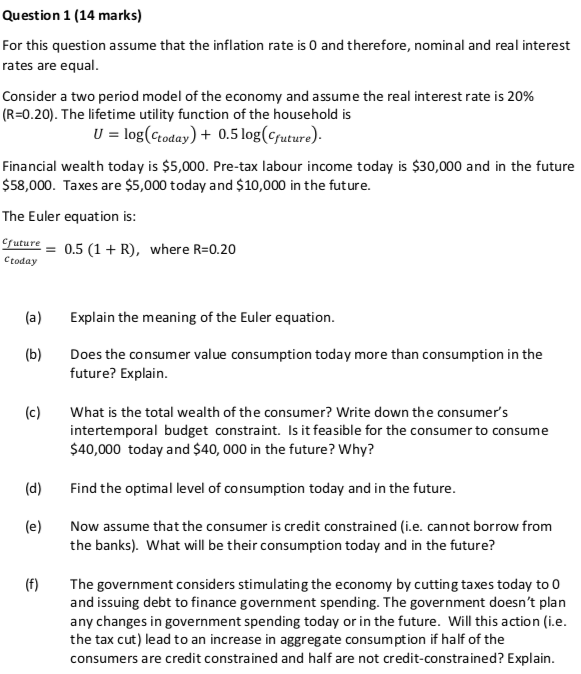

Question 1 (14 marks) For this question assume that the inflation rate is 0 and therefore, nominal and real interest rates are equal Consider a two period model of the economy and assume the real interest rate is 20% (R-0.20). The lifetime utility function of the household is U log(Coday)0.5 log(cfuture). Financial wealth today is $5,000. Pre-tax labour income today is $30,000 and in the future $58,000. Taxes are $5,000 today and $10,000 in the future. The Euler equation is: Cfuture 0.5 (1R), where R-0.20 Ctoday (a) Explain the meaning of the Euler equation. (b) Does the consumer value consumption today more than consumption in the future? Explain (c) What is the total wealth of the consumer? Write down the consumer's intertemporal budget constraint. Is it feasible for the consumer to consume $40,000 today and $40, 000 in the future? Why? Find the optimal level of consumption today and in the future (d) (e) Now assume that the consumer is credit constrained (i.e. cannot borrow from the banks). What will be their consumption today and in the future? (f) The government considers stimulating the economy by cutting taxes today to 0 and issuing debt to finance government spending. The government doesn't plan any changes in government spending today or in the future. Will this action (i.e the tax cut) lead to an increase in aggregate consumption if half of the consumers are credit constrained and half are not credit-constrained? Explain Question 1 (14 marks) For this question assume that the inflation rate is 0 and therefore, nominal and real interest rates are equal Consider a two period model of the economy and assume the real interest rate is 20% (R-0.20). The lifetime utility function of the household is U log(Coday)0.5 log(cfuture). Financial wealth today is $5,000. Pre-tax labour income today is $30,000 and in the future $58,000. Taxes are $5,000 today and $10,000 in the future. The Euler equation is: Cfuture 0.5 (1R), where R-0.20 Ctoday (a) Explain the meaning of the Euler equation. (b) Does the consumer value consumption today more than consumption in the future? Explain (c) What is the total wealth of the consumer? Write down the consumer's intertemporal budget constraint. Is it feasible for the consumer to consume $40,000 today and $40, 000 in the future? Why? Find the optimal level of consumption today and in the future (d) (e) Now assume that the consumer is credit constrained (i.e. cannot borrow from the banks). What will be their consumption today and in the future? (f) The government considers stimulating the economy by cutting taxes today to 0 and issuing debt to finance government spending. The government doesn't plan any changes in government spending today or in the future. Will this action (i.e the tax cut) lead to an increase in aggregate consumption if half of the consumers are credit constrained and half are not credit-constrained? Explain