Question

QUESTION 1: 25 marks (a) Calculate the standard deviation of the following portfolio. (b) The expected return on particular asset is 10%, and its beta

QUESTION 1: 25 marks

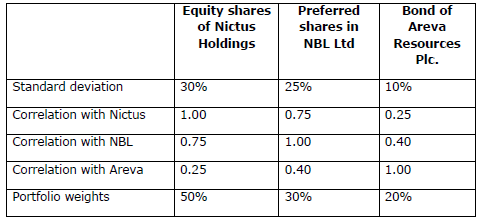

(a) Calculate the standard deviation of the following portfolio.

(b) The expected return on particular asset is 10%, and its beta is 1.5. The risk-free return is 2%, and the expected return on the market portfolio is 14%. Does this asset lie on, or below the security market line. Explain.

QUESTION 02 (25 MARKS)

Cax Ltd issued corporate bonds with a coupon rate of 8.0%. The face value is N$100 and the bond is stated on the statement of financial position at its total par value of N$80m. The bonds are currently trading at a price of N$94. Interest is payable annually in arrears. The maturity date is in five years time. The company has also issued variable loan finance of N$10m at a current interest rate of 9.0% per year.

The company has 200 000 non-redeemable preference shares which were issued at a price of N$100 each. Preference dividends are payable annually in arrears. The non-redeemable preference shares are currently priced at N$106. The coupon rate is 8% and the company has recently paid the preference dividends for the current year. The companys equity beta is 1.15 and the risk free rate is 6%. The company uses a market premium of 6.5% as this is the average between 5-8 which is the range of the market premiums recommended by some analysts. The current share price is N$3.20 and the company has 30 million ordinary shares in issue.

Required:

(a) What is Caxs after-tax cost of debt is taxation is 30%?

(b) What is the cost of preference shares?

(c) What is the cost of equity?

Equity sharesPreferre Bond of Areva Resources Plc. of Nictus Holdings shares in NBL Ltd deviation Stan Correlation with Nictus Correlation with NBL Correlation with Areva 3090 1.00 0.75 0.25 50% 25% 0.75 1.00 0.40 30% 10% 0.25 0.40 1.00 20% olio weights

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started