Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 2 Best Foods is considering a new project and has hired Calima Financial to raise money through a bond issue. Calima has recommended

Question

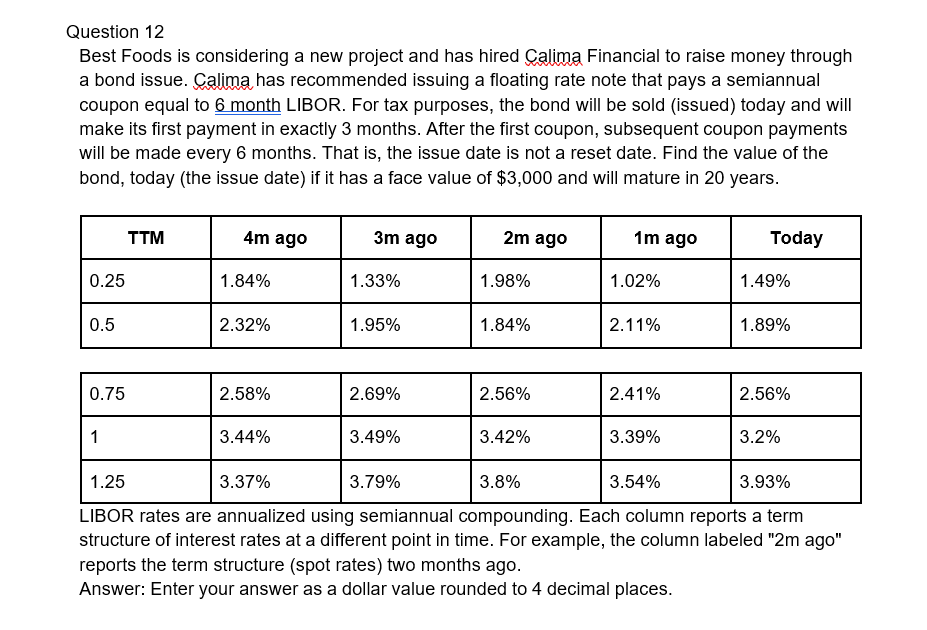

Best Foods is considering a new project and has hired Calima Financial to raise money through

a bond issue. Calima has recommended issuing a floating rate note that pays a semiannual

coupon equal to month LIBOR. For tax purposes, the bond will be sold issued today and will

make its first payment in exactly months. After the first coupon, subsequent coupon payments

will be made every months. That is the issue date is not a reset date. Find the value of the

bond, today the issue date if it has a face value of $ and will mature in years.

LIBOR rates are annualized using semiannual compounding. Each column reports a term

structure of interest rates at a different point in time. For example, the column labeled m ago"

reports the term structure spot rates two months ago.

Answer: Enter your answer as a dollar value rounded to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started