Answered step by step

Verified Expert Solution

Question

1 Approved Answer

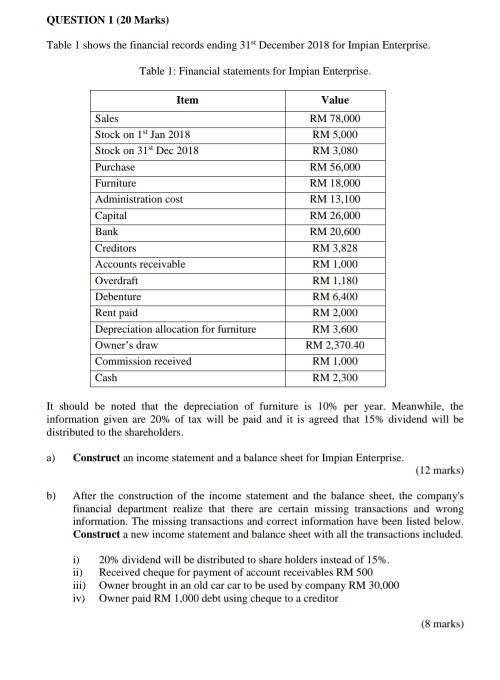

QUESTION 1 (20 Marks) Table 1 shows the financial records ending 31 December 2018 for Impian Enterprise. Table 1: Financial statements for Impian Enterprise. Item

QUESTION 1 (20 Marks) Table 1 shows the financial records ending 31 December 2018 for Impian Enterprise. Table 1: Financial statements for Impian Enterprise. Item Sales Stock on 1 Jan 2018 Stock on 31 Dec 2018 Purchase Furniture Administration cost Capital Bank Creditors Accounts receivable Overdraft Debenture Rent paid Depreciation allocation for furniture Owner's draw Commission received Cash Value RM 78,000 RM 5,000 RM 3,080 RM 56,000 RM 18,000 RM 13,100 RM 26,000 RM 20,600 RM 3,828 RM 1,000 RM 1,180 RM 6,400 RM 2,000 RM 3,600 RM 2,370.40 RM 1,000 RM 2,300 It should be noted that the depreciation of furniture is 10% per year. Meanwhile, the information given are 20% of tax will be paid and it is agreed that 15% dividend will be distributed to the shareholders. Construct an income statement and a balance sheet for Impian Enterprise. (12 marks) b) After the construction of the income statement and the balance sheet, the company's financial department realize that there are certain missing transactions and wrong information. The missing transactions and correct information have been listed below. Construct a new income statement and balance sheet with all the transactions included. i) 20% dividend will be distributed to share holders instead of 15%. ii) Received cheque for payment of account receivables RM 500 iii) Owner brought in an old car car to be used by company RM 30,000 iv) Owner paid RM 1,000 debt using cheque to a creditor (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started