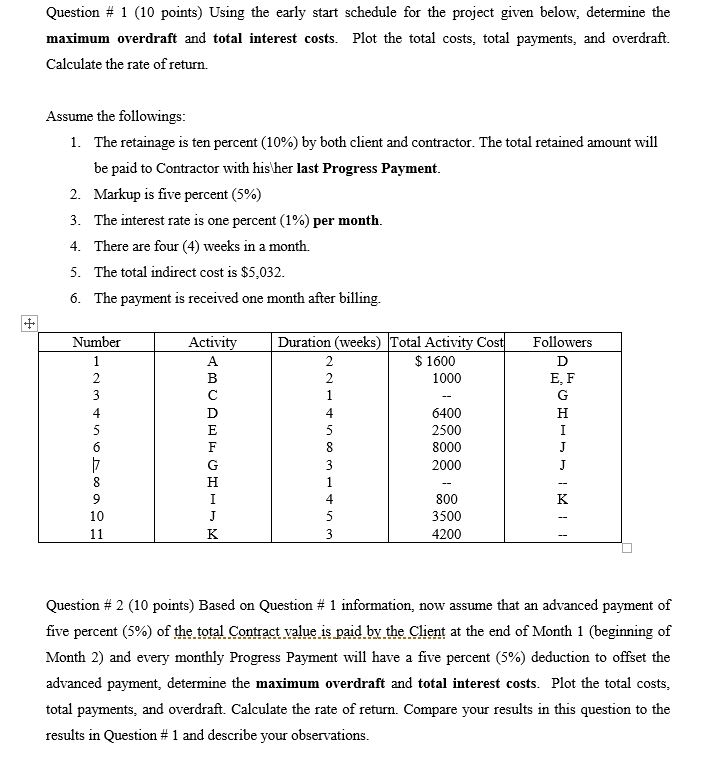

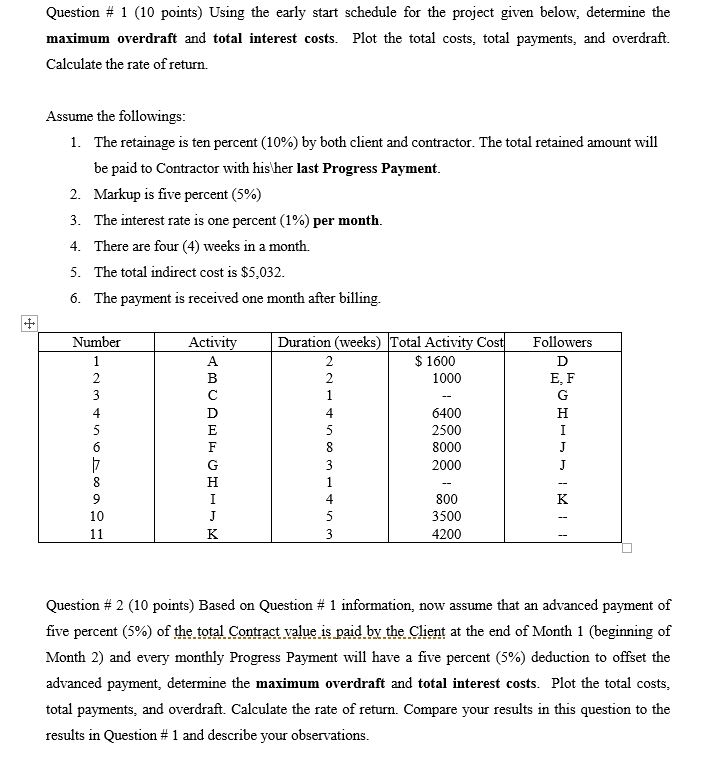

Question # 1 (10 points) Using the early start schedule for the project given below, determine the maximum overdraft and total interest costs. Plot the total costs, total payments, and overdraft. Calculate the rate of return.

Assume the followings:

The retainage is ten percent (10%) by both client and contractor. The total retained amount will be paid to Contractor with his\her last Progress Payment.

Markup is five percent (5%)

The interest rate is one percent (1%) per month.

There are four (4) weeks in a month.

The total indirect cost is $5,032.

The payment is received one month after billing.

Question # 2 (10 points) Based on Question # 1 information, now assume that an advanced payment of five percent (5%) of the total Contract value is paid by the Client at the end of Month 1 (beginning of Month 2) and every monthly Progress Payment will have a five percent (5%) deduction to offset the advanced payment, determine the maximum overdraft and total interest costs. Plot the total costs, total payments, and overdraft. Calculate the rate of return. Compare your results in this question to the results in Question # 1 and describe your observations.

No more information needed

Question # 1 (10 points) Using the early start schedule for the project given below, determine the maximum overdraft and total interest costs. Plot the total costs, total payments, and overdraft. Calculate the rate of return. Assume the followings The retainage is ten percent (10%) by both client and contractor. The total retained amount will be paid to Contractor with his her last Progress Payment Markup is five percent (5%) The interest rate is one percent (1%) per month There are four (4) weeks in a month. The total indirect cost is $5,032. The payment is received one month after billing. I. 2. 3. 4- 5. 6. Number Activi Duration (weeks) Total Activi Followers 1600 1000 E, F 4 4 2500 8000 2000 800 3500 4200 10 Question # 2 (10 points) Based on Question # 1 information, now assume that an advanced payment of five percent (5%) of thetotal. Contract value is-paid-by the Client at the end of Month 1 (beginning of Month 2) and every monthly Progress Payment will have a five percent (5%) deduction to offset the advanced payment, determine the maximum overdraft and total interest costs. Plot the total costs total payments, and overdraft. Calculate the rate of return. Compare your results in this question to the results in Question # 1 and describe your observations. Question # 1 (10 points) Using the early start schedule for the project given below, determine the maximum overdraft and total interest costs. Plot the total costs, total payments, and overdraft. Calculate the rate of return. Assume the followings The retainage is ten percent (10%) by both client and contractor. The total retained amount will be paid to Contractor with his her last Progress Payment Markup is five percent (5%) The interest rate is one percent (1%) per month There are four (4) weeks in a month. The total indirect cost is $5,032. The payment is received one month after billing. I. 2. 3. 4- 5. 6. Number Activi Duration (weeks) Total Activi Followers 1600 1000 E, F 4 4 2500 8000 2000 800 3500 4200 10 Question # 2 (10 points) Based on Question # 1 information, now assume that an advanced payment of five percent (5%) of thetotal. Contract value is-paid-by the Client at the end of Month 1 (beginning of Month 2) and every monthly Progress Payment will have a five percent (5%) deduction to offset the advanced payment, determine the maximum overdraft and total interest costs. Plot the total costs total payments, and overdraft. Calculate the rate of return. Compare your results in this question to the results in Question # 1 and describe your observations