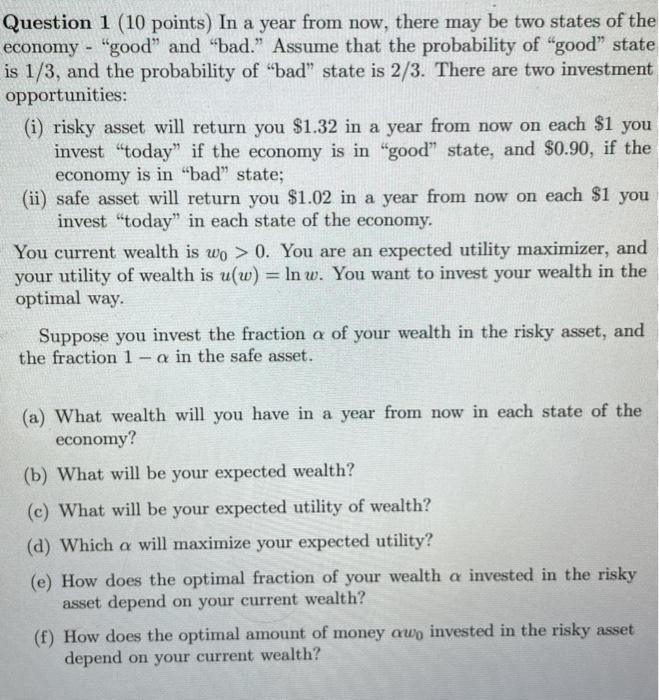

Question 1 (10 points) In a year from now, there may be two states of the economy - "good" and "bad." Assume that the probability of good state is 1/3, and the probability of "bad" state is 2/3. There are two investment opportunities: (i) risky asset will return you $1.32 in a year from now on each $1 you invest "today if the economy is in good state, and $0.90, if the economy is in "bad" state; (ii) safe asset will return you $1.02 in a year from now on each $1 you invest "today" in each state of the economy. You current wealth is wo > 0. You are an expected utility maximizer, and your utility of wealth is u(w) = In w. You want to invest your wealth in the optimal way. Suppose you invest the fraction a of your wealth in the risky asset, and the fraction 1-a in the safe asset. (a) What wealth will you have in a year from now in each state of the economy? (b) What will be your expected wealth? (c) What will be your expected utility of wealth? (d) Which a will maximize your expected utility? (e) How does the optimal fraction of your wealth a invested in the risky asset depend on your current wealth? (f) How does the optimal amount of money awo invested in the risky asset depend on your current wealth? Question 1 (10 points) In a year from now, there may be two states of the economy - "good" and "bad." Assume that the probability of good state is 1/3, and the probability of "bad" state is 2/3. There are two investment opportunities: (i) risky asset will return you $1.32 in a year from now on each $1 you invest "today if the economy is in good state, and $0.90, if the economy is in "bad" state; (ii) safe asset will return you $1.02 in a year from now on each $1 you invest "today" in each state of the economy. You current wealth is wo > 0. You are an expected utility maximizer, and your utility of wealth is u(w) = In w. You want to invest your wealth in the optimal way. Suppose you invest the fraction a of your wealth in the risky asset, and the fraction 1-a in the safe asset. (a) What wealth will you have in a year from now in each state of the economy? (b) What will be your expected wealth? (c) What will be your expected utility of wealth? (d) Which a will maximize your expected utility? (e) How does the optimal fraction of your wealth a invested in the risky asset depend on your current wealth? (f) How does the optimal amount of money awo invested in the risky asset depend on your current wealth