans to withdraw $148,500 each year from his retirement account for a 27-year period. The account earns 10.5% annual interest. How much does Larry need to have in the account at the beginning of his retirement, in order to allow these withdrawals? $1,318,840.17 $158,521.78 $505,288.05 $19,542,209.92 Question 6 0.5 pts Charlie wants to know how much his cost of living will be in 28 years, based on a 2.75% annual rate of inflation. His current cost of living is $47,000 $100,459.06 O $1,943,965.84 O $21,989.06 $92,667.04 Question 7 0.5 pts Logan wants to know how much his cost of living will be in 16 years, based on a 2.65% annual rate of inflation. His current cost of living is $54,700. $81,058.95 O $35.995.16 O $83,545.90 O $83,124.79 Question 8 0.5 pts Aaron plans to have $980,000 on the day he retires 27 years from now. If he earns 10% annual return on his investments, how much does he need to invest each month, in order to reach his goal? O $8,762.16 O $595.49 $3,024.69 O $32,516.35 Question 9 0.5 pts Blake wants to have $1,875,000 on the day he retires 32 years from now. If he earns 10.5% annual return on his investments, how much does he need to invest each month, in order to reach his goal? O $51,027.26 O $17,005.64 O $599.39 O $4,882.81 Question 10 0.5 pts Sophie wants to know how much her cost of living will be in 10 years, based on a 2.20% annual rate of inflation. His current cost of living is $75,000. O $60,332.64 O $93,233.12 O $92,496.47 $828,778.22