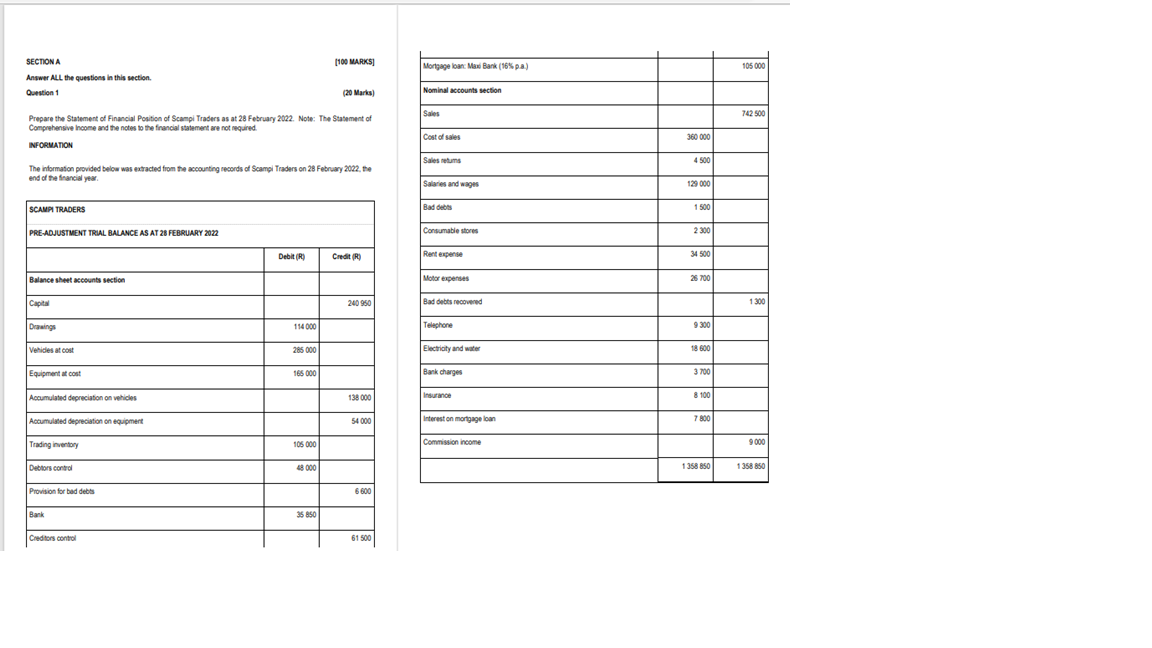

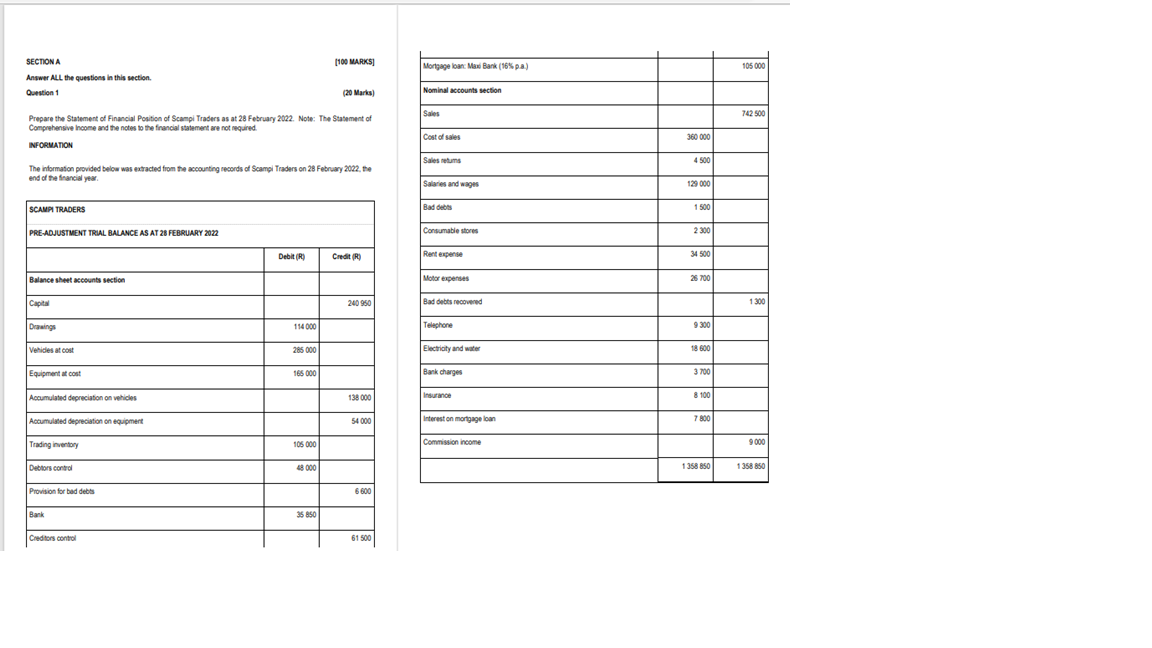

Question 1 (20 Marks) Prepare the Statement of Financial Position of Scampi Traders as at 28 February 2022. Note: The Statement of Comprehensive Income and the notes to the financial statement are not required. INFORMATION The information provided below was extracted from the accounting records of Scampi Traders on 28 February 2022, the end of the financial year.

