Answered step by step

Verified Expert Solution

Question

1 Approved Answer

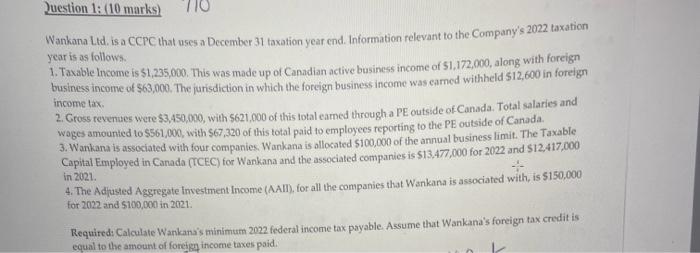

Question 1: (10 marks) 710 Wankana Ltd. is a CCPC that uses a December 31 taxation year end. Information relevant to the Company's 2022 taxation

Question 1: (10 marks) 710 Wankana Ltd. is a CCPC that uses a December 31 taxation year end. Information relevant to the Company's 2022 taxation year is as follows. 1. Taxable Income is $1,235,000. This was made up of Canadian active business income of $1,172,000, along with foreign business income of $63,000. The jurisdiction in which the foreign business income was earned withheld $12,600 in foreign income tax. 2. Gross revenues were $3,450,000, with $621,000 of this total earned through a PE outside of Canada. Total salaries and wages amounted to $561,000, with $67,320 of this total paid to employees reporting to the PE outside of Canada. 3. Wankana is associated with four companies. Wankana is allocated $100,000 of the annual business limit. The Taxable Capital Employed in Canada (TCEC) for Wankana and the associated companies is $13,477,000 for 2022 and $12,417,000 in 2021. 4- 4. The Adjusted Aggregate Investment Income (AAII), for all the companies that Wankana is associated with, is $150,000 for 2022 and $100,000 in 2021. Required: Calculate Wankana's minimum 2022 federal income tax payable. Assume that Wankana's foreign tax credit is equal to the amount of foreign income taxes paid.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started