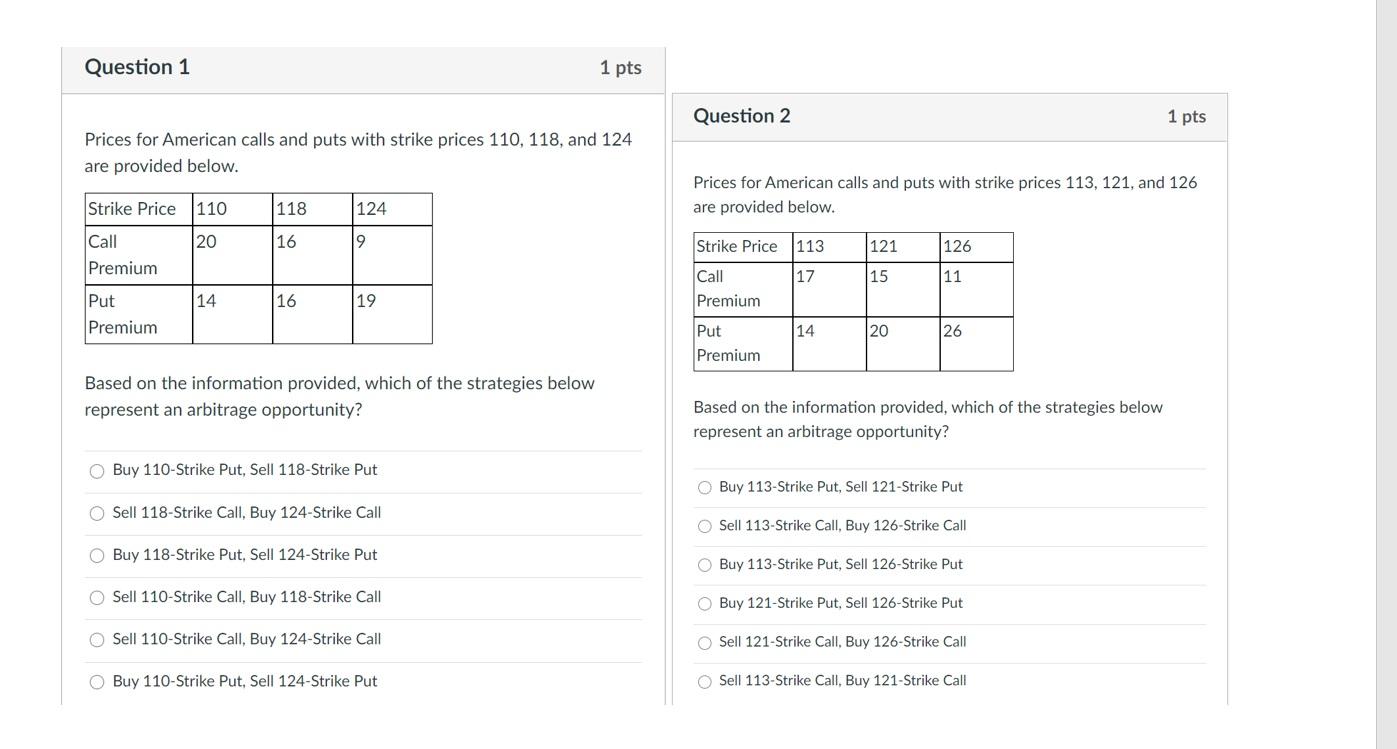

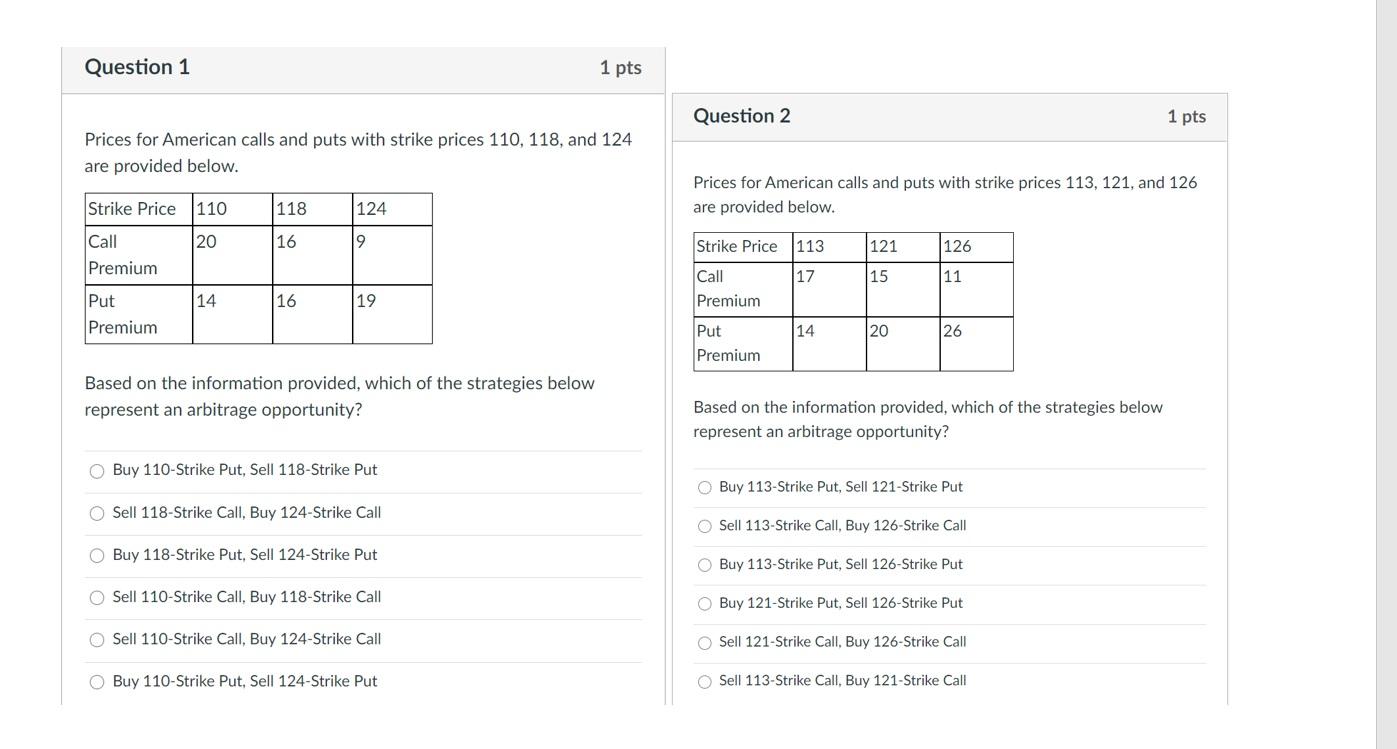

Question 1 1 pts Question 2 1 pts Prices for American calls and puts with strike prices 110, 118, and 124 are provided below. Prices for American calls and puts with strike prices 113, 121, and 126 are provided below. Strike Price 110 118 124 Call 20 16 Strike Price 113 121 126 Premium Call 17 15 11 14 16 19 Premium Put Premium 14 20 26 Put Premium Based on the information provided, which of the strategies below represent an arbitrage opportunity? Based on the information provided, which of the strategies below represent an arbitrage opportunity? Buy 110-Strike Put, Sell 118-Strike Put Buy 113-Strike Put, Sell 121-Strike Put Sell 118-Strike Call, Buy 124-Strike Call O Sell 113-Strike Call, Buy 126-Strike Call Buy 118-Strike Put, Sell 124-Strike Put Buy 113-Strike Put, Sell 126-Strike Put Sell 110-Strike Call. Buy 118-Strike Call Buy 121-Strike Put, Sell 126-Strike Put O Sell 110-Strike Call, Buy 124-Strike Call Sell 121-Strike Call, Buy 126-Strike Call O Buy 110-Strike Put, Sell 124-Strike Put Sell 113-Strike Call, Buy 121-Strike Call Question 1 1 pts Question 2 1 pts Prices for American calls and puts with strike prices 110, 118, and 124 are provided below. Prices for American calls and puts with strike prices 113, 121, and 126 are provided below. Strike Price 110 118 124 Call 20 16 Strike Price 113 121 126 Premium Call 17 15 11 14 16 19 Premium Put Premium 14 20 26 Put Premium Based on the information provided, which of the strategies below represent an arbitrage opportunity? Based on the information provided, which of the strategies below represent an arbitrage opportunity? Buy 110-Strike Put, Sell 118-Strike Put Buy 113-Strike Put, Sell 121-Strike Put Sell 118-Strike Call, Buy 124-Strike Call O Sell 113-Strike Call, Buy 126-Strike Call Buy 118-Strike Put, Sell 124-Strike Put Buy 113-Strike Put, Sell 126-Strike Put Sell 110-Strike Call. Buy 118-Strike Call Buy 121-Strike Put, Sell 126-Strike Put O Sell 110-Strike Call, Buy 124-Strike Call Sell 121-Strike Call, Buy 126-Strike Call O Buy 110-Strike Put, Sell 124-Strike Put Sell 113-Strike Call, Buy 121-Strike Call