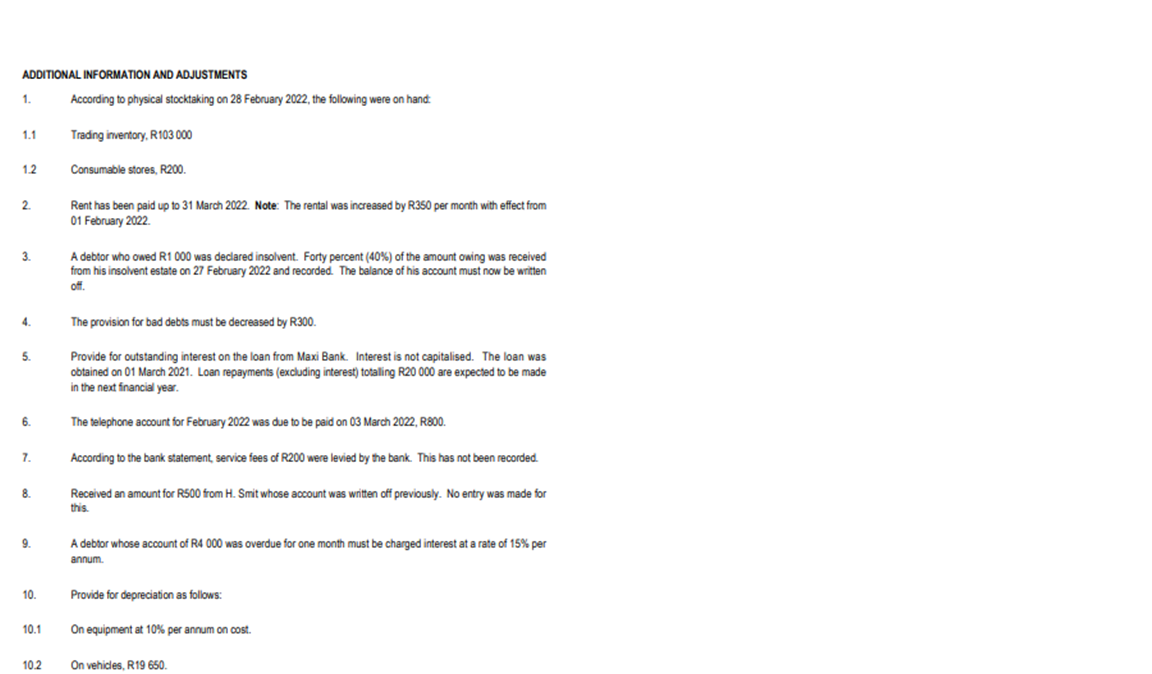

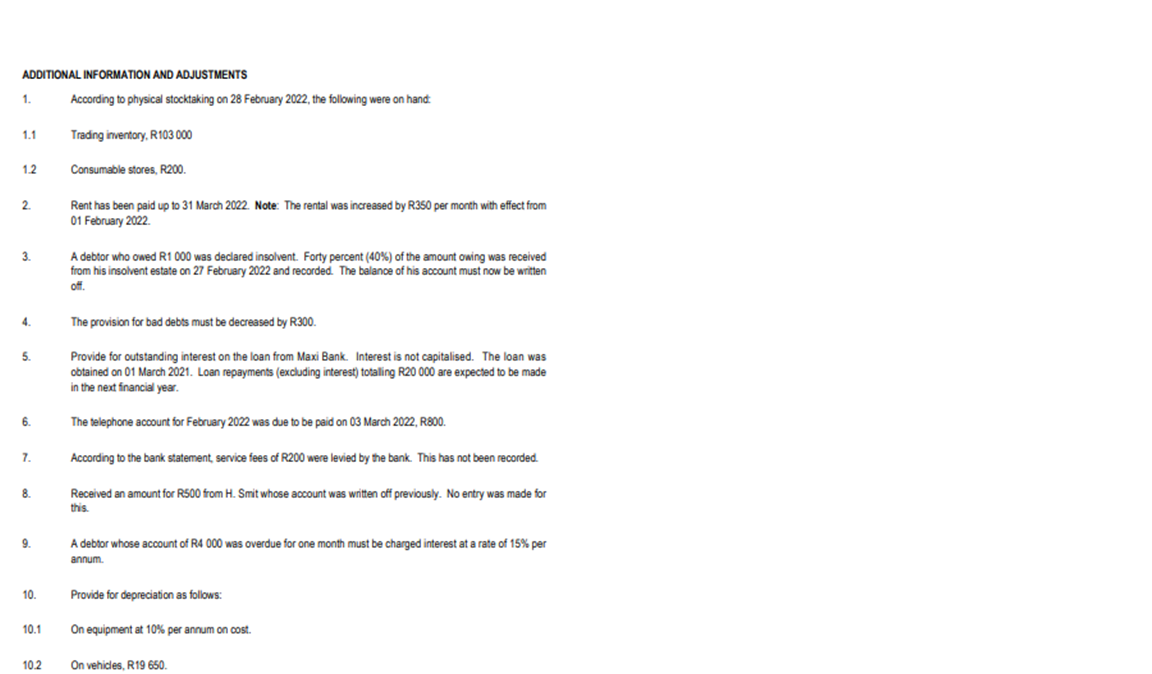

1100 MARKS 105 000 SECTION A Answer ALL the questions in this section. Question 1 Mortgage loan: Maxo Bank (16%) pa Nominal accounts section (20 Marks Sales 742 500 Prepare the Statement of Financial Position of Scampi Traders as at 28 February 2022. Note: The Statement of : Comprehensive Income and the notes to the financial statement are not required INFORMATION Cost of sales 360 000 Sales retums 4500 The information provided below was extracted from the accounting records of Scampi Traders on 28 February 2022, the end of the financial year Salaries and wages 129 000 SCAMPI TRADERS Bades 1 500 PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Consumable stores 2 300 Debit (R) Credit Rent expense 34500 Balance sheet accounts section Motor expenses 26 700 Capital 240 950 Bad debts recovered 1300 Drings 114 000 Telephone 9 300 Verides a cost 285 000 Electricity and water 18 600 Equipment at cost 165 000 Bank charges 3700 Accumulated depreciation on vehicles 138 000 Insurance 8100 Accumulated depreciation on equipment 54000 Interest on mortgage loan 7800 Trading inventory 105 000 Commission income 9000 Debtors control 8 000 1 358 850 1 358 850 Provision for bad debes 6600 Bank 35 850 Creditos control 61 500 ADDITIONAL INFORMATION AND ADJUSTMENTS 1. According to physical stocktaking on 28 February 2022, the following were on hand. 1.1 Trading inventory, R103 000 12 Consumable stores, R200. 2 Rent has been paid up to 31 March 2022. Note: The rental was increased by R350 per month with effect from 01 February 2022 3. A debtor who owed R1 000 was declared insolvent. Forty percent (40%) of the amount owing was received from his insolvent estate on 27 February 2022 and recorded. The balance of his account must now be written off 4. The provision for bad debts must be decreased by R300 5. Provide for outstanding interest on the loan from Maxi Bank. Interest is not capitalised. The loan was obtained on 01 March 2021. Loan repayments (excluding interest) totaling R20 000 are expected to be made in the next financial year. 6. The telephone account for February 2022 was due to be paid on 03 March 2022, R800. 7. According to the bank statement, service fees of R200 were levied by the bank. This has not been recorded 8. Received an amount for R500 from H. Smit whose account was written off previously. No entry was made for this. 9. A debtor whose account of R4 000 was overdue for one month must be charged interest at a rate of 15% per annum 10. Provide for depreciation as follows: 10.1 On equipment at 10% per annum on cost. 102 On vehicles, R19 650