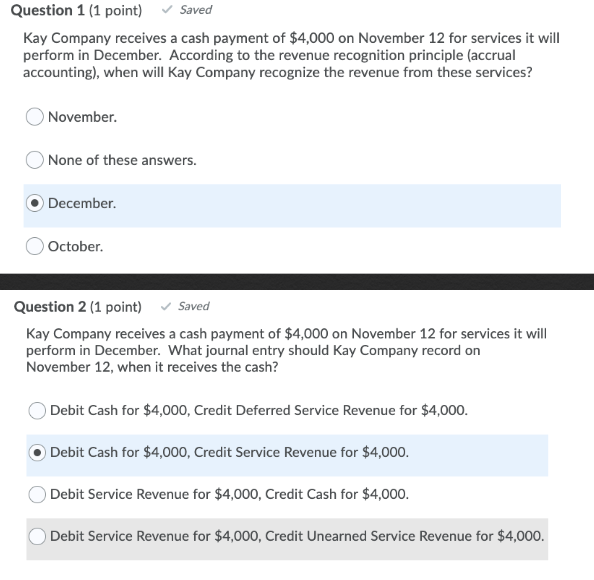

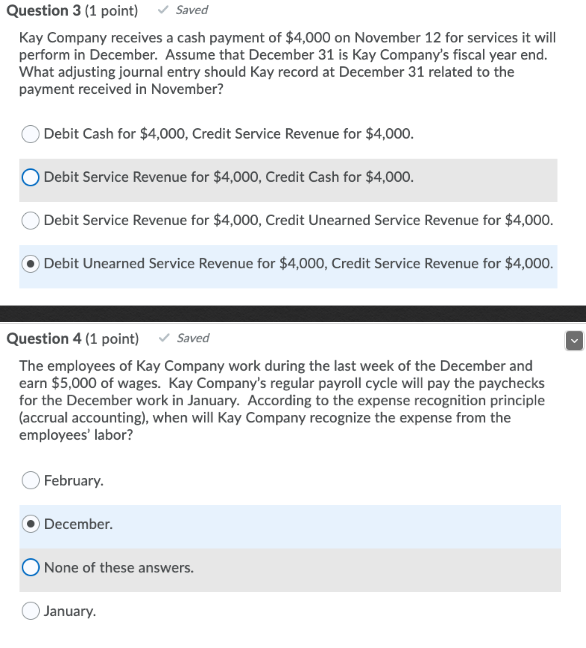

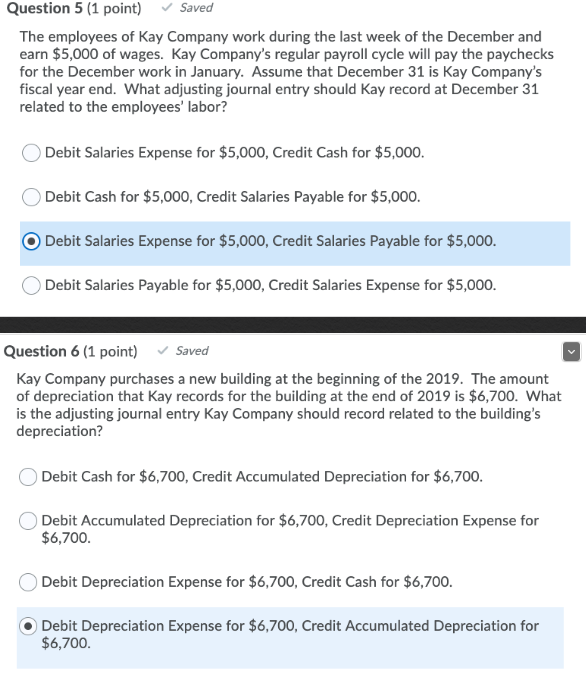

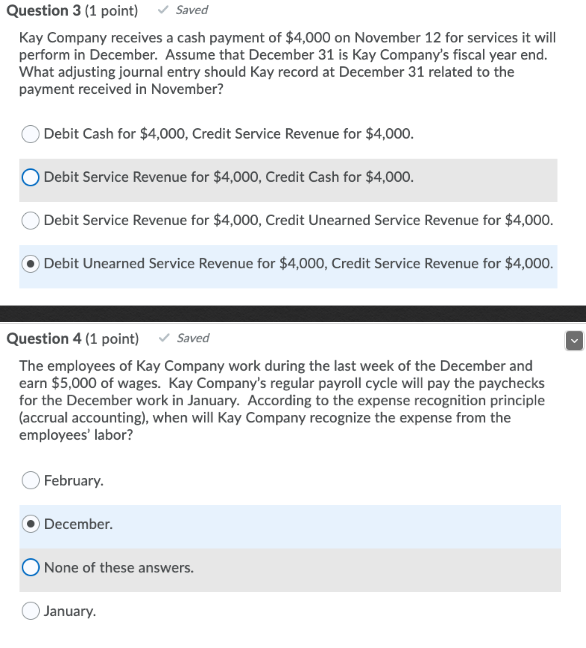

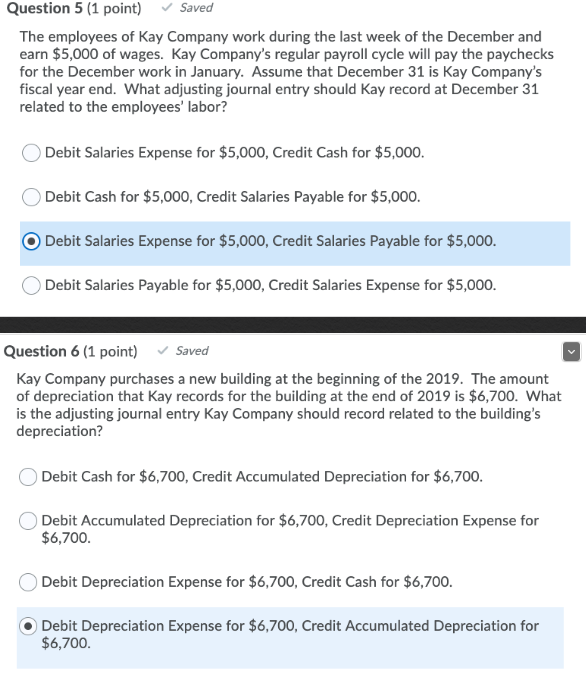

Question 1 (1 point) v Saved Kay Company receives a cash payment of $4,000 on November 12 for services it will perform in December. According to the revenue recognition principle (accrual accounting), when will Kay Company recognize the revenue from these services? November None of these answers. December October Question 2 (1 point) Saved Kay Company receives a cash payment of $4,000 on November 12 for services it will perform in December. What journal entry should Kay Company record on November 12, when it receives the cash? Debit Cash for $4,000, Credit Deferred Service Revenue for $4,000. Debit Cash for $4,000, Credit Service Revenue for $4,000. Debit Service Revenue for $4,000, Credit Cash for $4,000. Debit Service Revenue for $4,000, Credit Unearned Service Revenue for $4,000. Question 3 (1 point) Saved Kay Company receives a cash payment of $4,000 on November 12 for services it will perform in December. Assume that December 31 is Kay Company's fiscal year end. What adjusting journal entry should Kay record at December 31 related to the payment received in November? Debit Cash for $4,000, Credit Service Revenue for $4,000. Debit Service Revenue for $4,000, Credit Cash for $4,000. Debit Service Revenue for $4,000, Credit Unearned Service Revenue for $4,000. Debit Unearned Service Revenue for $4,000, Credit Service Revenue for $4,000. Question 4 (1 point) Saved