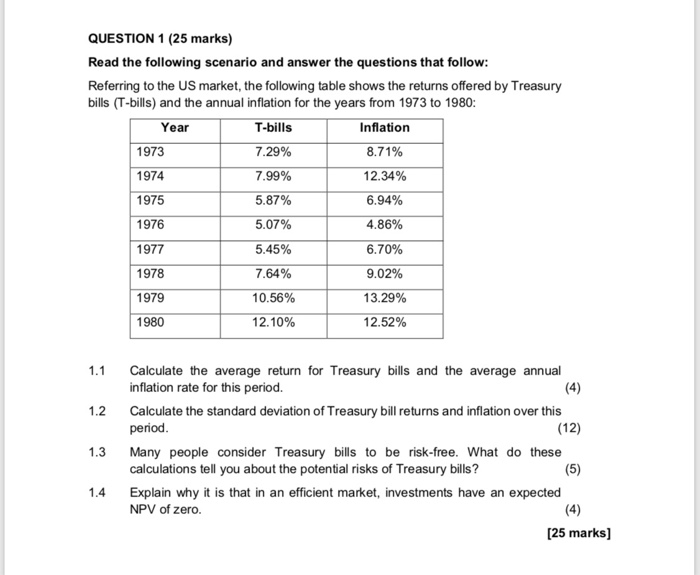

Question: QUESTION 1 (25 marks) Read the following scenario and answer the questions that follow Referring to the US market, the following table shows the returns

