Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the Junior Credit Officer at Medium Bank Ltd, a commercial bank. Wellthem Ltd, a new pharmacy being established and owned by Mr. John

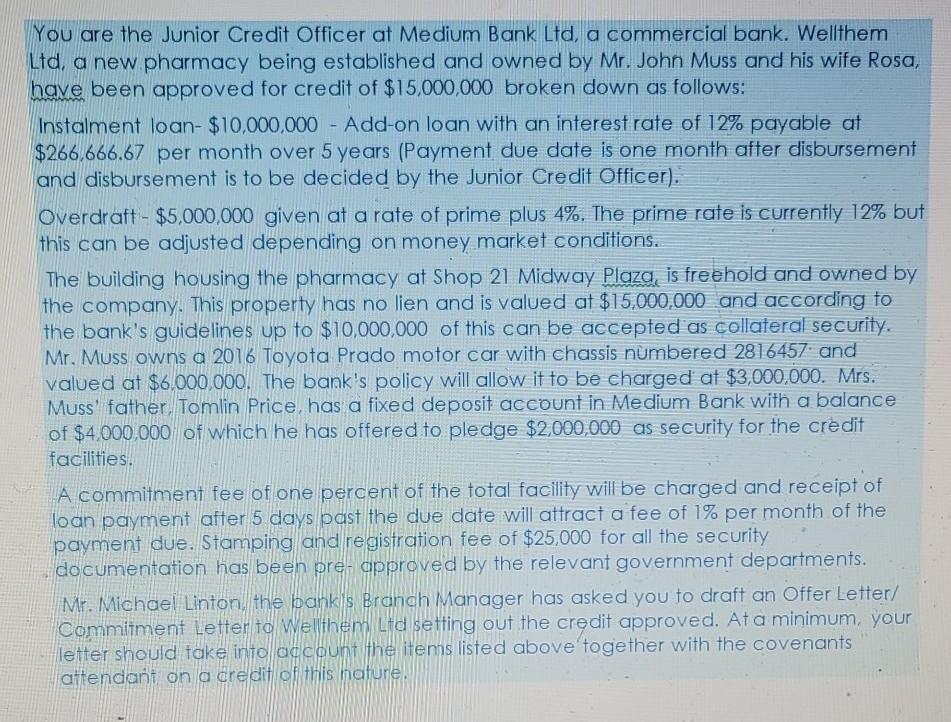

You are the Junior Credit Officer at Medium Bank Ltd, a commercial bank. Wellthem Ltd, a new pharmacy being established and owned by Mr. John Muss and his wife Rosa, have been approved for credit of $15,000,000 broken down as follows: Instalment loan-$10,000,000 - Add-on loan with an interest rate of 12% payable at $266,666.67 per month over 5 years (Payment due date is one month after disbursement and disbursement is to be decided by the Junior Credit Officer). Overdraft - $5,000,000 given at a rate of prime plus 4%. The prime rate is currently 12% but this can be adjusted depending on money market conditions. The building housing the pharmacy at Shop 21 Midway Plaza, is freehold and owned by the company. This property has no lien and is valued at $15,000,000 and according to the bank's guidelines up to $10,000,000 of this can be accepted as collateral security. Mr. Muss owns a 2016 Toyota Prado motor car with chassis numbered 2816457 and valued at $6,000,000. The bank's policy will allow it to be charged at $3,000,000. Mrs. Muss father, Tomlin Price, has a fixed deposit account in Medium Bank with a balance of $4,000,000 of which he has offered to pledge $2,000,000 as security for the credit facilities. A commitment fee of one percent of the total facility will be charged and receipt of loan payment after 5 days past the due date will attract a fee of 1% per month of the payment due. Stamping and registration fee of $25,000 for all the security documentation has been pre-approved by the relevant government departments. Mr. Michael Linton the bank's Branch Manager has asked you to draft an Offer Letter/ Commitment Letter to Wellthem Ltd setting out the credit approved. Ata minimum, your letter should take into account the items listed above together with the covenants attendant on a credit of this nature

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started