Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 [1/2 Mark] Dharwish Corporation uses normal costing where overhead is allocated to jobs on the basis of direct labour hours. The company estimated

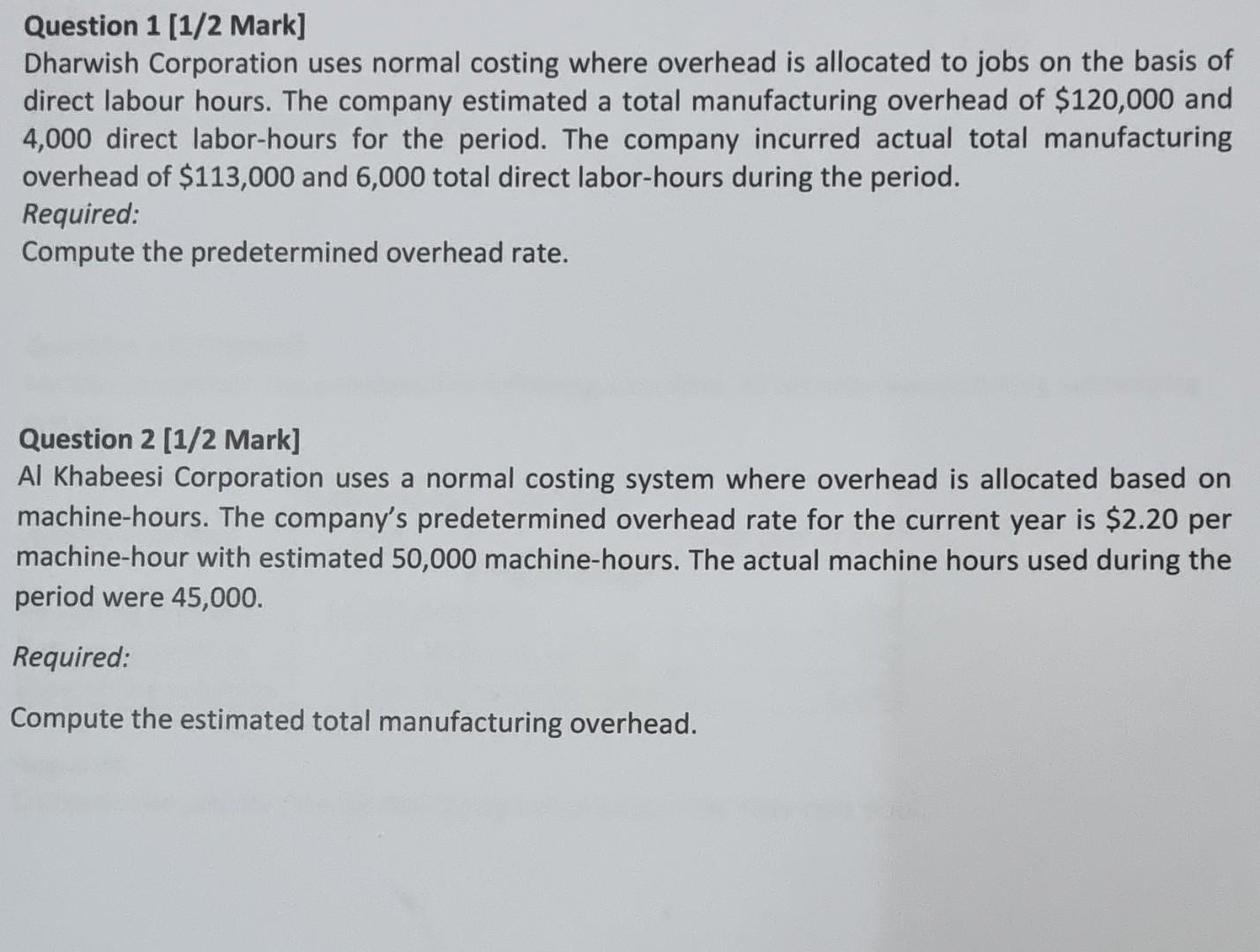

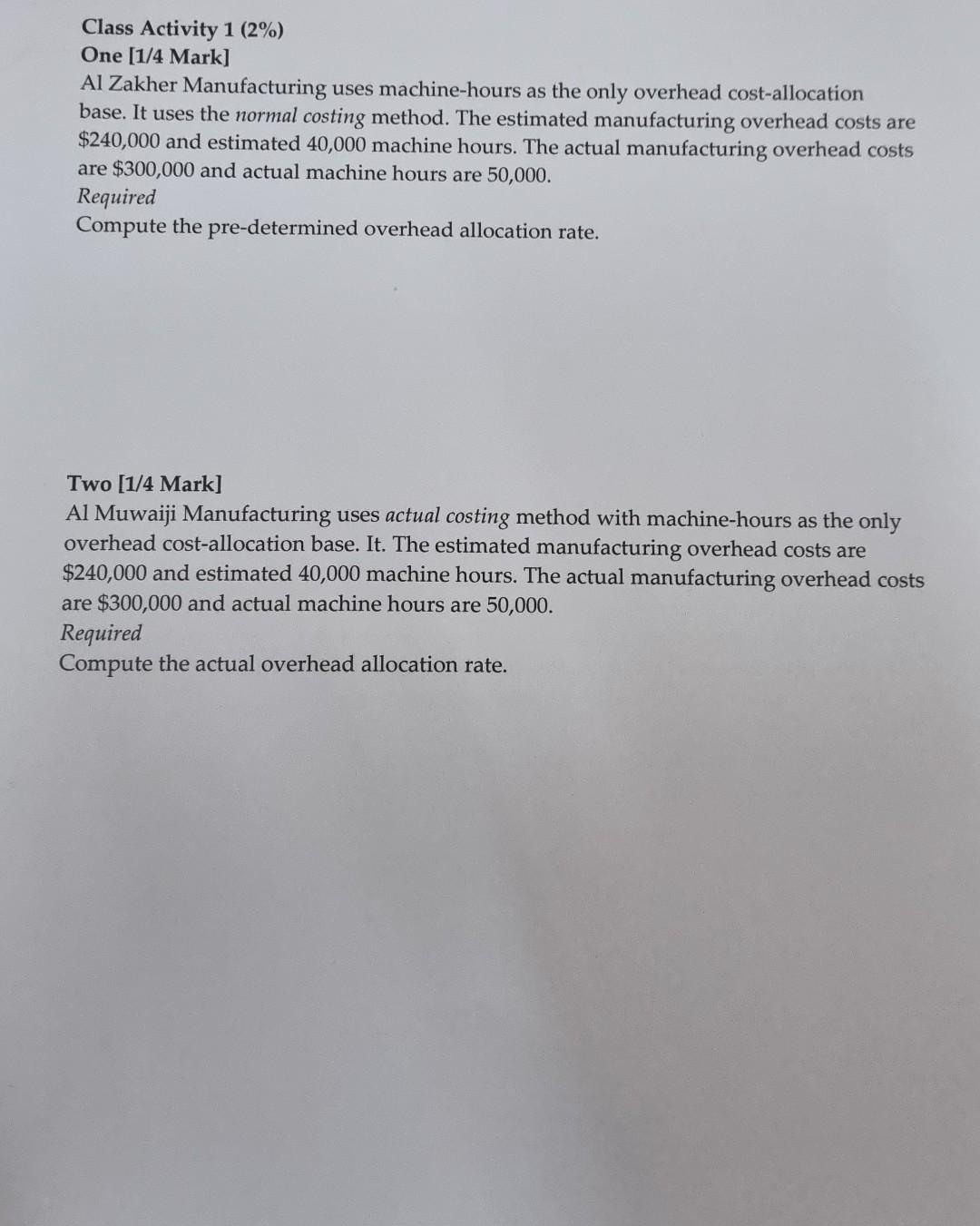

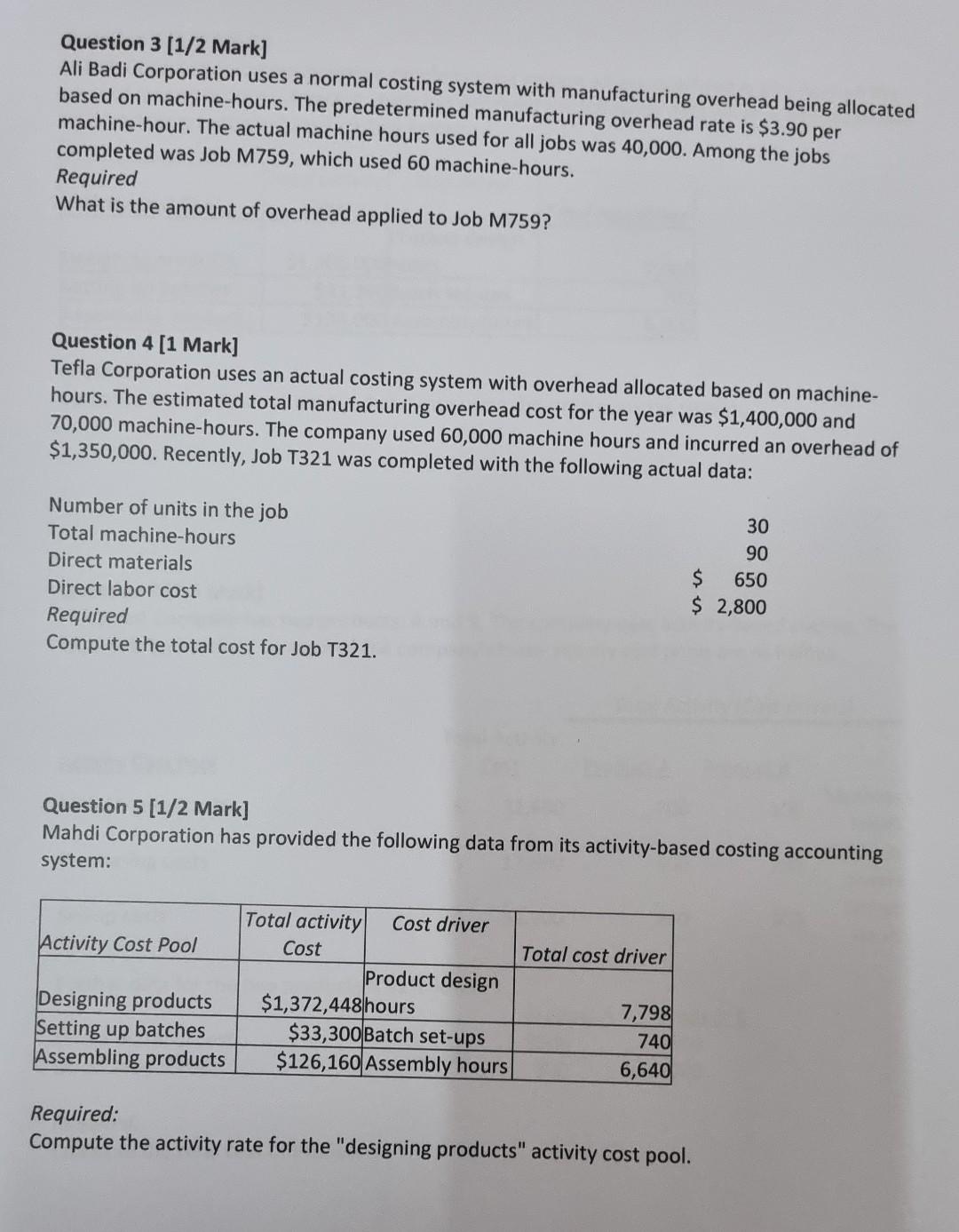

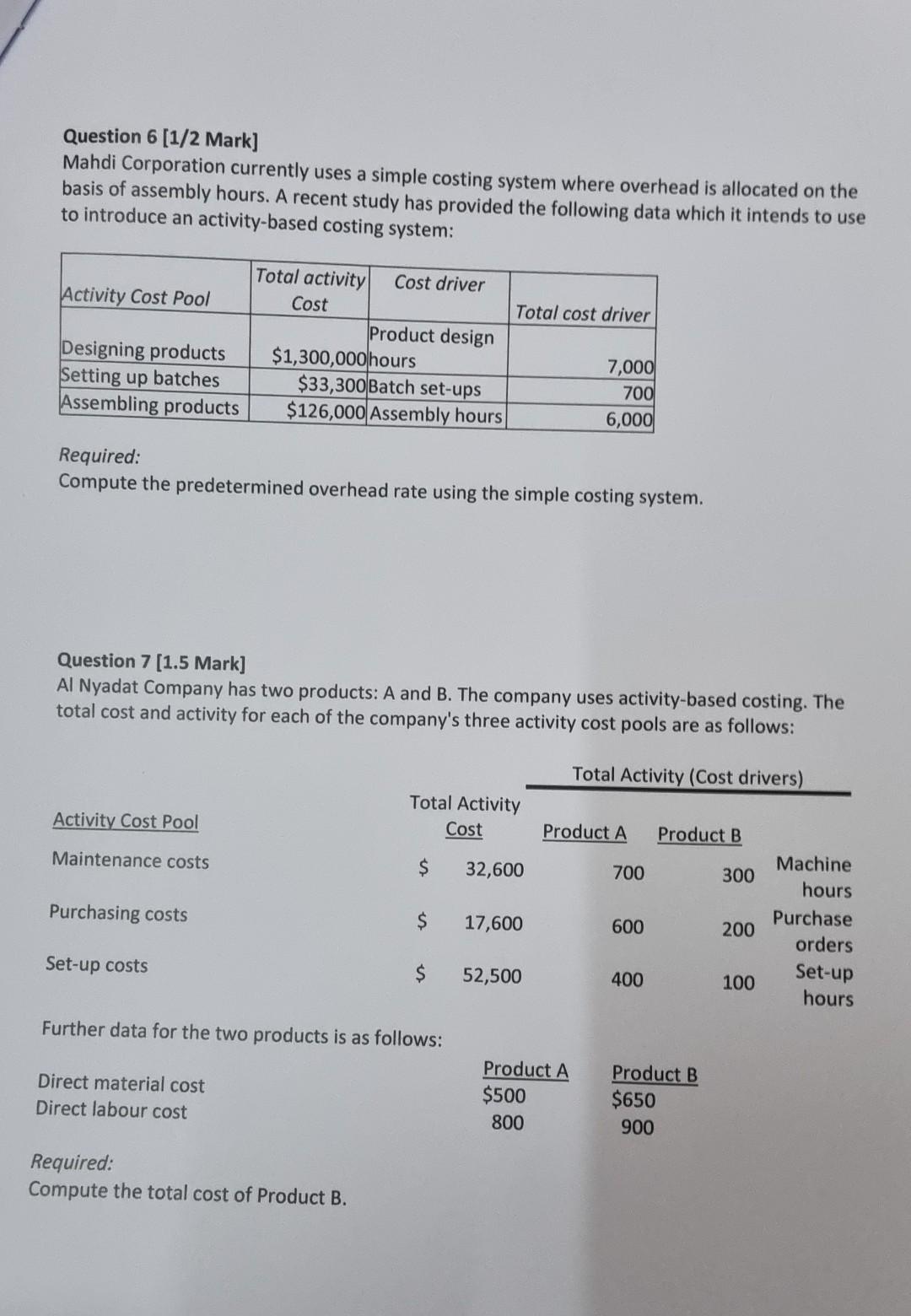

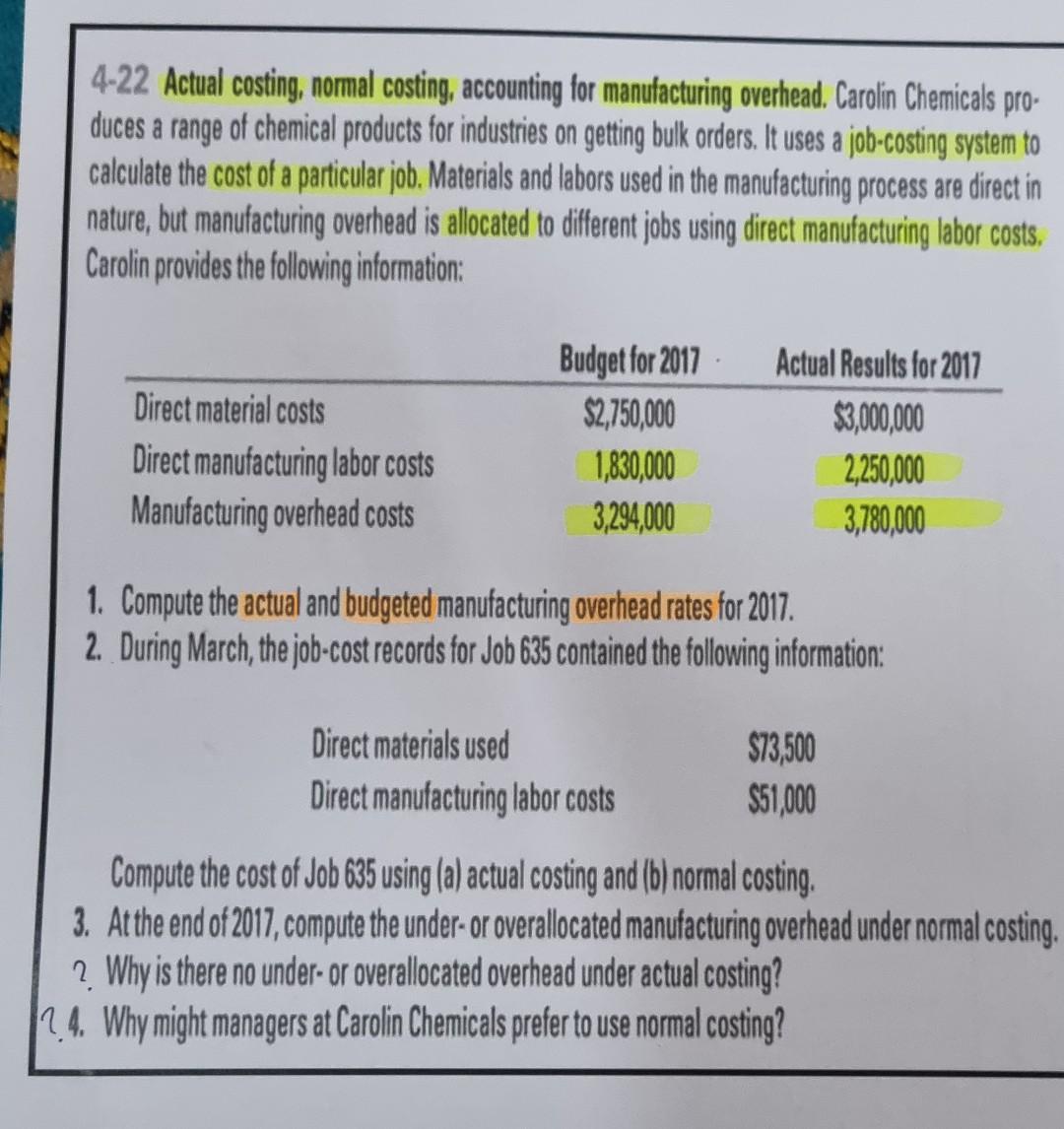

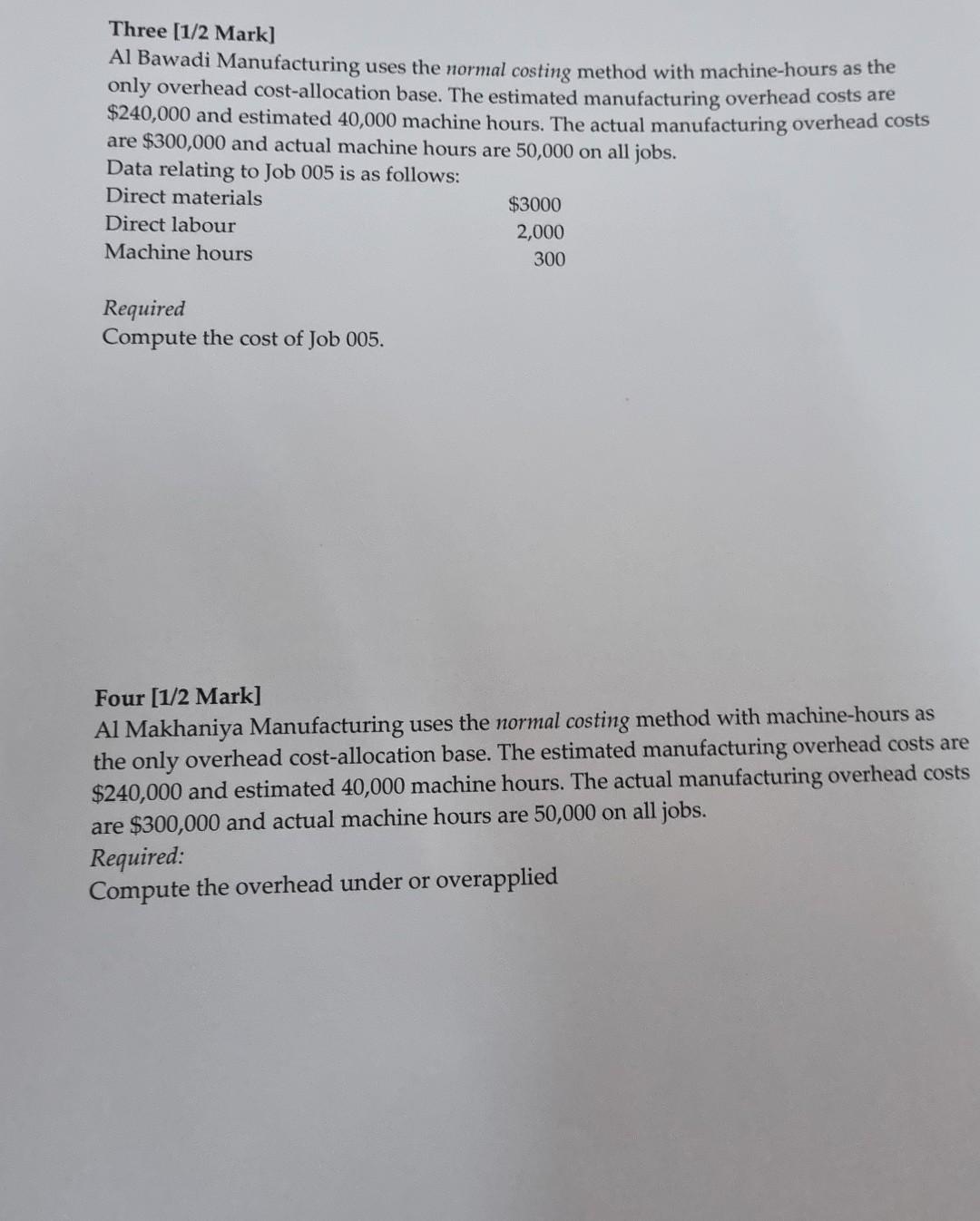

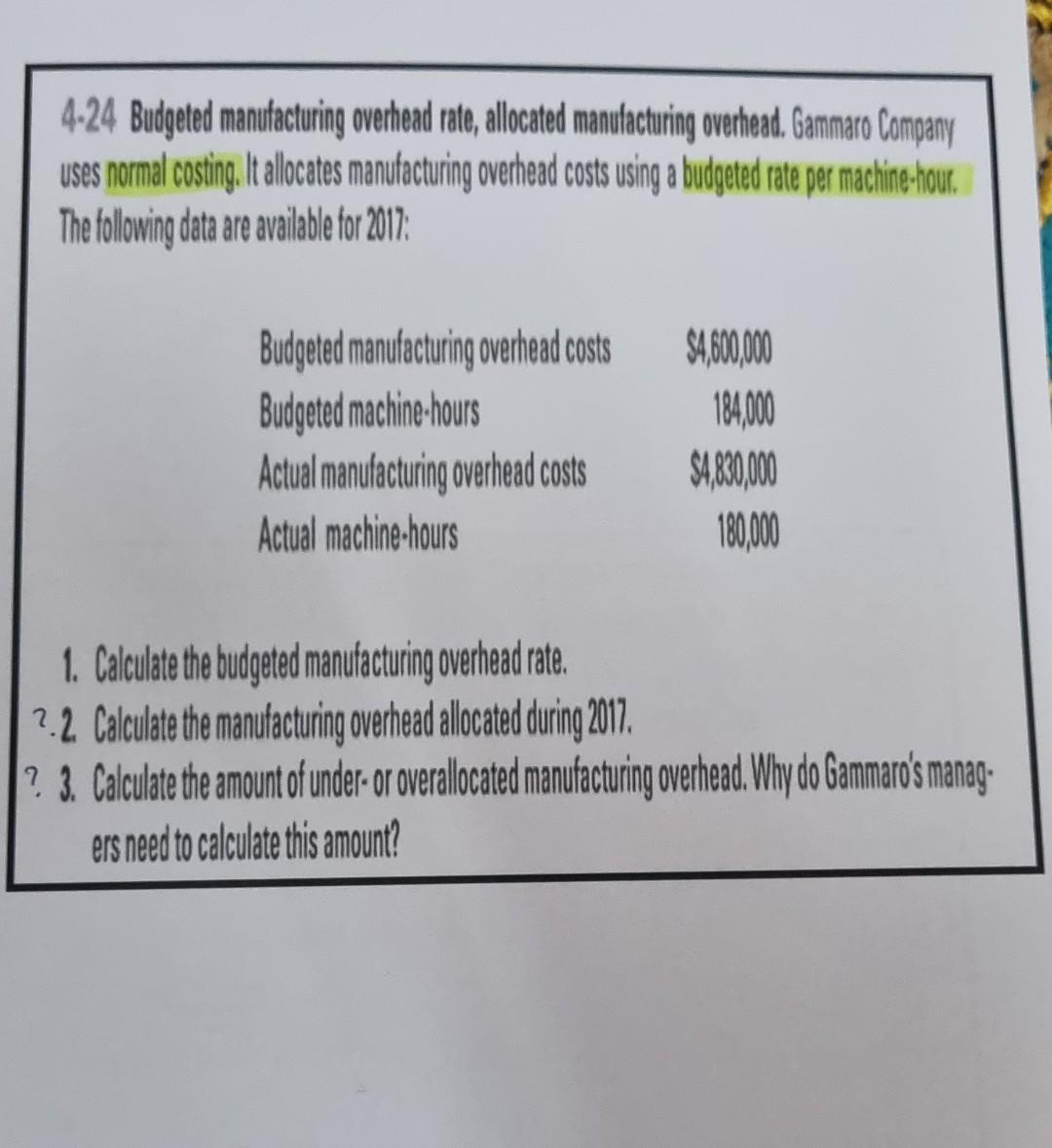

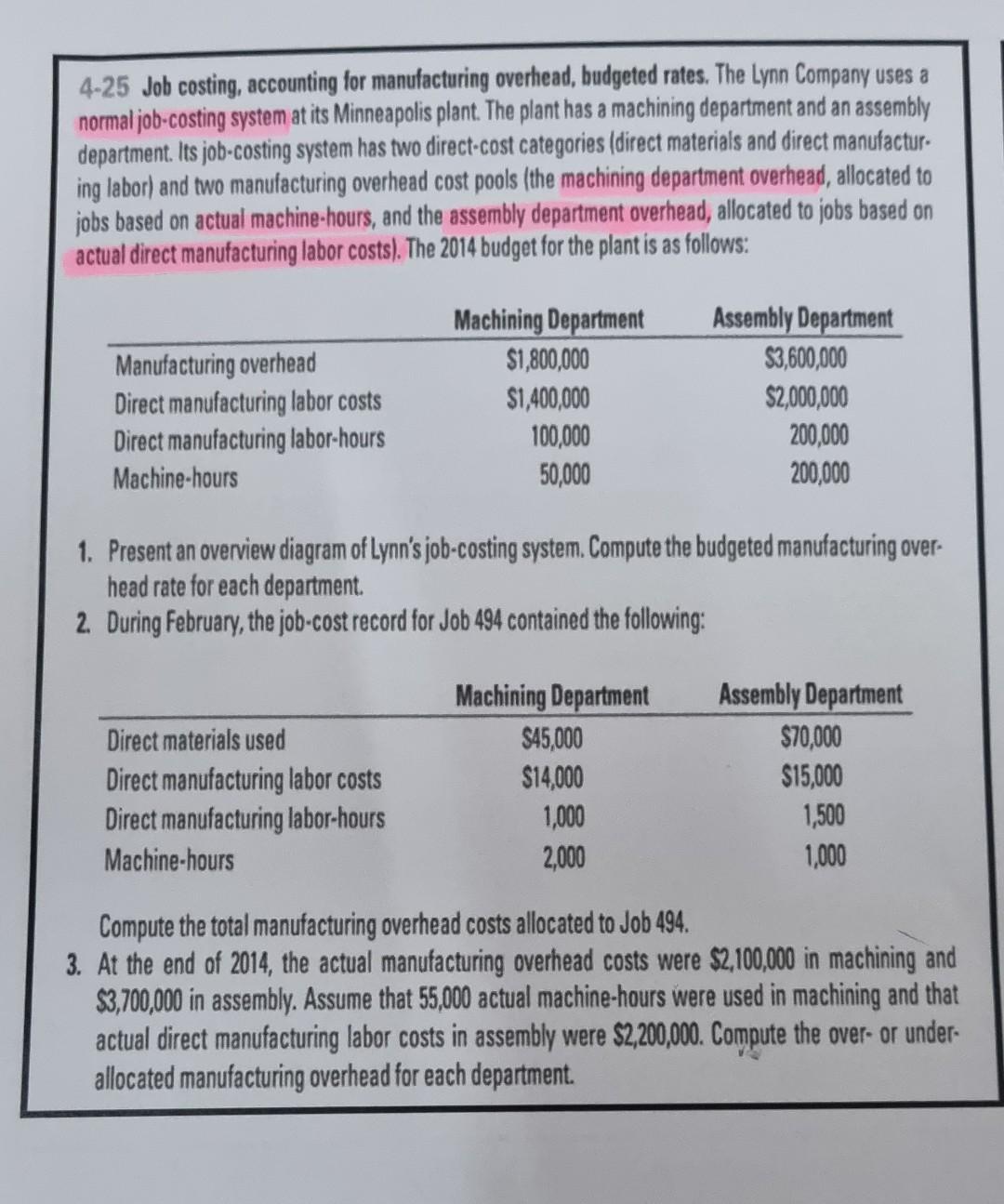

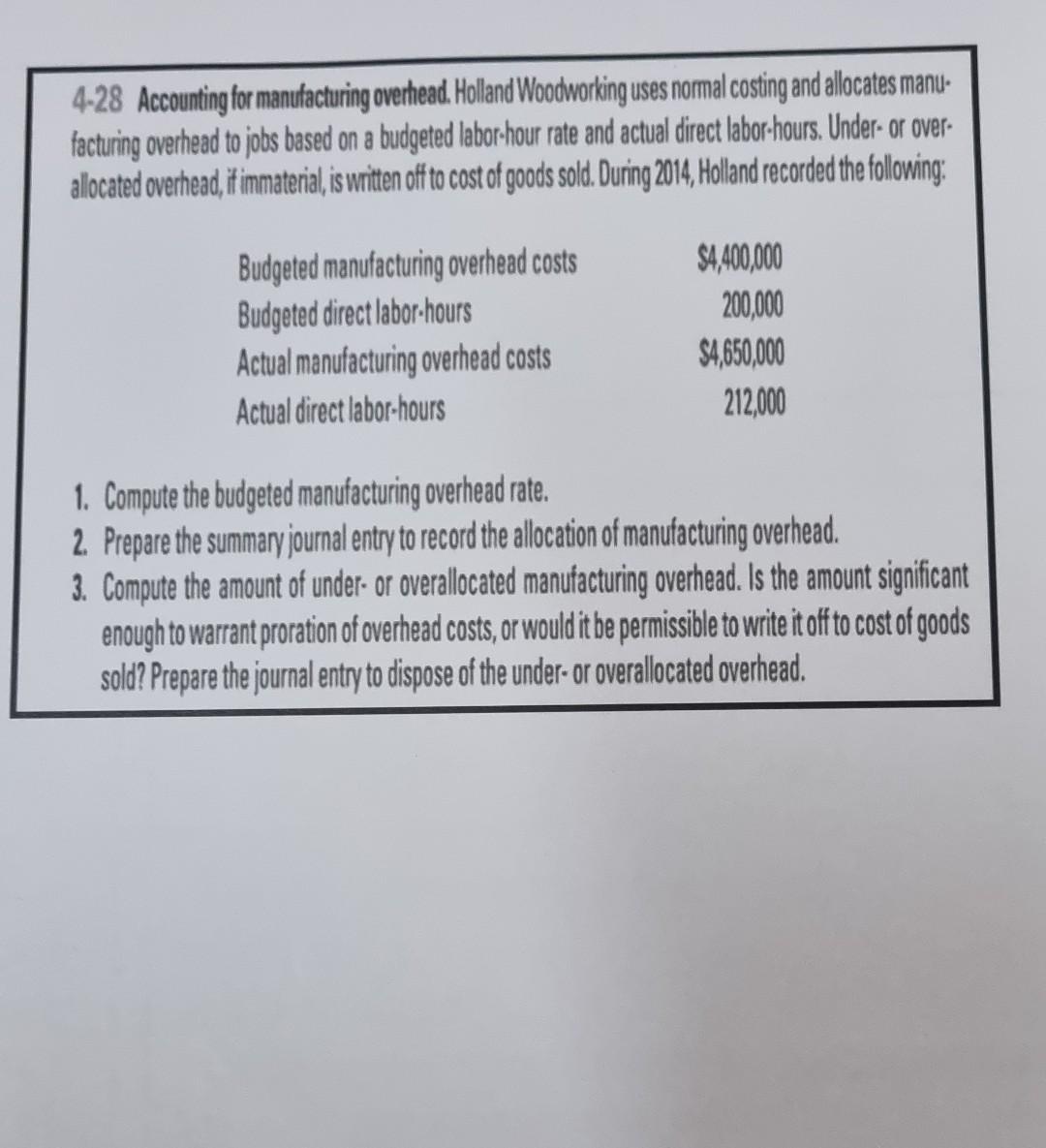

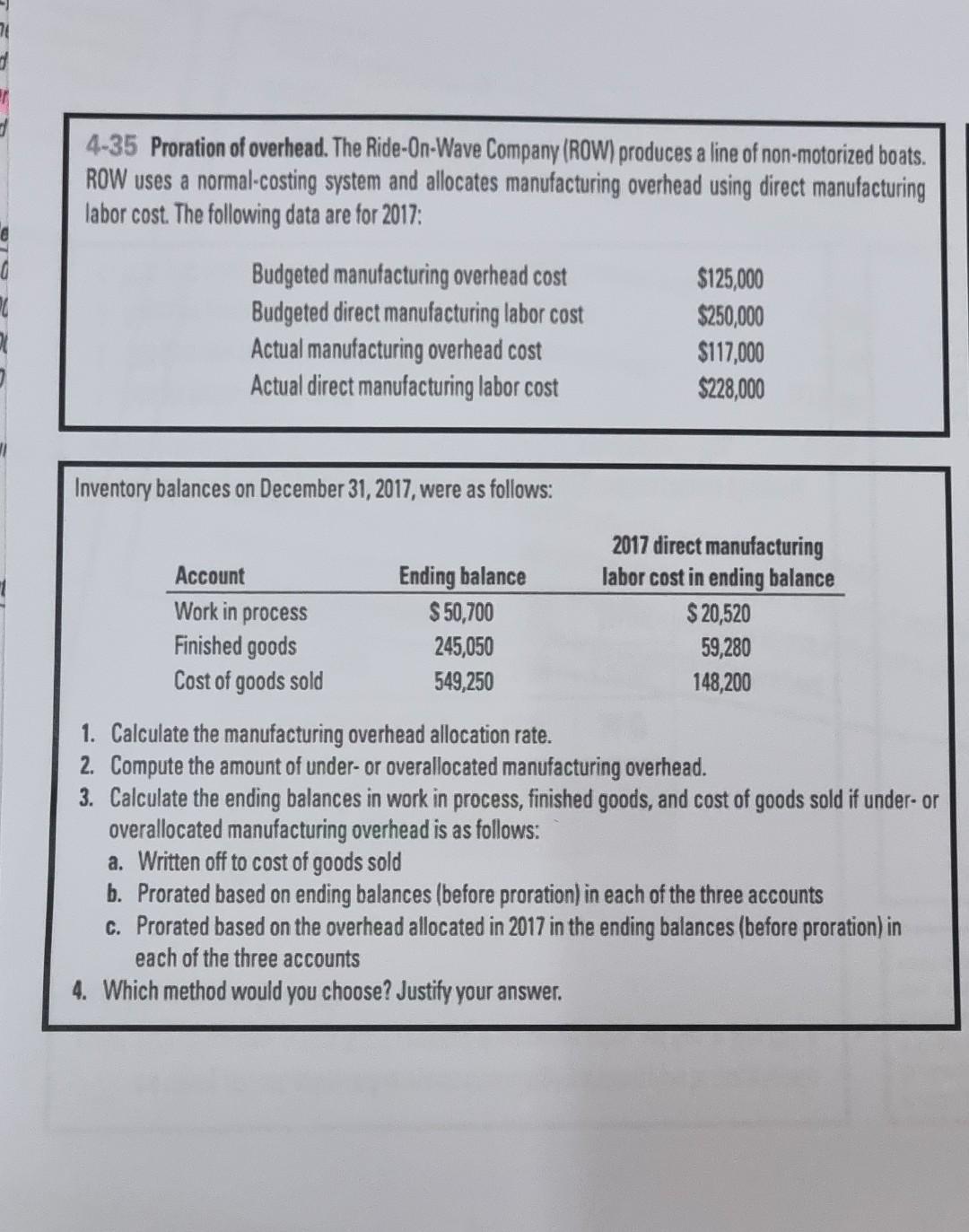

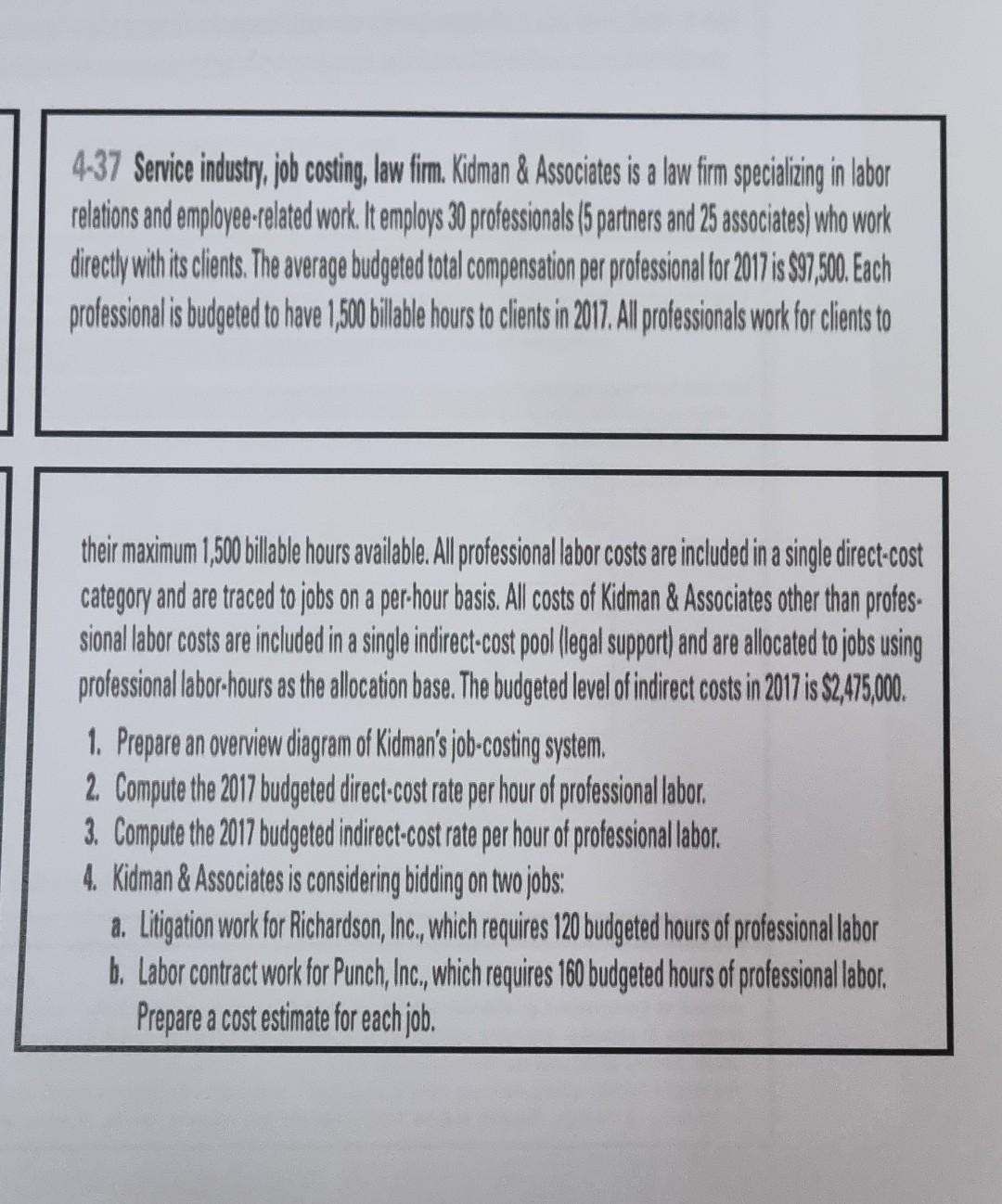

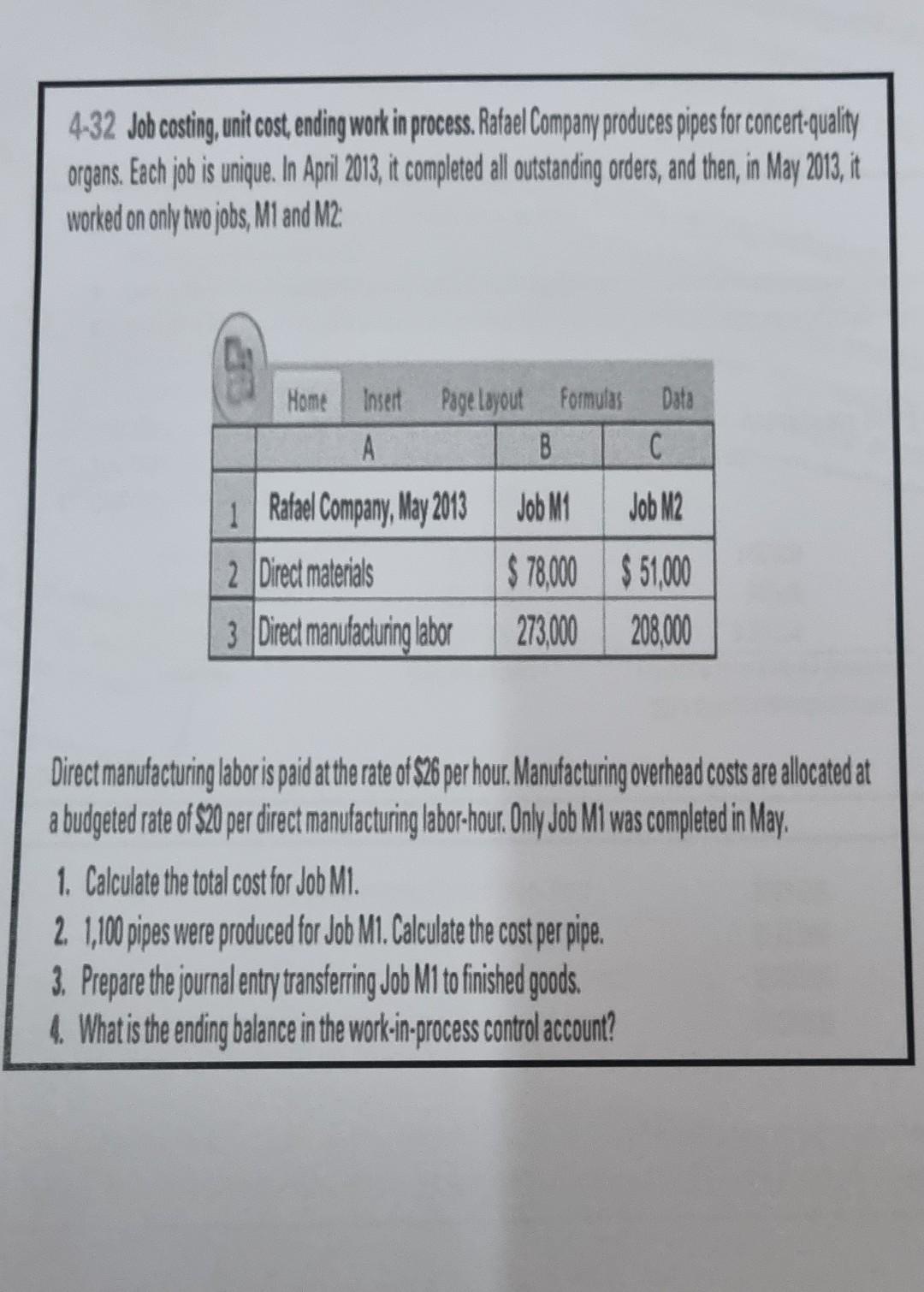

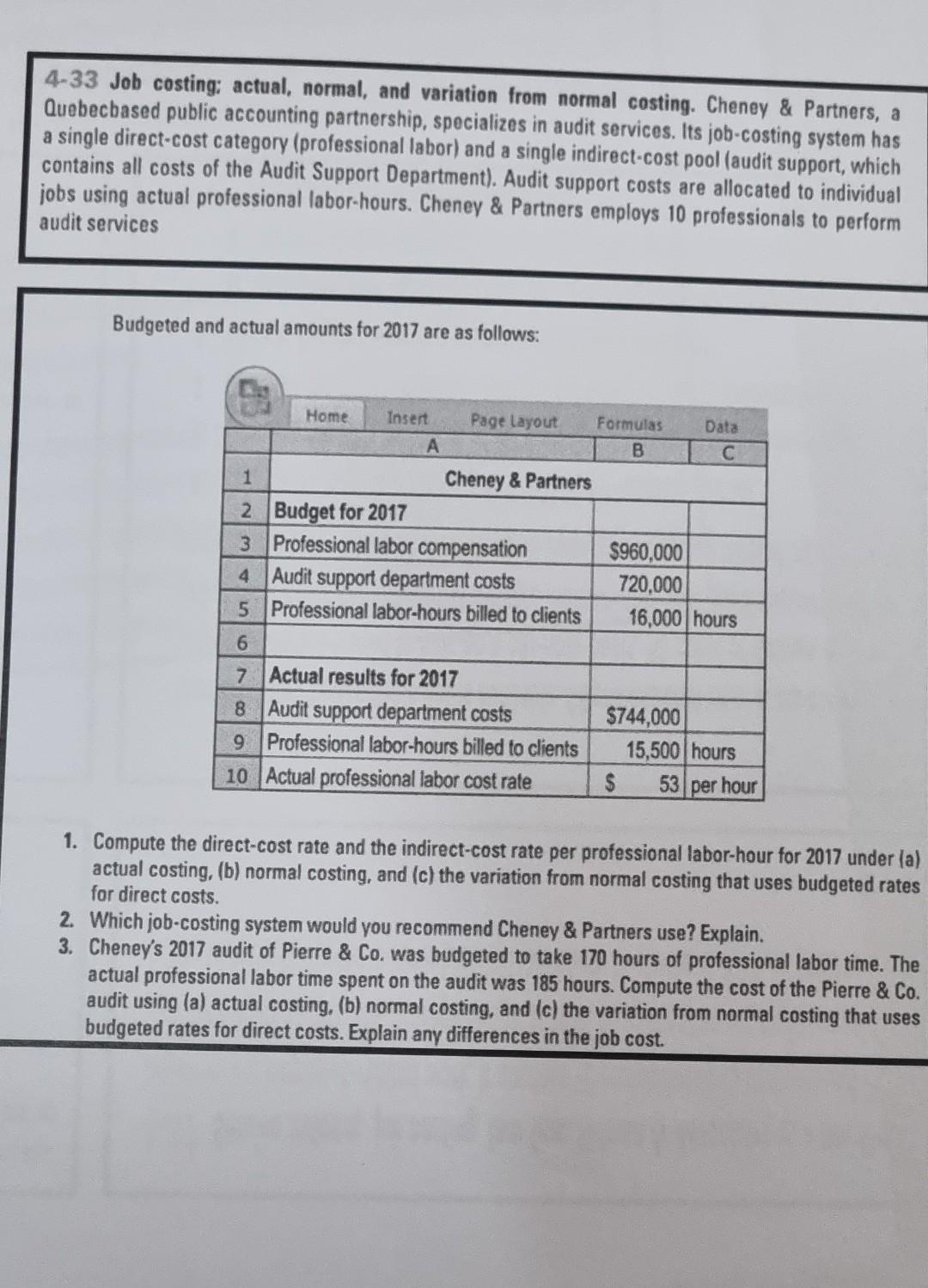

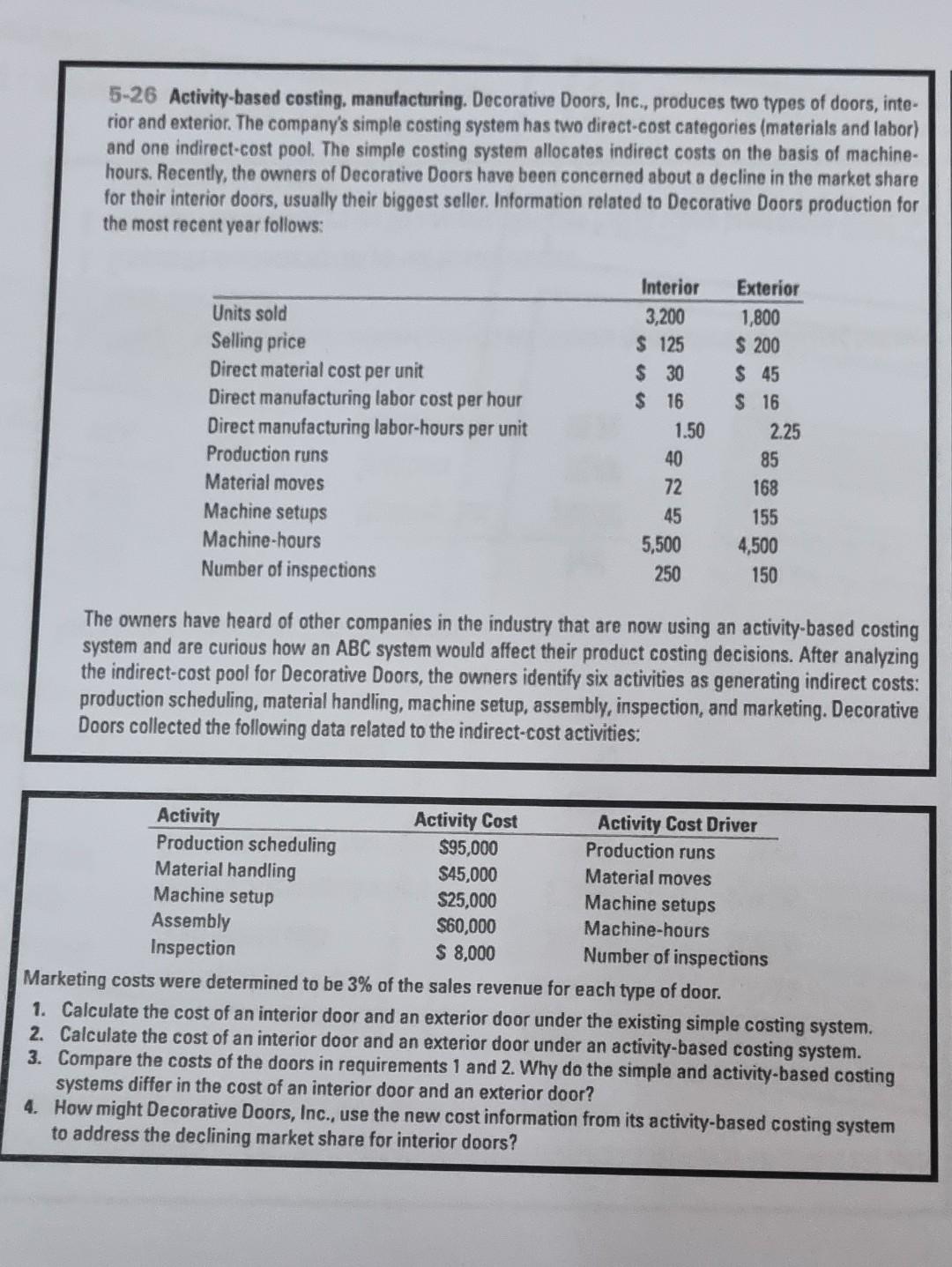

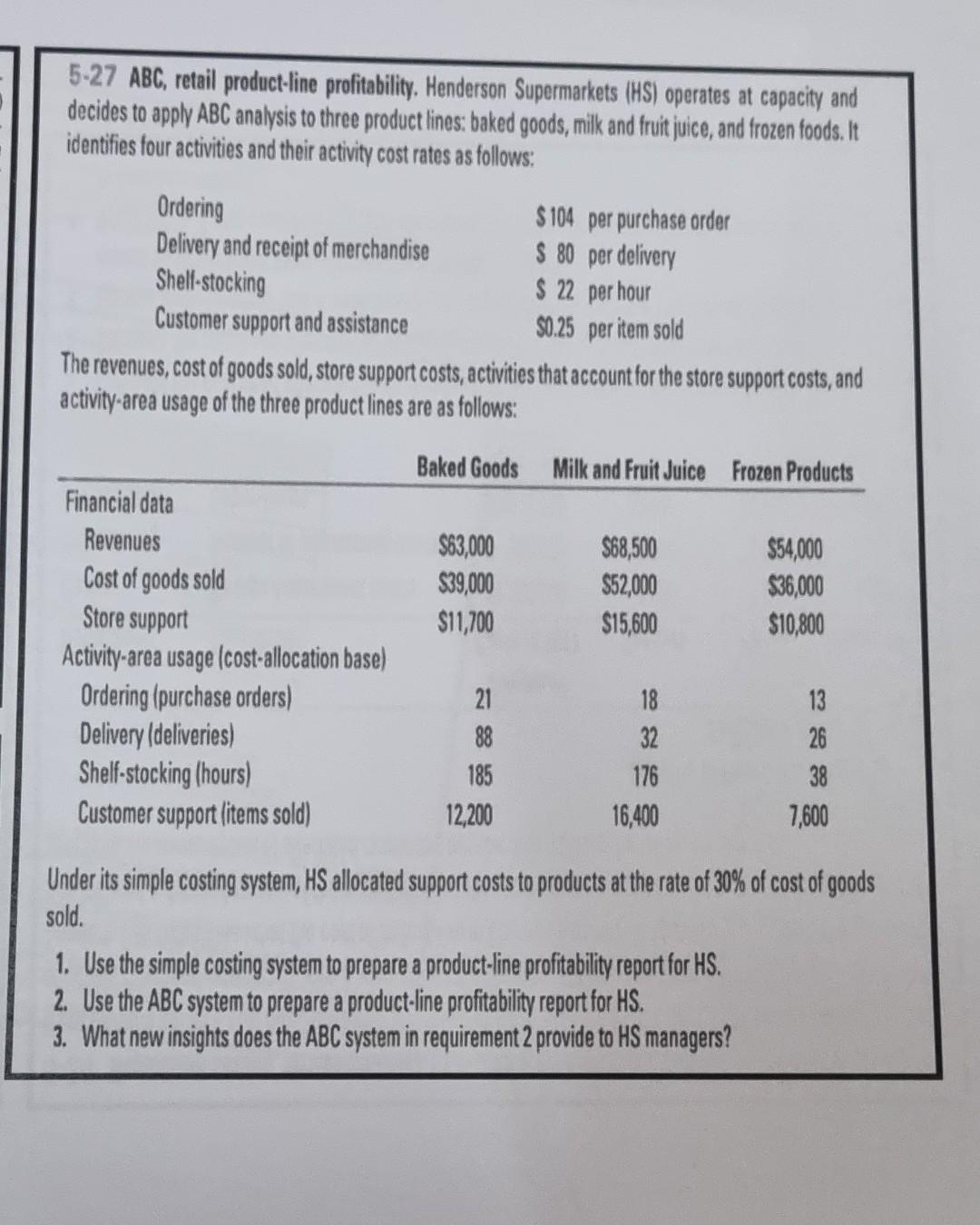

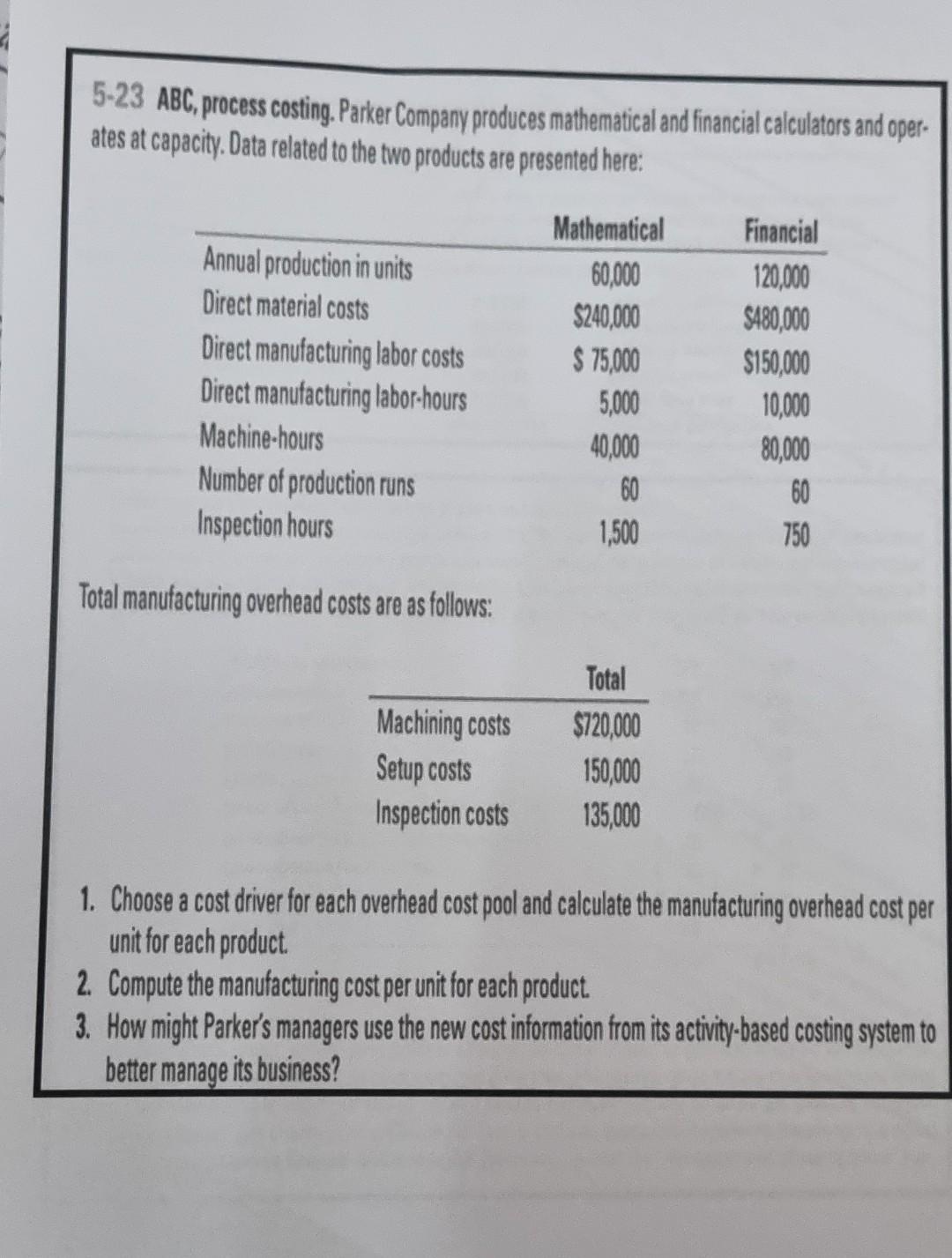

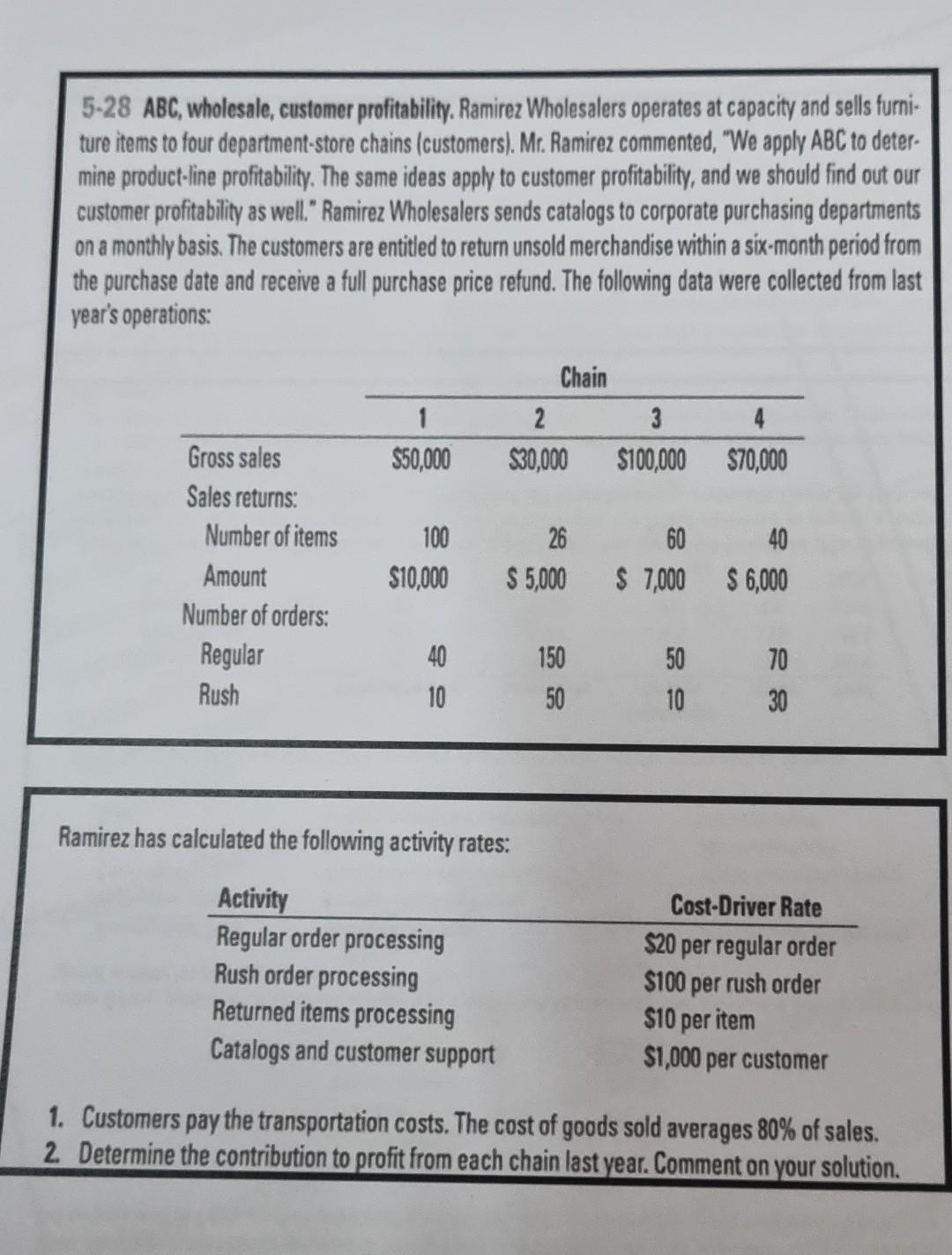

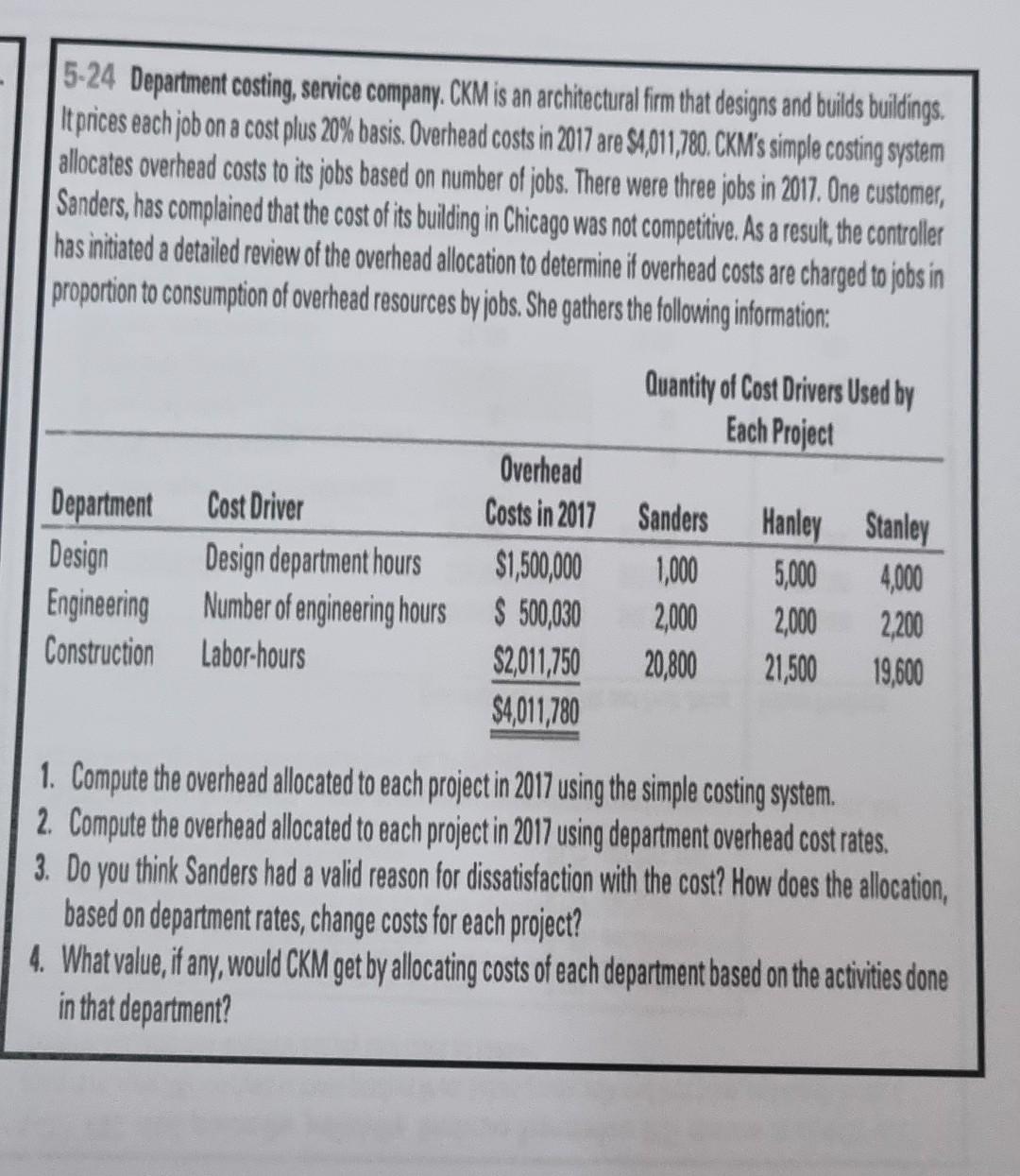

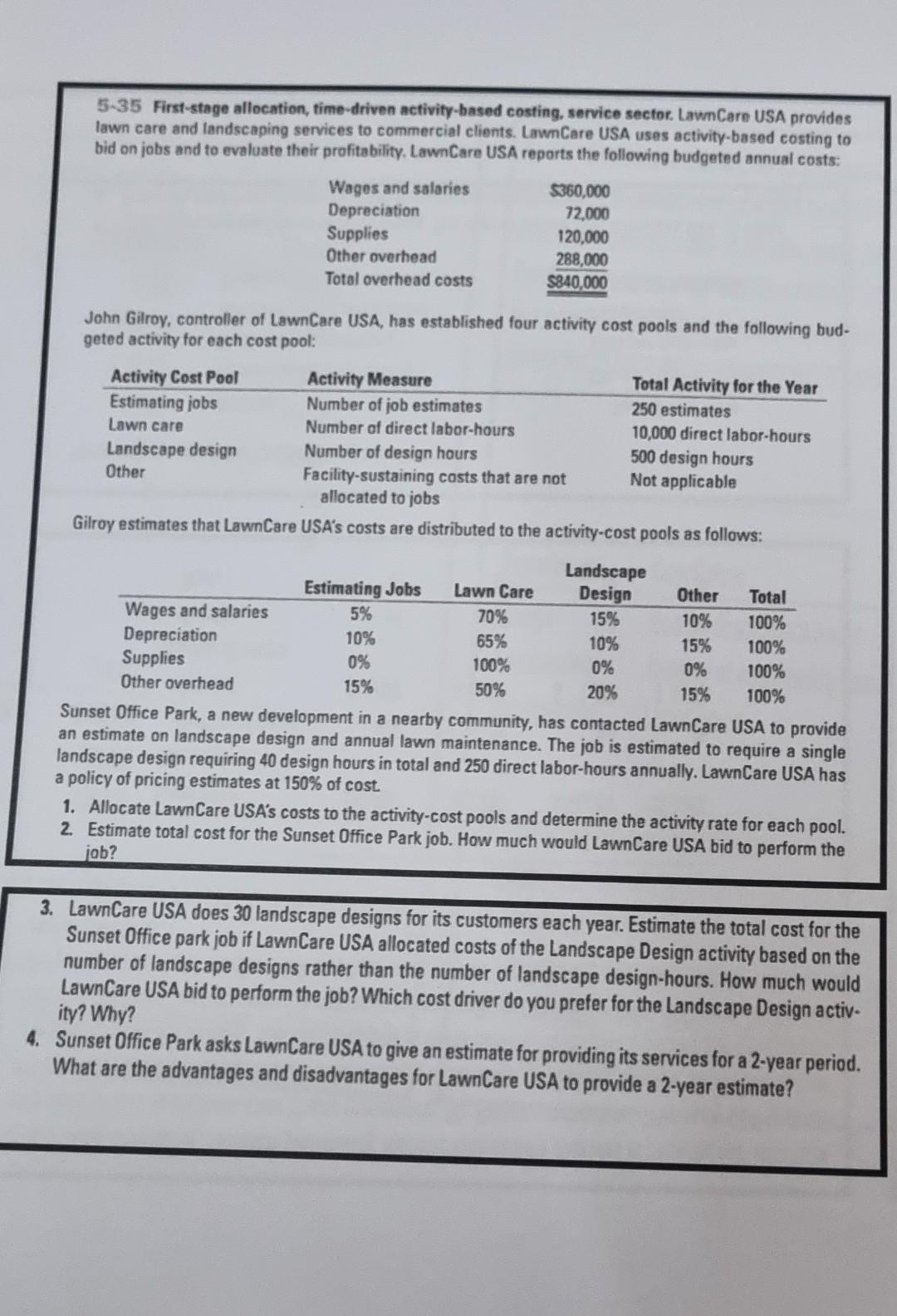

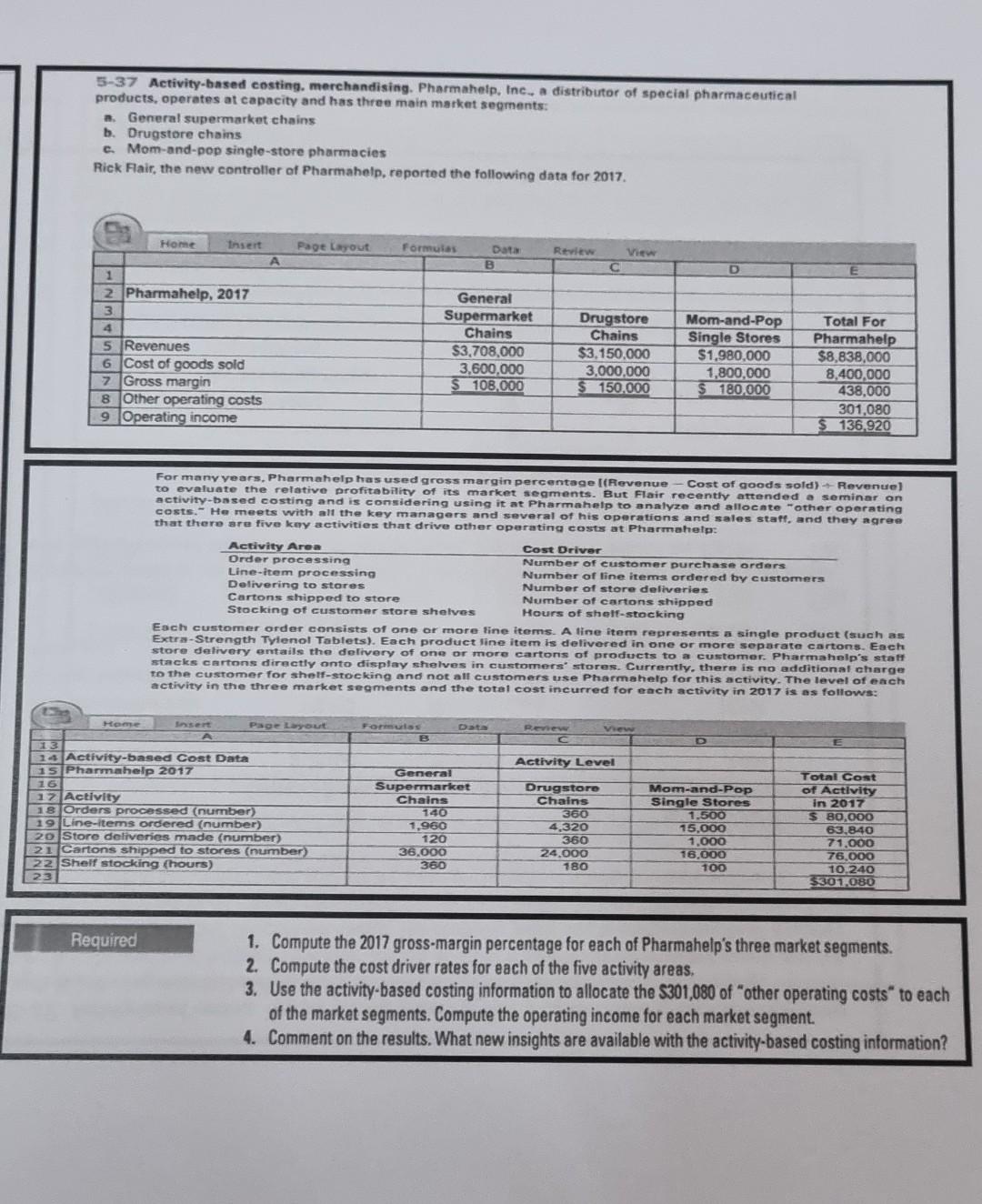

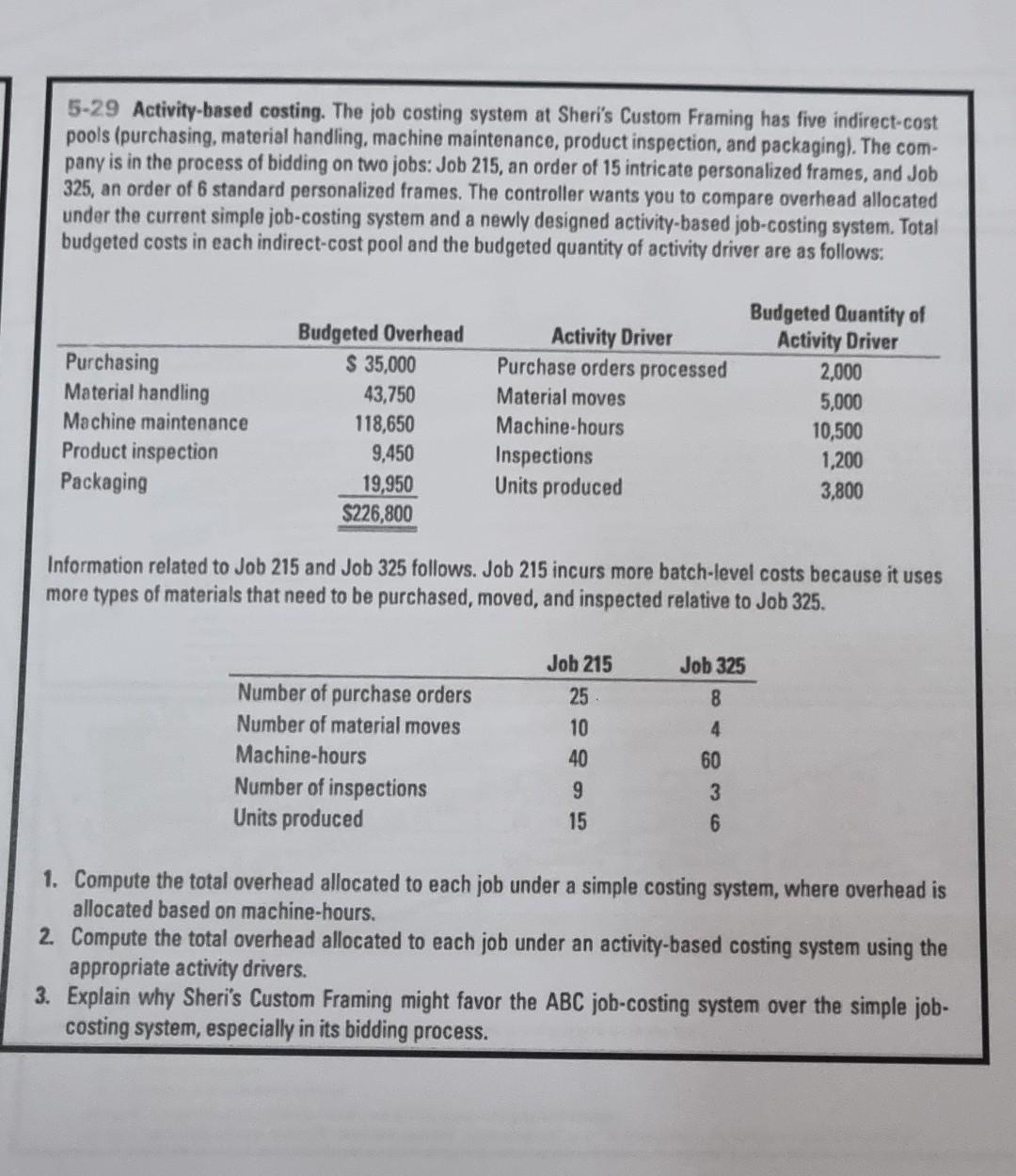

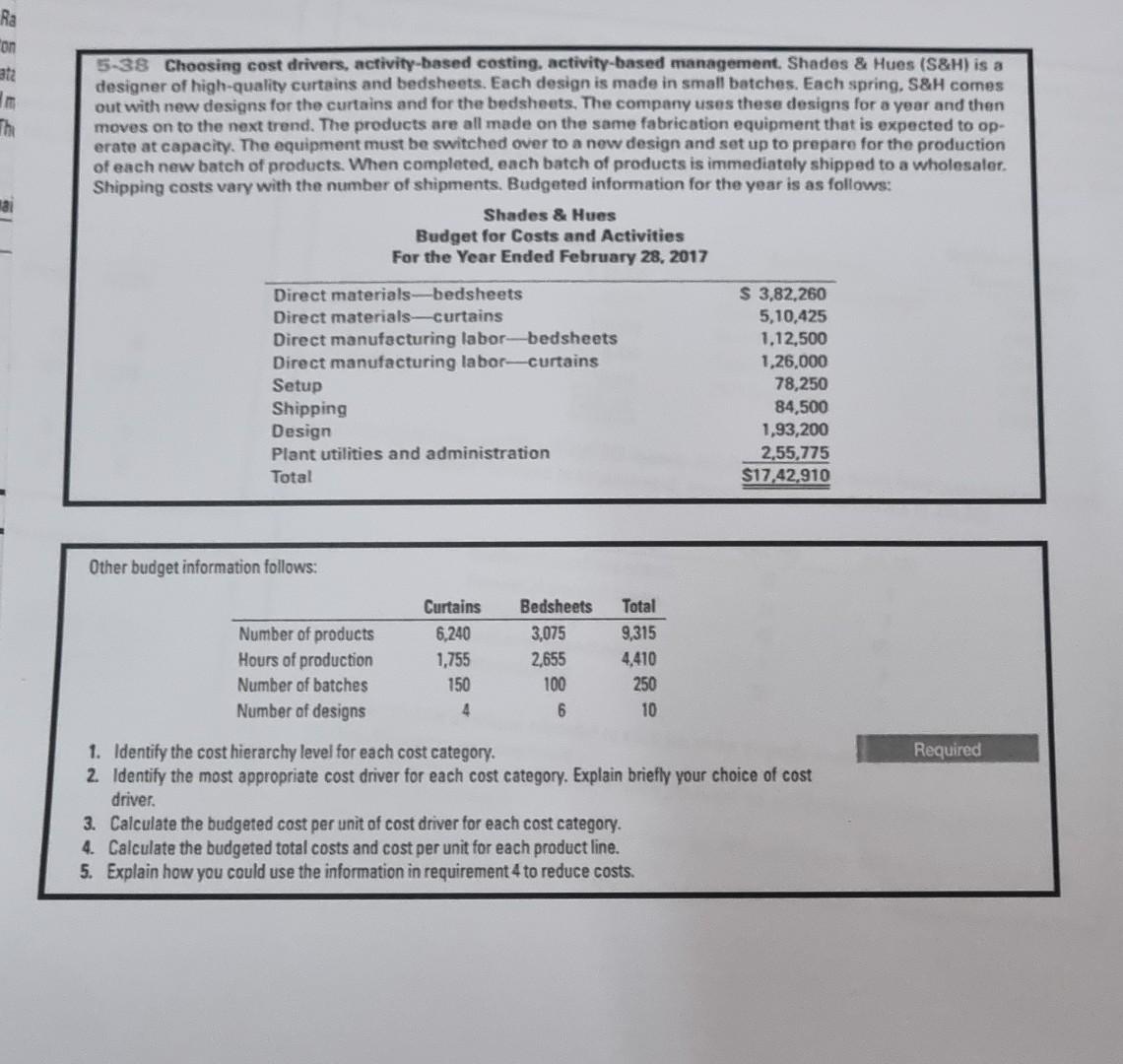

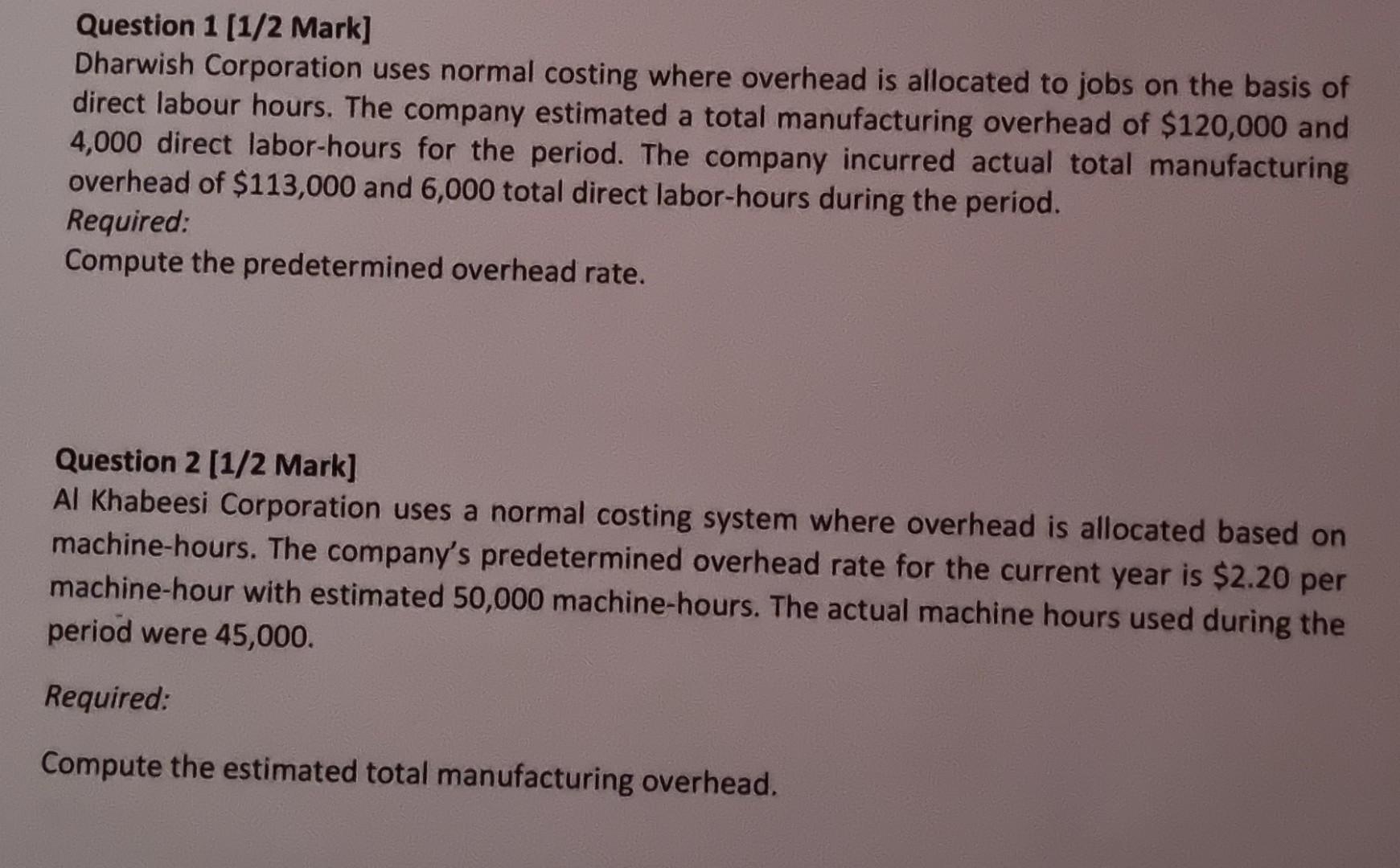

Question 1 [1/2 Mark] Dharwish Corporation uses normal costing where overhead is allocated to jobs on the basis of direct labour hours. The company estimated a total manufacturing overhead of $120,000 and 4,000 direct labor-hours for the period. The company incurred actual total manufacturing overhead of $113,000 and 6,000 total direct labor-hours during the period. Required: Compute the predetermined overhead rate. Question 2 [1/2 Mark] Al Khabeesi Corporation uses a normal costing system where overhead is allocated based on machine-hours. The company's predetermined overhead rate for the current year is $2.20 per machine-hour with estimated 50,000 machine-hours. The actual machine hours used during the period were 45,000. Required: Compute the estimated total manufacturing overhead. Class Activity 1 (2\%) One [1/4 Mark] Al Zakher Manufacturing uses machine-hours as the only overhead cost-allocation base. It uses the normal costing method. The estimated manufacturing overhead costs are $240,000 and estimated 40,000 machine hours. The actual manufacturing overhead costs are $300,000 and actual machine hours are 50,000 . Required Compute the pre-determined overhead allocation rate. Two [1/4 Mark] Al Muwaiji Manufacturing uses actual costing method with machine-hours as the only overhead cost-allocation base. It. The estimated manufacturing overhead costs are $240,000 and estimated 40,000 machine hours. The actual manufacturing overhead costs are $300,000 and actual machine hours are 50,000 . Required Compute the actual overhead allocation rate. Question 3 [1/2 Mark] Ali Badi Corporation uses a normal costing system with manufacturing overhead being allocated based on machine-hours. The predetermined manufacturing overhead rate is $3.90 per machine-hour. The actual machine hours used for all jobs was 40,000. Among the jobs completed was Job M759, which used 