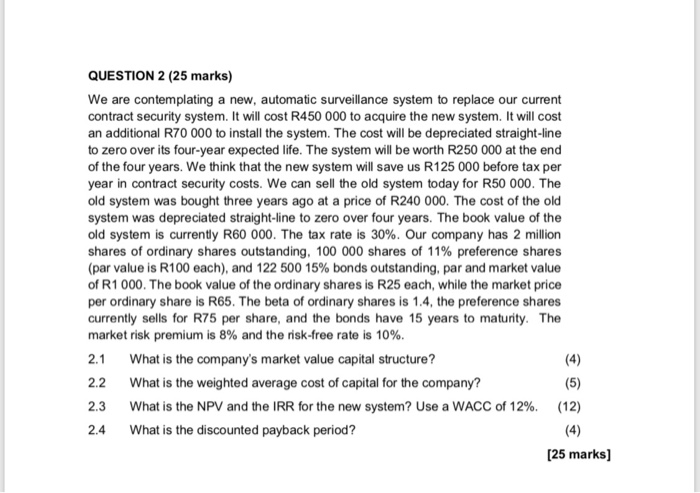

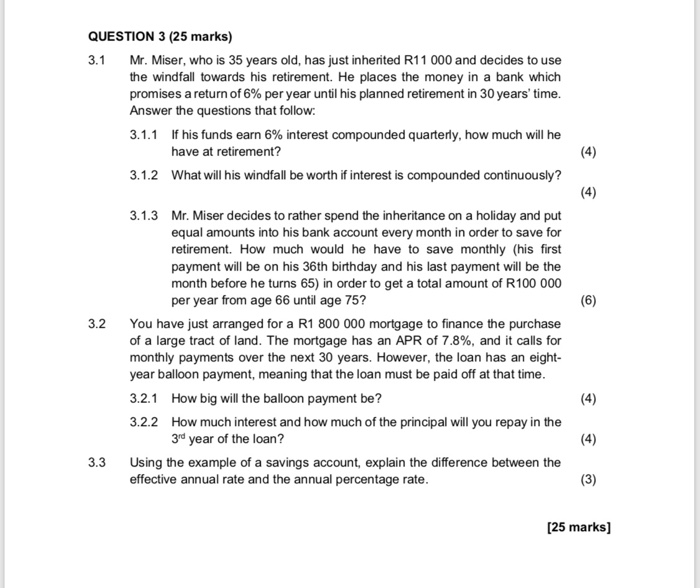

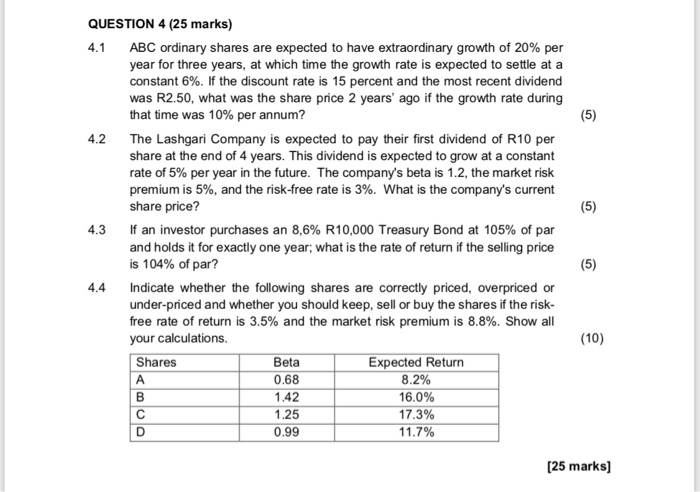

QUESTION 1 (25 marks) Read the following scenario and answer the questions that follow Referring to the US market, the following table shows the returns offered by Treasury bills (T-bills) and the annual inflation for the years from 1973 to 1980: T-bills 72 % 7.99% 5.87% 5.07% 5.45% 7.64% 10.56% 12.10% Year 1973 1974 1975 1976 1977 1978 1979 1980 Inflation 8.71% 12.34% 6.94% 4.86% 670% 9.02% 13.29% 12.52% 1.1 Calculate the average return for Treasury bills and the average annual inflation rate for this period. 1.2 Calculate the standard deviation of Treasury bill returns and inflation over this period (12) 1.3 Many people consider Treasury bills to be risk-free. What do these calculations tell you about the potential risks of Treasury bills? 1.4 Explain why it is that in an efficient market, investments have an expected NPV of zero. [25 marks] QUESTION 2 (25 marks) We are contemplating a new, automatic surveillance system to replace our current contract security system. It will cost R450 000 to acquire the new system. It will cost an additional R70 000 to install the system. The cost will be depreciated straight-line to zero over its four-year expected life. The system will be worth R250 000 at the end of the four years. We think that the new system will save us R125 000 before tax per year in contract security costs. We can sell the old system today for R50 000. The old system was bought three years ago at a price of R240 000. The cost of the old system was depreciated straight-line to zero over four years. The book value of the old system is currently R60 000. The tax rate is 30%. Our company has 2 million shares of ordinary shares outstanding, 100 000 shares of 11% preference shares (par value is R100 each), and 122 500 15% bonds outstanding, par and market value of R1 000. The book value of the ordinary shares is R25 each, while the market price per ordinary share is R65. The beta of ordinary shares is 1.4, the preference shares currently sells for R75 per share, and the bonds have 15 years to maturity. The market risk premium is 8% and the risk-free rate is 10%. 2.1 2.2 2.3 2.4 What is the company's market value capital structure? What is the weighted average cost of capital for the company? what is the NPV and the IRR for the new system? Use a WACC of 12%. What is the discounted payback period? (12) [25 marks] QUESTION 3 (25 marks) 3.1 Mr. Miser, who is 35 years old, has just inherited R11 000 and decides to use the windfall towards his retirement. He places the money in a bank which promises a return of 6% per year until his planned retirement in 30 years' time Answer the questions that follow 3.1.1 If his funds earn 6% interest compounded quarterly, how much will he have at retirement? 3.1.2 What will his windfall be worth if interest is compounded continuously? 3.1.3 Mr. Miser decides to rather spend the inheritance on a holiday and put equal amounts into his bank account every month in order to save for retirement. How much would he have to save monthly (his first payment will be on his 36th birthday and his last payment will be the month before he turns 65) in order to get a total amount of R100 000 per year from age 66 until age 75? 3.2 You have just arranged for a R1 800 000 mortgage to finance the purchase of a large tract of land. The mortgage has an APR of 7.8%, and it calls for monthly payments over the next 30 years. However, the loan has an eight year balloon payment, meaning that the loan must be paid off at that time 3.2.1 How big will the balloon payment be? 3.2.2 How much interest and how much of the principal will you repay in the 3rd year of the loan? 3.3 Using the example of a savings account, explain the difference between the effective annual rate and the annual percentage rate [25 marks] QUESTION 4 (25 marks) 4.1 ABC ordinary shares are expected to have extraordinary growth of 20% per year for three years, at which time the growth rate is expected to settle at a constant 6%. If the discount rate is 15 percent and the most recent dividend was R2.50, what was the share price 2 years' ago if the growth rate during that time was 10% per annum 4.2 The Lashgari Company is expected to pay their first dividend of R10 per share at the end of 4 years. This dividend is expected to grow at a constant rate of 5% per year in the future. The company's beta is 1.2, the market risk premium is 5%, and the risk-free rate is 3%, what is the company's current share price? If an investor purchases an 8,6% RI 0,000 Treasury Bond at 105% of par and holds it for exactly one year; what is the rate of return if the selling price is 104% of par? 4.3 .4 Indicate whether the following shares are correctly priced, overpriced or under-priced and whether you should keep, sell or buy the shares if the risk- free rate of return is 3.5% and the market risk premium is 8.8%. Show all your calculations Expected Return 8.2% 16.0% 17.3% Shares Beta 0.99 [25 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts