Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (20 Marks) You are the financial manager of Emperors (Pty) Ltd, a property company eaming its income from both commercial rentals (office blocks

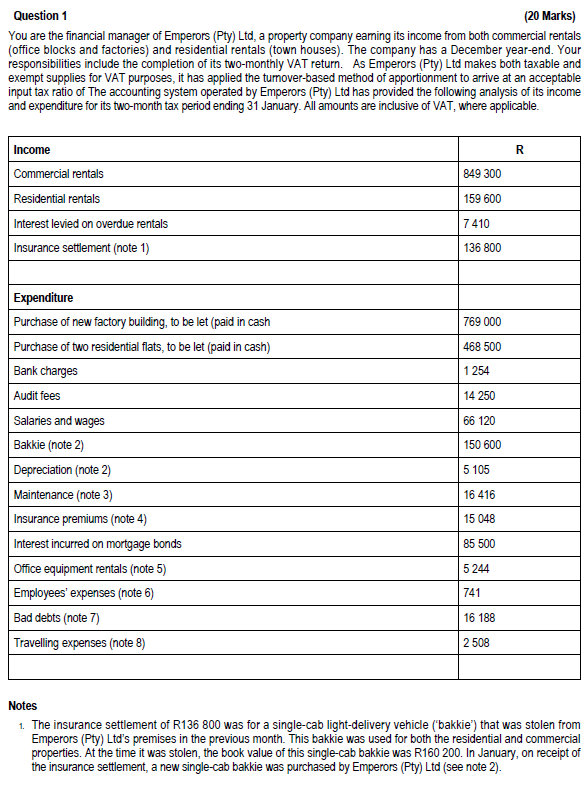

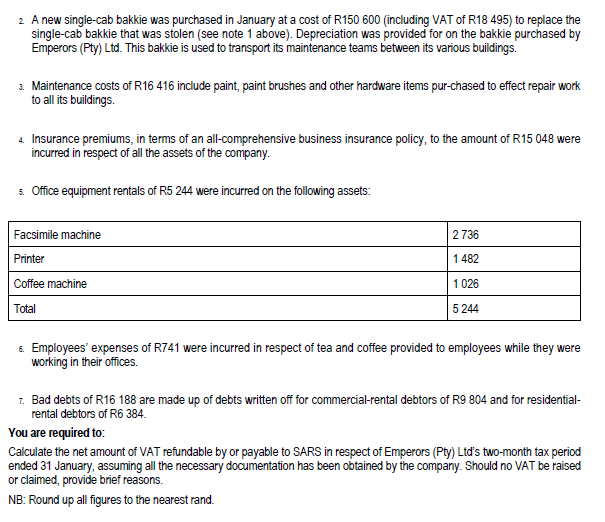

Question 1 (20 Marks) You are the financial manager of Emperors (Pty) Ltd, a property company eaming its income from both commercial rentals (office blocks and factories) and residential rentals (town houses). The company has a December year-end. Your responsibilities include the completion of its two-monthly VAT return. As Emperors (Pty) Ltd makes both taxable and exempt supplies for VAT purposes, it has applied the turnover-based method of apportionment to arrive at an acceptable input tax ratio of The accounting system operated by Emperors (Pty) Ltd has provided the following analysis of its income and eynenditre for ite tun-mnnth tay nerind endinn .21. Ianarv All amnunte are inclcive nf VAT where annlirahle Notes 1. The insurance settlement of R136 800 was for a single-cab light-delivery vehicle ('bakkie') that was stolen from Emperors (Pty) Ltd's premises in the previous month. This bakkie was used for both the residential and commercial properties. At the time it was stolen, the book value of this single-cab bakkie was R160 200. In January, on receipt of the insurance settlement, a new single-cab bakkie was purchased by Emperors (Pty) Ltd (see note 2). 2. A new single-cab bakkie was purchased in January at a cost of R150 600 (including VAT of R18 495) to replace the single-cab bakkie that was stolen (see note 1 above). Depreciation was provided for on the bakkie purchased by Emperors (Pty) Ltd. This bakkie is used to transport its maintenance teams between its various buildings. 3. Maintenance costs of R16 416 include paint, paint brushes and other hardware items pur-chased to effect repair work to all its buildings. 4. Insurance premiums, in terms of an all-comprehensive business insurance policy, to the amount of R15 048 were incurred in respect of all the assets of the company. 5. Office equipment rentals of R5 244 were incurred on the following assets: 6. Employees' expenses of R741 were incurred in respect of tea and coffee provided to employees while they were working in their offices. 7. Bad debts of R16 188 are made up of debts written off for commercial-rental debtors of R9 804 and for residentialrental debtors of R6384. You are required to: Calculate the net amount of VAT refundable by or payable to SARS in respect of Emperors (Pty) Ltd's two-month tax period ended 31 January, assuming all the necessary documentation has been obtained by the company. Should no VAT be raised or claimed, provide brief reasons. NB: Round up all figures to the nearest rand

Question 1 (20 Marks) You are the financial manager of Emperors (Pty) Ltd, a property company eaming its income from both commercial rentals (office blocks and factories) and residential rentals (town houses). The company has a December year-end. Your responsibilities include the completion of its two-monthly VAT return. As Emperors (Pty) Ltd makes both taxable and exempt supplies for VAT purposes, it has applied the turnover-based method of apportionment to arrive at an acceptable input tax ratio of The accounting system operated by Emperors (Pty) Ltd has provided the following analysis of its income and eynenditre for ite tun-mnnth tay nerind endinn .21. Ianarv All amnunte are inclcive nf VAT where annlirahle Notes 1. The insurance settlement of R136 800 was for a single-cab light-delivery vehicle ('bakkie') that was stolen from Emperors (Pty) Ltd's premises in the previous month. This bakkie was used for both the residential and commercial properties. At the time it was stolen, the book value of this single-cab bakkie was R160 200. In January, on receipt of the insurance settlement, a new single-cab bakkie was purchased by Emperors (Pty) Ltd (see note 2). 2. A new single-cab bakkie was purchased in January at a cost of R150 600 (including VAT of R18 495) to replace the single-cab bakkie that was stolen (see note 1 above). Depreciation was provided for on the bakkie purchased by Emperors (Pty) Ltd. This bakkie is used to transport its maintenance teams between its various buildings. 3. Maintenance costs of R16 416 include paint, paint brushes and other hardware items pur-chased to effect repair work to all its buildings. 4. Insurance premiums, in terms of an all-comprehensive business insurance policy, to the amount of R15 048 were incurred in respect of all the assets of the company. 5. Office equipment rentals of R5 244 were incurred on the following assets: 6. Employees' expenses of R741 were incurred in respect of tea and coffee provided to employees while they were working in their offices. 7. Bad debts of R16 188 are made up of debts written off for commercial-rental debtors of R9 804 and for residentialrental debtors of R6384. You are required to: Calculate the net amount of VAT refundable by or payable to SARS in respect of Emperors (Pty) Ltd's two-month tax period ended 31 January, assuming all the necessary documentation has been obtained by the company. Should no VAT be raised or claimed, provide brief reasons. NB: Round up all figures to the nearest rand Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started