60 machine-hours. Required What is the amount of overhead applied to Job M759? Question 4 [1 Mark] Tefla Corporation uses an actual costing system with overhead allocated based on machinehours. The estimated total manufacturing overhead cost for the year was $1,400,000 and 70,000 machine-hours. The company used 60,000 machine hours and incurred an overhead of $1,350,000. Recently, Job T321 was completed with the following actual data: Question 5[1/2 Mark] Mahdi Corporation has provided the following data from its activity-based costing accounting system: Required: Compute the activity rate for the "designing products" activity cost pool. Question 6 [1/2 Mark] Mahdi Corporation currently uses a simple costing system where overhead is allocated on the basis of assembly hours. A recent study has provided the following data which it intends to use to introduce an activity-based costing system: Required: Compute the predetermined overhead rate using the simple costing system. Question 7 [1.5 Mark] Al Nyadat Company has two products: A and B. The company uses activity-based costing. The total cost and activity for each of the company's three activity cost pools are as follows: Further data for the two products is as follows: 4-22 Actual costing, normal costing, accounting for manufacturing overhead. Carolin Chemicals pro. duces a range of chemical products for industries on getting bulk orders. It uses a job-costing system to calculate the cost of a particular job. Materials and labors used in the manufacturing process are direct in nature, but manufacturing overhead is allocated to different jobs using direct manufacturing labor costs. Carolin provides the following information: 1. Compute the actual and budgeted manufacturing overhead rates for 2017. 2. During March, the job-cost records for Job 635 contained the following information: Compute the cost of Job 635 using (a) actual costing and (b) normal costing. 3. At the end of 2017, compute the under- or overallocated manufacturing overhead under normal costing ?. Why is there no under- or overallocated overhead under actual costing? 2.4. Why might managers at Carolin Chemicals prefer to use normal costing? Three [1/2 Mark] Al Bawadi Manufacturing uses the normal costing method with machine-hours as the only overhead cost-allocation base. The estimated manufacturing overhead costs are $240,000 and estimated 40,000 machine hours. The actual manufacturing overhead costs are $300,000 and actual machine hours are 50,000 on all jobs. Data relating to Job 005 is as follows: Required Compute the cost of Job 005. Four [1/2 Mark] Al Makhaniya Manufacturing uses the normal costing method with machine-hours as the only overhead cost-allocation base. The estimated manufacturing overhead costs are $240,000 and estimated 40,000 machine hours. The actual manufacturing overhead costs are $300,000 and actual machine hours are 50,000 on all jobs. Required: Compute the overhead under or overapplied 4.24 Budgeted manutacturing overhead rate, allocated manulacturing overhead. Gammarr Company uses normal cosing. It a llocates manufacturing overhead costs using a budgeted rate per machine-hour. The following data are available for 2017: 1. Calculate the budgeted manufacturing overhead iate. 2.2. Calculate the manulacturing overhead allocated during 2017. ? 3. Calculate the amount of under- or overallocated manufacturing overhead. Why do Gammaro's manage" ers need to calculate this amount? 4-25 Job costing, accounting for manulacturing overhead, budgeted rates. The Lynn Company uses a normal job-costing system at its Minneapolis plant. The plant has a machining department and an assembly department. Its job-costing system has two direct-cost categories Idirect materials and direct manufacturing labor) and two manufacturing overhead cost pools (the machining department overhead, allocated to jobs based on actual machine-hours, and the assembly department overhead, allocated to jobs based on actual direct manufacturing labor costs). The 2014 budget for the plant is as follows: 1. Present an overview diagram of Lynn's job-costing system. Compute the budgeted manufacturing overhead rate for each department. 2. During February, the job-cost record for Job 494 contained the following: Compute the total manufacturing overhead costs allocated to Job 494. 3. At the end of 2014, the actual manufacturing overhead costs were $2,100,000 in machining and $3,700,000 in assembly. Assume that 55,000 actual machine-hours were used in machining and that actual direct manufacturing labor costs in assembly were $2,200,000. Compute the over- or underallocated manufacturing overhead for each department. 4.28 Accounting for manulacturing overhead. Holland Woodworking uses normal costing and allocates manufacturing overhead to jobs based on a budgeted labor-hour rate and actual direct labor-hours. Under- or overallocated overhead, if immaterial, is witten off to cost of goods sold. During 2014, Holland recorded the following: 1. Compute the budgeted manufacturing overhead rate. 2. Prepare the summary journal entry to record the allocation of manufacturing overhead. 3. Compute the amount of under- or overallocated manufacturing overhead. Is the amount significant enough to warrant proration of overhead costs, or would it be permissible to write it off to cost of goods sold? Prepare the journal entry to dispose of the under- or overallocated overhead. 4-35 Proration of overhead. The Ride-On-Wave Company (ROW) produces a line of non-motorized boats. ROW uses a normal-costing system and allocates manufacturing overhead using direct manufacturing labor cost. The following data are for 2017 : Inventory balances on December 31, 2017, were as follows: 1. Calculate the manufacturing overhead allocation rate. 2. Compute the amount of under- or overallocated manufacturing overhead. 