Answered step by step

Verified Expert Solution

Question

1 Approved Answer

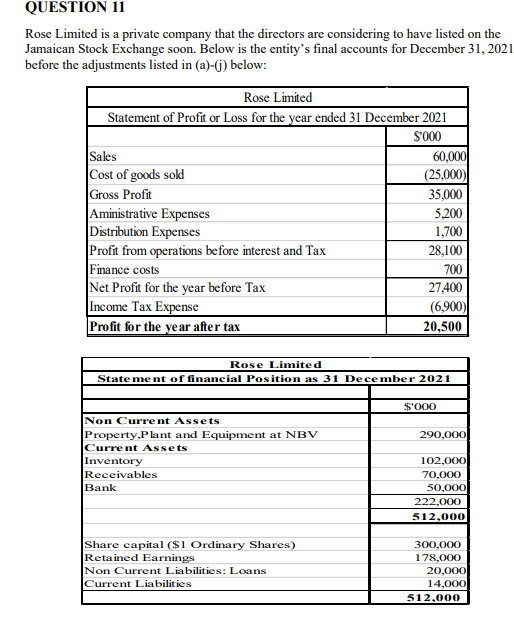

QUESTION 1 1 Rose Limited is a private company that the directors are considering to have listed on the Jamaican Stock Exchange soon. Below is

QUESTION

Rose Limited is a private company that the directors are considering to have listed on the

Jamaican Stock Exchange soon. Below is the entity's final accounts for December

before the adjustments listed in aj below: The following information below have not yet been taken into account and is relevant

to the entitys financial statements for the year ended December :

a A revaluation of property took place on January which revealed that the

property had a fair value of $ on that date carrying value

$ The effect of the revaluation has not been included in the books

b Property is depreciated straight line over years and depreciation charges are

split equally between administrative expenses and distribution expense.

c Equipment Cost $ is depreciated over years on the straightline

basis and charged to distribution costs and to administrative

expenses.

d Noncurrent asset under plant held for sale of at a cost of $accumulated

depreciation, $ had not been accounted for.

e A yearend provision for bad of of gross receivables is to be made. Any

provision for bad debts should be recorded in administrative expenses refer to

note h

f The entity sold a defective product and was sued by the customer. On December

the entitys attorney indicated that it is probable that the entity will lose and

have to pay $ million. Settlement is likely to be within the next six months. Any

amount provided for should be charged to distribution costs.

g The entity made a one for five rights issue on June fully taken up at a price

of $

h On January a debtor included in receivables for $ is declared

bankrupt

i Corporation tax is rate is of net profit before tax the taxation displayed in the

Statement of profit and loss has not been paid

j Provide for an ordinary dividend of on all shares in issue on December

Required:

iPrepare the statement of profit or loss for the year ended December

iiPrepare the statement of financial position as at December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started