Question 1 (12 marks) The ABCEasyAs123 Corporation has numerous retail clothing stores in the Lower Mainland. Its tax rate is 40 percent. ABC is

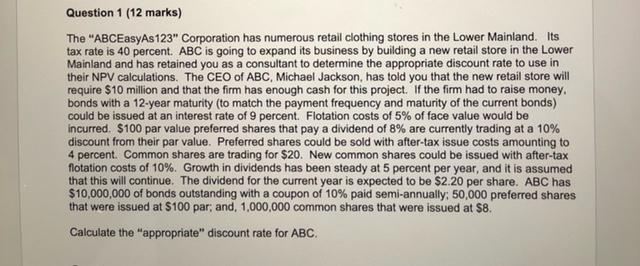

Question 1 (12 marks) The "ABCEasyAs123" Corporation has numerous retail clothing stores in the Lower Mainland. Its tax rate is 40 percent. ABC is going to expand its business by building a new retail store in the Lower Mainland and has retained you as a consultant to determine the appropriate discount rate to use in their NPV calculations. The CEO of ABC, Michael Jackson, has told you that the new retail store will require $10 million and that the firm has enough cash for this project. If the firm had to raise money. bonds with a 12-year maturity (to match the payment frequency and maturity of the current bonds) could be issued at an interest rate of 9 percent. Flotation costs of 5% of face value would be incurred. $100 par value preferred shares that pay a dividend of 8% are currently trading at a 10% discount from their par value. Preferred shares could be sold with after-tax issue costs amounting to 4 percent. Common shares are trading for $20. New common shares could be issued with after-tax flotation costs of 10%. Growth in dividends has been steady at 5 percent per year, and it is assumed that this will continue. The dividend for the current year is expected to be $2.20 per share. ABC has $10,000,000 of bonds outstanding with a coupon of 10% paid semi-annually; 50,000 preferred shares that were issued at $100 par; and, 1,000,000 common shares that were issued at $8. Calculate the "appropriate" discount rate for ABC.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the appropriate discount rate for ABC we need to find the weighted average cost of capital WACC Well consider the cost of equity cost of ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started