Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 [15 MARKS] A company has the following shares in issue throughout 2020 : - 12000 ordinary shares, and 13000 non-redeemable, 9% discretionary, participating

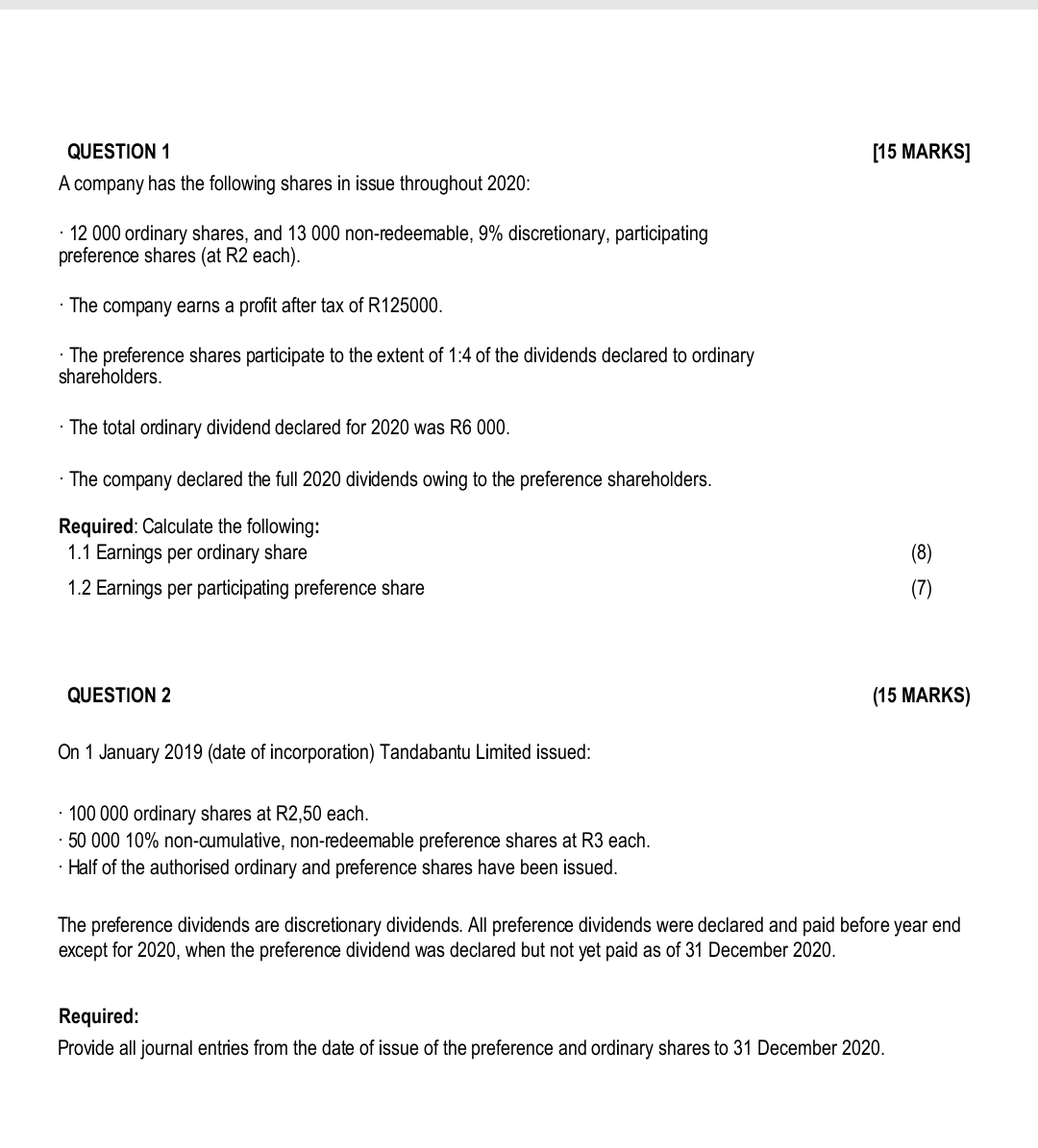

QUESTION 1 [15 MARKS] A company has the following shares in issue throughout 2020 : - 12000 ordinary shares, and 13000 non-redeemable, 9% discretionary, participating preference shares (at R2 each). - The company earns a profit after tax of R125000. - The preference shares participate to the extent of 1:4 of the dividends declared to ordinary shareholders. - The total ordinary dividend declared for 2020 was R6 000. - The company declared the full 2020 dividends owing to the preference shareholders. Required: Calculate the following: 1.1 Earnings per ordinary share (8) 1.2 Earnings per participating preference share (7) QUESTION 2 (15 MARKS) On 1 January 2019 (date of incorporation) Tandabantu Limited issued: - 100000 ordinary shares at R2,50 each. - 5000010% non-cumulative, non-redeemable preference shares at R3 each. - Half of the authorised ordinary and preference shares have been issued. The preference dividends are discretionary dividends. All preference dividends were declared and paid before year end except for 2020, when the preference dividend was declared but not yet paid as of 31 December 2020. Required: Provide all journal entries from the date of issue of the preference and ordinary shares to 31 December 2020

QUESTION 1 [15 MARKS] A company has the following shares in issue throughout 2020 : - 12000 ordinary shares, and 13000 non-redeemable, 9% discretionary, participating preference shares (at R2 each). - The company earns a profit after tax of R125000. - The preference shares participate to the extent of 1:4 of the dividends declared to ordinary shareholders. - The total ordinary dividend declared for 2020 was R6 000. - The company declared the full 2020 dividends owing to the preference shareholders. Required: Calculate the following: 1.1 Earnings per ordinary share (8) 1.2 Earnings per participating preference share (7) QUESTION 2 (15 MARKS) On 1 January 2019 (date of incorporation) Tandabantu Limited issued: - 100000 ordinary shares at R2,50 each. - 5000010% non-cumulative, non-redeemable preference shares at R3 each. - Half of the authorised ordinary and preference shares have been issued. The preference dividends are discretionary dividends. All preference dividends were declared and paid before year end except for 2020, when the preference dividend was declared but not yet paid as of 31 December 2020. Required: Provide all journal entries from the date of issue of the preference and ordinary shares to 31 December 2020 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started