3. Calculate the ending balances in work in process, finished goods, and cost of goods sold if under- or overallocated manufacturing overhead is as follows: a. Written off to cost of goods sold b. Prorated based on ending balances (before proration) in each of the three accounts c. Prorated based on the overhead allocated in 2017 in the ending balances (before proration) in each of the three accounts 4. Which method would you choose? Justify your answer. 4.37 Service industry, job costing, law fim. Kidman \& Assocites is a law firm specializing in labor relations and emplovee-related work. It employ 30 professionals 5 partners and 25 associates who work directly with its clients. The average budgeted total compensation per protessional tor 2017 is 597,500. Each professional is budgeted to have 1,500 billable hours to clients in 2017. All protessionals work for clients to their maximum 1,500 billable hours available.All professionall labor costs are included in a single direct-cost category and are traced to jobs on a per hour basis. All costs of Kidman \& Assocites other than protes. sional labor costs are included in a single indirect-cost pool| (legal support) and are allocated to jobs using professional labor-hours as the alloction base. The budggeted level of indirect costs in 2017 is 52,475,000. 1. Prepare an ovenview diagram of Kidman's job-costing system. 2. Compute the 2017 budgeted direcl-cost rate per hour of professional labor. 3. Compute the 2017 budgeted indirect-cost rate per hour of protessional labor. 4. Kidman \& Associates is considering bidding on two jobs: a. Litigation work for Richardson, Inc, which requires 120 budgeted hours of professionall labor b. Labor contract work for Punch, Inc,, which requires 160 budgeted hours of protessional labor. Prepare a cost estimate for each job. 4.32 Job costing, unit cost, ending work in process. Rafael Company produces pipes for concert-quality organs. Each job is unique. In April 20133 , it completed all outstanding orders, and then, in May 2013 , it worked on only two jobs, Ml and M2 : Direct manufacturing labor is paid at the rate of SZ6 per hour. Manufacturing overhead costs are allocated at a budgeted rate of S20 per direct manufacturing labor hour. Only Job M1 was completed in May. 1. Calculate the total cost for Job MI. 2. 1,100 pipes were produced for Job M1. Calculate the cost per pipe. 3. Prepare the journal entry transierring Job M1 to finished goods. 4. What is the ending balance in the work in oprocess control account? 4-33 Job costing: actual, normal, and variation from normal costing. Cheney \& Partners, a Quebecbased public accounting partnership, specializes in audit services. Its job-costing system has a single direct-cost category (professional labor) and a single indirect-cost pool (audit support, which contains all costs of the Audit Support Department). Audit support costs are allocated to individual jobs using actual professional labor-hours. Cheney \& Partners employs 10 professionals to perform audit services Budgeted and actual amounts for 2017 are as follows: 1. Compute the direct-cost rate and the indirect-cost rate per professional labor-hour for 2017 under (a) actual costing, (b) normal costing, and (c) the variation from normal costing that uses budgeted rates for direct costs. 