Answered step by step

Verified Expert Solution

Question

1 Approved Answer

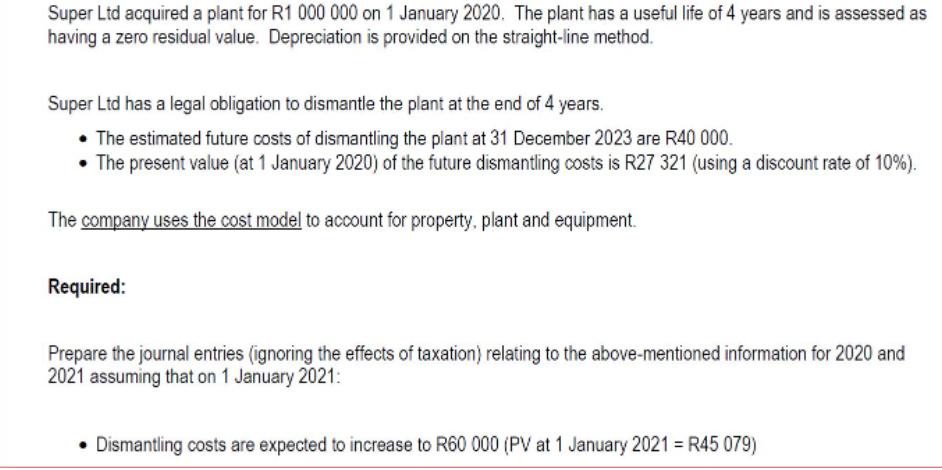

Super Ltd acquired a plant for R1 000 000 on 1 January 2020. The plant has a useful life of 4 years and is

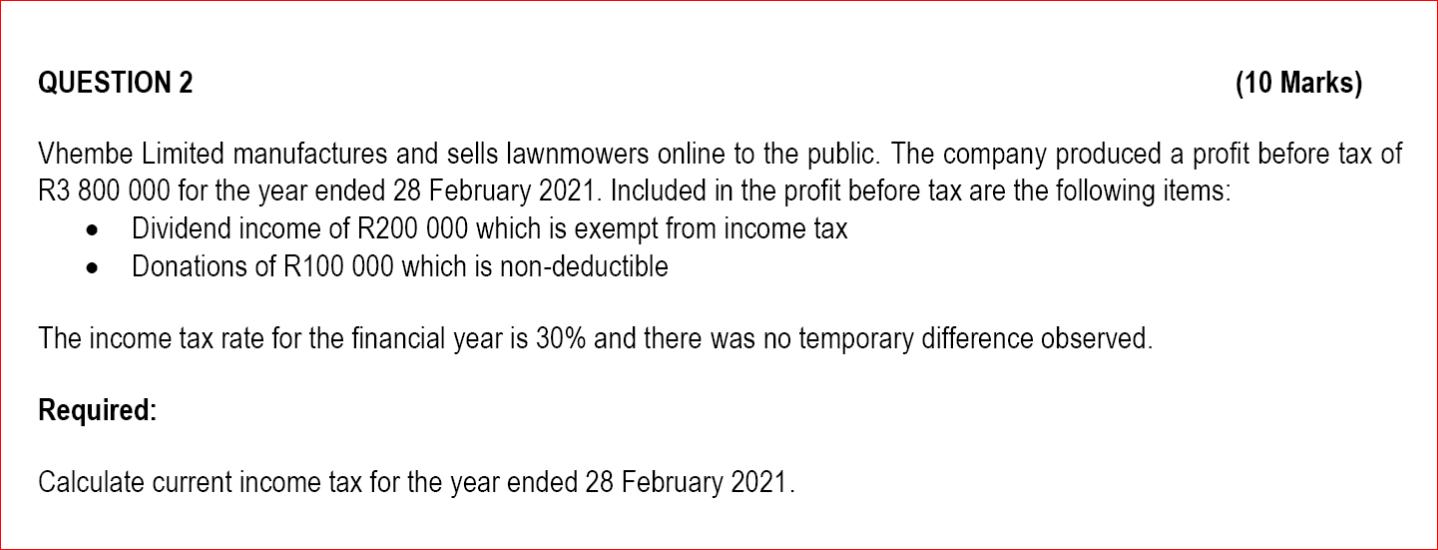

Super Ltd acquired a plant for R1 000 000 on 1 January 2020. The plant has a useful life of 4 years and is assessed as having a zero residual value. Depreciation is provided on the straight-line method. Super Ltd has a legal obligation to dismantle the plant at the end of 4 years. The estimated future costs of dismantling the plant at 31 December 2023 are R40 000. The present value (at 1 January 2020) of the future dismantling costs is R27 321 (using a discount rate of 10%). The company uses the cost model to account for property, plant and equipment. Required: Prepare the journal entries (ignoring the effects of taxation) relating to the above-mentioned information for 2020 and 2021 assuming that on 1 January 2021: Dismantling costs are expected to increase to R60 000 (PV at 1 January 2021 R45 079) QUESTION 2 (10 Marks) Vhembe Limited manufactures and sells lawnmowers online to the public. The company produced a profit before tax of R3 800 000 for the year ended 28 February 2021. Included in the profit before tax are the following items: Dividend income of R200 000 which is exempt from income tax Donations of R100 000 which is non-deductible The income tax rate for the financial year is 30% and there was no temporary difference observed. Required: Calculate current income tax for the year ended 28 February 2021.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer q1 q2 Date ccount Dr Cr Property plant and equipment PPE 202001...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started