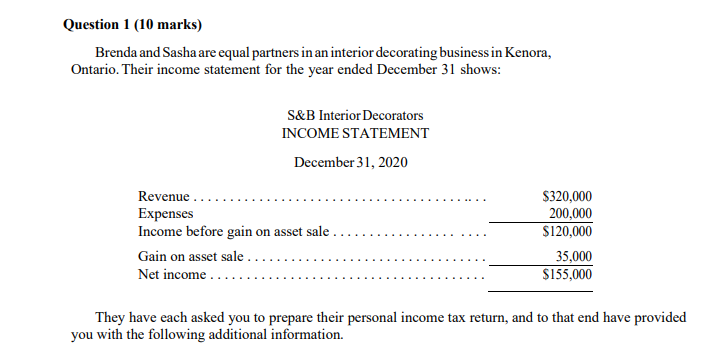

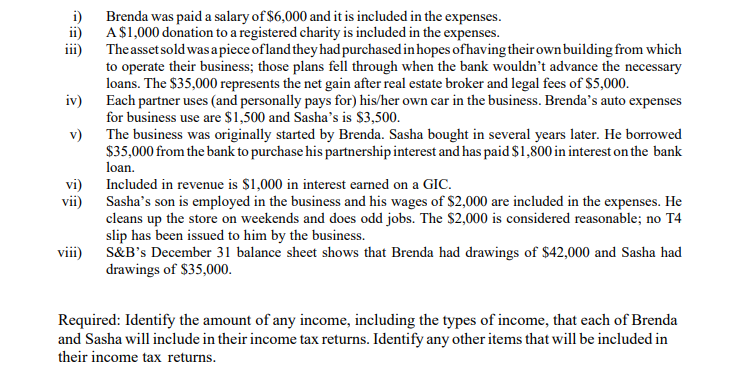

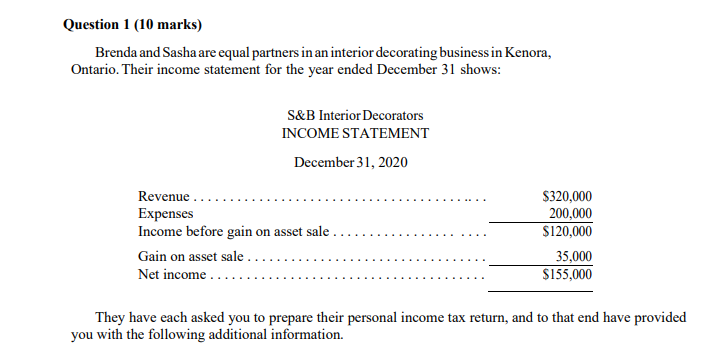

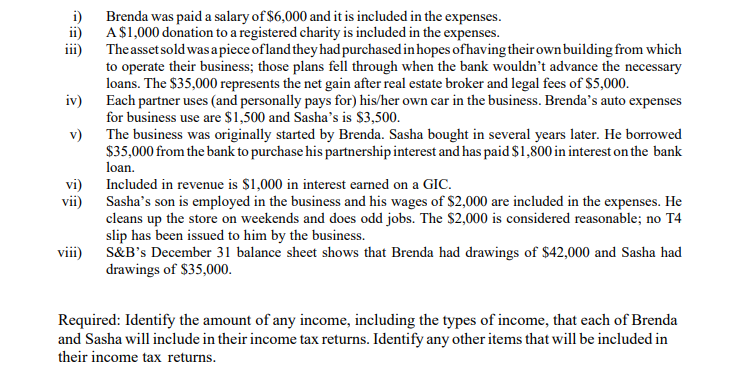

Question 1 (10 marks) Brenda and Sasha are equal partners in an interior decorating business in Kenora, Ontario. Their income statement for the year ended December 31 shows: S&B Interior Decorators INCOME STATEMENT December 31, 2020 Revenue Expenses Income before gain on asset sale Gain on asset sale Net income $320,000 200,000 $120,000 35,000 $155,000 They have each asked you to prepare their personal income tax return, and to that end have provided you with the following additional information. i) Brenda was paid a salary of $6,000 and it is included in the expenses. A $1,000 donation to a registered charity is included in the expenses. iii) The asset sold was a piece of land they had purchased in hopes of having their own building from which to operate their business; those plans fell through when the bank wouldn't advance the necessary loans. The $35,000 represents the net gain after real estate broker and legal fees of $5,000. iv) Each partner uses and personally pays for) his/her own car in the business. Brenda's auto expenses for business use are $1,500 and Sasha's is $3,500. v) The business was originally started by Brenda. Sasha bought in several years later. He borrowed $35,000 from the bank to purchase his partnership interest and has paid $1,800 in interest on the bank loan. vi) Included in revenue is $1,000 in interest earned on a GIC. vii) Sasha's son is employed in the business and his wages of $2,000 are included in the expenses. He cleans up the store on weekends and does odd jobs. The $2,000 is considered reasonable; no T4 slip has been issued to him by the business. vii) S&B's December 31 balance sheet shows that Brenda had drawings of $42,000 and Sasha had drawings of $35,000. Required: Identify the amount of any income, including the types of income, that each of Brenda and Sasha will include in their income tax returns. Identify any other items that will be included in their income tax returns. Question 1 (10 marks) Brenda and Sasha are equal partners in an interior decorating business in Kenora, Ontario. Their income statement for the year ended December 31 shows: S&B Interior Decorators INCOME STATEMENT December 31, 2020 Revenue Expenses Income before gain on asset sale Gain on asset sale Net income $320,000 200,000 $120,000 35,000 $155,000 They have each asked you to prepare their personal income tax return, and to that end have provided you with the following additional information. i) Brenda was paid a salary of $6,000 and it is included in the expenses. A $1,000 donation to a registered charity is included in the expenses. iii) The asset sold was a piece of land they had purchased in hopes of having their own building from which to operate their business; those plans fell through when the bank wouldn't advance the necessary loans. The $35,000 represents the net gain after real estate broker and legal fees of $5,000. iv) Each partner uses and personally pays for) his/her own car in the business. Brenda's auto expenses for business use are $1,500 and Sasha's is $3,500. v) The business was originally started by Brenda. Sasha bought in several years later. He borrowed $35,000 from the bank to purchase his partnership interest and has paid $1,800 in interest on the bank loan. vi) Included in revenue is $1,000 in interest earned on a GIC. vii) Sasha's son is employed in the business and his wages of $2,000 are included in the expenses. He cleans up the store on weekends and does odd jobs. The $2,000 is considered reasonable; no T4 slip has been issued to him by the business. vii) S&B's December 31 balance sheet shows that Brenda had drawings of $42,000 and Sasha had drawings of $35,000. Required: Identify the amount of any income, including the types of income, that each of Brenda and Sasha will include in their income tax returns. Identify any other items that will be included in their income tax returns