2. Which job-costing system would you recommend Cheney \& Partners use? Explain. 3. Cheney's 2017 audit of Pierre \& Co. was budgeted to take 170 hours of professional labor time. The actual professional labor time spent on the audit was 185 hours. Compute the cost of the Pierre \& Co. audit using (a) actual costing, (b) normal costing, and (c) the variation from normal costing that uses budgeted rates for direct costs. Explain any differences in the job cost. 5-26 Activity-based costing, manulacturing. Decorative Doors, Inc., produces two types of doors, interior and exterior. The company's simple costing system has two direct-cost categories (materials and labor) and one indirect-cost pool. The simple costing system allocates indirect costs on the basis of machinehours. Recently, the owners of Decorative Doors have been concerned about a decline in the market share for their interior doors, usually their biggest seller. Information related to Decorative Doors production for the most recent year follows: The owners have heard of other companies in the industry that are now using an activity-based costing system and are curious how an ABC system would affect their product costing decisions. After analyzing the indirect-cost pool for Decorative Doors, the owners identify six activities as generating indirect costs: production scheduling, material handling, machine setup, assembly, inspection, and marketing. Decorative Doors collected the following data related to the indirect-cost activities: Marketing costs were determined to be 3% of the sales revenue for each type of door. 1. Calculate the cost of an interior door and an exterior door under the existing simple costing system. 2. Calculate the cost of an interior door and an exterior door under an activity-based costing system. 3. Compare the costs of the doors in requirements 1 and 2 . Why do the simple and activity-based costing systems differ in the cost of an interior door and an exterior door? 4. How might Decorative Doors, Inc., use the new cost information from its activity-based costing system to address the declining market share for interior doors? 5-27 ABC, retail product-line profitability. Henderson Supermarkets (HS) operates at capacity and decides to apply ABC analysis to three product lines: baked goods, milk and fruit juice, and frozen foods. It identifies four activities and their activity cost rates as follows: The revenues, cost of goods sold, store support costs, activities that account for the store support costs, and activity-area usage of the three product lines are as follows: Under its simple costing system, HS allocated support costs to products at the rate of 30% of cost of goods sold. 1. Use the simple costing system to prepare a product-line profitability report for HS. 2. Use the ABC system to prepare a product-line profitability report for HS. 3. What new insights does the ABC system in requirement 2 provide to HS managers? 