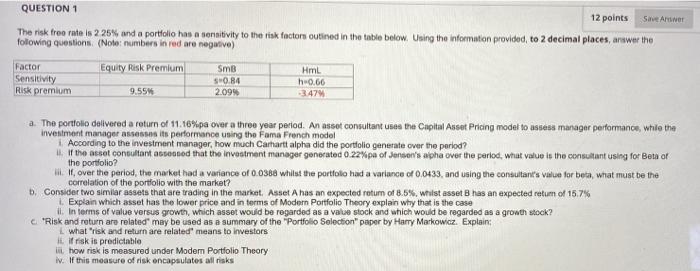

QUESTION 1 12 points Save ARNO The risk free rate is 2 25%, and a portfolio has a sensitivity to the risk factors outined in the table below. Using the information provided to 2 decimal places, answer the following questions. (Note: numbers in red are negative) Equity Risk Premium Factor Sensitivity Risk premium SmB SH0.84 2.09% Hml h 0.66 3.47% 9.55% a. The portfolio delivered a return of 11.16%pa over a three year period. An asset consultant see the Capital Asset Pricing model to assess manager performance, while the investment manager assesses its performance using the Fama French model 1. According to the investment manager, how much Carhartt alpha did the portfolio generate over the period? If the asset consultant and that the investment manager generated 0.22% pa of Jewaris apha over the period, what value is the consultant using for Beta ar L M over the period, the market had a variance of 0.0368 whilst the portfoto had a variance of 0.0433, and using the consultant's value for beta, what must be the correlation of the portfolio with the market? D. Consider two similar assets that are trading in the market. Asset A has an expected rotum of 8.5%, whilst asset B has an expected retum of 15.7% 1. Explain which asset has the lower price and in terms of Modern Portfolio Theory explain why that is the case ii. In terms of value versus growth, which asset would be regarded as a value stock and which would be regarded as a growth stock? "Risk and return are related may be used as a summary of the Portfolio Selection paper by Harry Markowicz. Explain: risk and return are relat means to investor ifrisk is predictable ill. how risk is measured under Modern Portfolio Theory iv. If this measure of risk encapsulates all risks QUESTION 1 12 points Save ARNO The risk free rate is 2 25%, and a portfolio has a sensitivity to the risk factors outined in the table below. Using the information provided to 2 decimal places, answer the following questions. (Note: numbers in red are negative) Equity Risk Premium Factor Sensitivity Risk premium SmB SH0.84 2.09% Hml h 0.66 3.47% 9.55% a. The portfolio delivered a return of 11.16%pa over a three year period. An asset consultant see the Capital Asset Pricing model to assess manager performance, while the investment manager assesses its performance using the Fama French model 1. According to the investment manager, how much Carhartt alpha did the portfolio generate over the period? If the asset consultant and that the investment manager generated 0.22% pa of Jewaris apha over the period, what value is the consultant using for Beta ar L M over the period, the market had a variance of 0.0368 whilst the portfoto had a variance of 0.0433, and using the consultant's value for beta, what must be the correlation of the portfolio with the market? D. Consider two similar assets that are trading in the market. Asset A has an expected rotum of 8.5%, whilst asset B has an expected retum of 15.7% 1. Explain which asset has the lower price and in terms of Modern Portfolio Theory explain why that is the case ii. In terms of value versus growth, which asset would be regarded as a value stock and which would be regarded as a growth stock? "Risk and return are related may be used as a summary of the Portfolio Selection paper by Harry Markowicz. Explain: risk and return are relat means to investor ifrisk is predictable ill. how risk is measured under Modern Portfolio Theory iv. If this measure of risk encapsulates all risks