Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1, 2 and 3 GIVEN INFORMATION FOR QUESTIONS 1-3 The financial information below pertains to Notsonice CC. The information was prepared by the Close

Question 1, 2 and 3

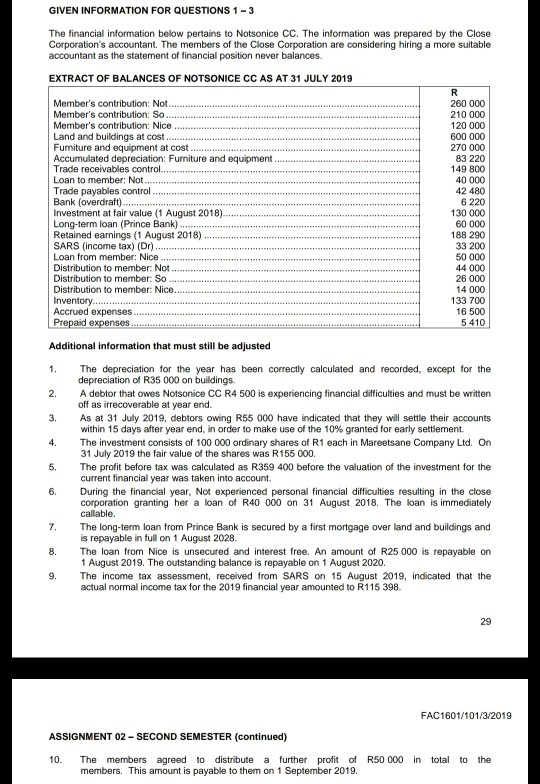

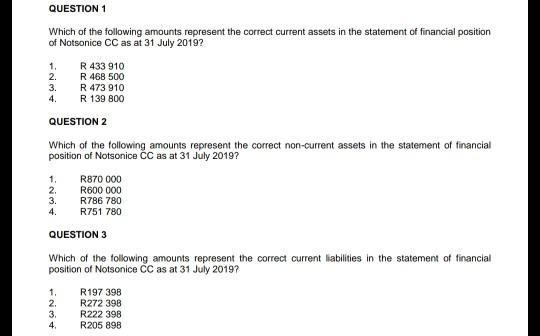

GIVEN INFORMATION FOR QUESTIONS 1-3 The financial information below pertains to Notsonice CC. The information was prepared by the Close Corporation's accountant. The members of the Close Corporation are considering hiring a more suitable accountant as the statement of financial position never balances. EXTRACT OF BALANCES OF NOTSONICE CC AS AT 31 JULY 2019 Member's contribution: Not Member's contribution: So Member's contribution: Nice Land and buildings at cost Furniture and equipment at cost Accumulated depreciation: Furniture and equipment Trade receivables Loan to member: Not Trade payables control 260 000 210 000 120 000 600 000 270 000 83 220 149 800 40 000 42 480 6 220 130 000 60 000 188 290 33 200 50 000 44 000 26 000 14 000 133 700 16 500 Investment at fair value (1 August 2018) Long-term loan (Prince Bank) Retained earnings (1 August 2018) SARS (income tax) (Dr) Loan from member: Nice Distribution to member: Not Distribution to member: So Distribution to member: Nice Accrued expenses Additional information that must still be adjusted 1. The depreciation for the year has been correctly calculated and recorded, except for the 2. A debtor that owes Notsonice CC R4 500 is experiencing financial difficulties and must be written 3. As at 31 July 2019, debtors owing R55 000 have indicated that they will settle their accounts 4. The investment consists of 100 000 ordinary shares of R1 each in Mareetsane Company Ltd. Orn 5. The profit before tax was calculated as R359 400 before the valuation of the investment for the 6. During the financial year, Not experienced personal financial difficulties resulting in the close depreciation of R35 000 on buildings. off as irrecoverable at year end. within 15 days after year end, in order to make use of the 10% granted for early settlement. 31 July 2019 the fair value of the shares was R155 000. current financial year was taken into account. corporation granting her a loan of R40 000 on 31 August 2018. The loan is immediately 7 The long-term loan from Prince Bank is secured by a first mortgage over land and buildings and 8 The loan from Nice is unsecured and interest free. An amount of R25 000 is repayable on 9 The income tax assessment, received from SARS on 15 August 2019, indicated that the s repayable in full on 1 August 2028. 1 August 2019. The outstanding balance is repayable on 1 August 2020 actual normal income tax for the 2019 financial year amounted to R115 398. FAC1601/101/3/2019 ASSIGNMENT 02-SECOND SEMESTER (continued) 10 The members agreed to distribute a further profit of R50 000 in total to the members. This amount is payable to them on 1 September 2019 QUESTION 1 Which of the following amounts represent the correct current assets in the statement of financial position of Notsonice CC as at 31 July 2019? R 433 910 R 468 500 R 473 910 R 139 800 2. 3. QUESTION 2 Which of the following amounts represent the correct non-current assets in the statement of financial position of Notsonice CC as at 31 July 2019? R870 000 R600 000 R786 780 R751 780 3. 4. QUESTION 3 Which of the following amounts represent the correct current liabilities in the statement of financial position of Notsonice CC as at 31 July 2019? R197 398 2. R272 398 3, R222 398 4.R205 898Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started