5-23 ABC, process costing. Parker Company produces mathematical and financial calculators and operates at capacity. Data related to the two products are presented here: Total manufacturing overhead costs are as follows: 1. Choose a cost driver for each overhead cost pool and calculate the manufacturing overhead cost per unit for each product. 2. Compute the manufacturing cost per unit for each product. 3. How might Parker's managers use the new cost information from its activity-based costing system to better manage its business? 5-28 ABC, wholesale, customer profitability. Ramirez Wholesalers operates at capacity and sells furniture items to four department-store chains (customers). Mr. Ramirez commented, "We apply ABC to determine product-line profitability. The same ideas apply to customer profitability, and we should find out our customer profitability as well." Ramirez Wholesalers sends catalogs to corporate purchasing departments on a monthly basis. The customers are entitted to return unsold merchandise within a six-month period from the purchase date and receive a full purchase price refund. The following data were collected from last year's operations: Ramirez has calculated the following activity rates: 1. Customers pay the transportation costs. The cost of goods sold averages 80% of sales. 2. Determine the contribution to profit from each chain last year. Comment on your solution. 5-24 Department costing, service company. CKM is an architectural firm that designs and builds buildings. Itprices eacch job on a cost plus 20% basis. Overhead costs in 2017 are \$4,011,780. CKM's simple costing system allocates overhead costs to its jobs based on number of jobs. There were three jobs in 2017. One customer, Sanders, has complained that the cost of tits building in Chicago was not competitive. As a result, the controller has initiated a detailed review of the overhead allocation to determine it overhead costs are charged to jobs in proportion to consumption of overhead resources by iobs. She gathers the following information: 1. Compute the overhead allocated to each project in 2017 using the simple costing system. 2. Compute the overhead allocated to each project in 2017 using department overhead cost rates. 3. Do you think Sanders had a valid reason for dissatisfaction with the cost? How does the allocation, based on department rates, change costs for each project? 4. What value, if any, would CKM get by allocating costs of each department based on the activities done in that department? 5-35 First-stage allocation, time-driven activity-based costing, service sector. LawnCare USA provides lawn care and landscaping services to commercial clients. LawnCare USA uses activity-based costing to bid on jobs and to evaluate their profitability. LawnCare USA reports the following budgeted annual costs: John Gilroy, controller of LawnCare USA, has established four activity cost pools and the following budgeted activity for each cost pool: Gilroy estimates that LawnCare USA's costs are distributed to the activity-cost pools as follows: Sunser