The employees of Kay Company work during the last week of the December and earn $5,000 of wages. Kay Company's regular payroll cycle will pay the paychecks for the December work in January. According to the expense recognition principle (accrual accounting), when will Kay Company recognize the expense from the employees' labor? February December None of these answers. January. Question 5 (1 point) Saved The employees of Kay Company work during the last week of the December and earn $5,000 of wages. Kay Company's regular payroll cycle will pay the paychecks for the December work in January. Assume that December 31 is Kay Company's fiscal year end. What adjusting journal entry should Kay record at December 31 related to the employees' labor? Debit Salaries Expense for $5,000, Credit Cash for $5,000. Debit Cash for $5,000, Credit Salaries Payable for $5,000. Debit Salaries Expense for $5,000, Credit Salaries Payable for $5,000. Debit Salaries Payable for $5,000, Credit Salaries Expense for $5,000. Question 6 (1 point) Saved Kay Company purchases a new building at the beginning of the 2019. The amount of depreciation that Kay records for the building at the end of 2019 is $6,700. What is the adjusting journal entry Kay Company should record related to the building's depreciation? Debit Cash for $6,700, Credit Accumulated Depreciation for $6,700. Debit Accumulated Depreciation for $6,700, Credit Depreciation Expense for $6,700. Debit Depreciation Expense for $6,700, Credit Cash for $6,700. Debit Depreciation Expense for $6,700, Credit Accumulated Depreciation for $6,700