Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (13 marks, 600 words limit) Oaktree Bank has a two-asset loan portfolio. Both loans were issued today (day 0), and below are the

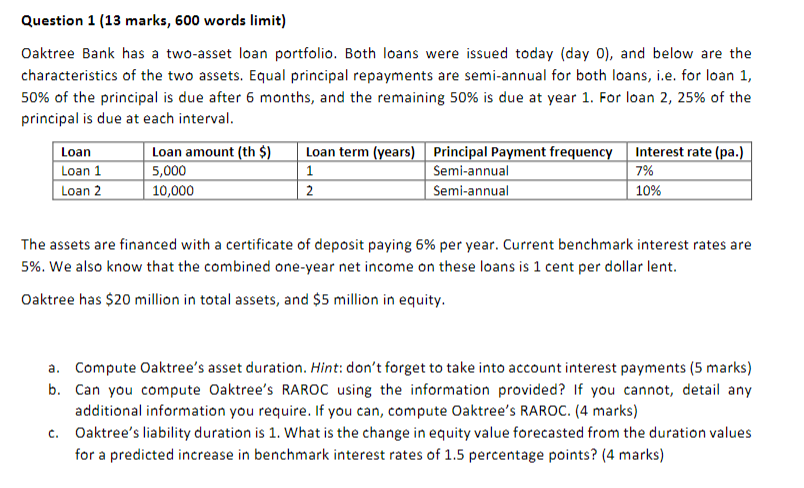

Question 1 (13 marks, 600 words limit) Oaktree Bank has a two-asset loan portfolio. Both loans were issued today (day 0), and below are the characteristics of the two assets. Equal principal repayments are semi-annual for both loans, i.e. for loan 1 , 50% of the principal is due after 6 months, and the remaining 50% is due at year 1 . For loan 2,25% of the principal is due at each interval. The assets are financed with a certificate of deposit paying 6% per year. Current benchmark interest rates are 5%. We also know that the combined one-year net income on these loans is 1 cent per dollar lent. Oaktree has $20 million in total assets, and $5 million in equity. a. Compute Oaktree's asset duration. Hint: don't forget to take into account interest payments (5 marks) b. Can you compute Oaktree's RAROC using the information provided? If you cannot, detail any additional information you require. If you can, compute Oaktree's RAROC. (4 marks) c. Oaktree's liability duration is 1. What is the change in equity value forecasted from the duration values for a predicted increase in benchmark interest rates of 1.5 percentage points? (4 marks)

Question 1 (13 marks, 600 words limit) Oaktree Bank has a two-asset loan portfolio. Both loans were issued today (day 0), and below are the characteristics of the two assets. Equal principal repayments are semi-annual for both loans, i.e. for loan 1 , 50% of the principal is due after 6 months, and the remaining 50% is due at year 1 . For loan 2,25% of the principal is due at each interval. The assets are financed with a certificate of deposit paying 6% per year. Current benchmark interest rates are 5%. We also know that the combined one-year net income on these loans is 1 cent per dollar lent. Oaktree has $20 million in total assets, and $5 million in equity. a. Compute Oaktree's asset duration. Hint: don't forget to take into account interest payments (5 marks) b. Can you compute Oaktree's RAROC using the information provided? If you cannot, detail any additional information you require. If you can, compute Oaktree's RAROC. (4 marks) c. Oaktree's liability duration is 1. What is the change in equity value forecasted from the duration values for a predicted increase in benchmark interest rates of 1.5 percentage points? (4 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started