umice Park, a new development in a nearby community, has contacted LawnCare USA to provide an estimate on landscape design and annual lawn maintenance. The job is estimated to require a single landscape design requiring 40 design hours in total and 250 direct labor-hours annually. LawnCare USA has a policy of pricing estimates at 150% of cost. 1. Allocate LawnCare USA's costs to the activity-cost pools and determine the activity rate for each pool. 2. Estimate total cost for the Sunset Office Park job. How much would LawnCare USA bid to perform the jab? 3. LawnCare USA does 30 landscape designs for its customers each year. Estimate the total cost for the Sunset Office park job if LawnCare USA allocated costs of the Landscape Design activity based on the number of landscape designs rather than the number of landscape design-hours. How much would LawnCare USA bid to perform the job? Which cost driver do you prefer for the Landscape Design activ. ity? Why? 4. Sunset Office Park asks LawnCare USA to give an estimate for providing its services for a 2-year period. What are the advantages and disadvantages for LawnCare USA to provide a 2-year estimate? 5-37 Activity-based costing. merehandising. Pharmahelp, Inc. a distributor of special pharmaceutical products, operates at capacity and has three main market segments: a. General supermarket chains b. Drugstore chains c. Mom-and-pop single-store pharmacies Rick Fair, the newv controller of Pharmahelp, reported the following data for 2017. Formany years, Pharmahelp has used gross margin percentage [(Revenue - Cost of goods sold) 4 Revenue] to evaluate the relative profitability of its market segments. But flair recenthy attended a seminar on activity-based costing and is considering using it at Pharmahetp to analyze and allocate -other operating that there are five key activities that drive other operating costs at Pharmatielp: Each customer order consists of one or more line items. A line item represents a single product (such as Extra-Strength Tylenol Tablets). Each product line item is defivered in one or more separate cartons. Each store delivery entails the delivery of one or more cartons of products to a customer. Pharmahelp's staff stacks cartons diractly onto display shelves in customers" stores. Currently, there is no additional oharge to the customer for shelf-stoeking and not all customers use Pharmahelp for this activity. The level of each activity in the three market segments and the total cost incurred for each activity in 2017 is as follows: 1. Compute the 2017 gross-margin percentage for each of Pharmahelp's three market segments. 2. Compute the cost driver rates for each of the five activity areas. 3. Use the activity-based costing information to allocate the $301,080 of "other operating costs" to each of the market segments. Compute the operating income for each market segment. 4. Comment on the results. What new insights are available with the activity-based costing information? 5-29 Activity-based costing. The job costing system at Sheri's Custom Framing has five indirect-cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs: Job 215, an order of 15 intricate personalized frames, and Job 325, an order of 6 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly designed activity-based job-costing system. Total budgeted costs in each indirect-cost pool and the budgeted quantity of activity driver are as follows: Information related to Job 215 and Job 325 follows. Job 215 incurs more batch-level costs because it uses more types of materials that need to be purchased, moved, and inspected relative to Job 325. 1. Compute the total overhead allocated to each job under a simple costing system, where overhead is allocated based on machine-hours. 2. Compute the total overhead allocated to each job under an activity-based costing system using the appropriate activity drivers. 3. Explain why Sheri's Custom Framing might favor the ABC job-costing system over the simple jobcosting system, especially in its bidding process. 5 -38 Choosing cost drivers, activity-based costing. activity-based management. Shades 8 Hues (S\&H) is a designer of high-quality curtains and bedsheets. Each design is made in small batches. Each spring. S\&H comes out with new designs for the curtains and for the bedsheets. The company uses these designs for a year and then moves on to the next trend. The products are all made on the same fabrication equipment that is expected to operate at capacity. The equipment must be switched over to a new design and set up to prepare for the production of each new batch of products. When completed, each batch of products is immediately shipped to a wholesaler. Shipping costs vary with the number of shipments. Budgeted information for the year is as follows: Other budget information follows: 1. Identify the cost hierarchy level for each cost category. 2. Identify the most appropriate cost driver for each cost category. Explain briefly your choice of cost driver. 3. Calculate the budgeted cost per unit of cost driver for each cost category. 4. Calculate the budgeted total costs and cost per unit for each product line. 5. Explain how you could use the information in requirement 4 to reduce costs. Question 1 [1/2 Mark] Dharwish Corporation uses normal costing where overhead is allocated to jobs on the basis of direct labour hours. The company estimated a total manufacturing overhead of $120,000 and 4,000 direct labor-hours for the period. The company incurred actual total manufacturing overhead of $113,000 and 6,000 total direct labor-hours during the period. Required: Compute the predetermined overhead rate. Question 2 [1/2 Mark] Al Khabeesi Corporation uses a normal costing system where overhead is allocated based on machine-hours. The company's predetermined overhead rate for the current year is $2.20 per machine-hour with estimated 50,000 machine-hours. The actual machine hours used during the period were 45,000. Required: Compute the estimated total manufacturing overhead

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started