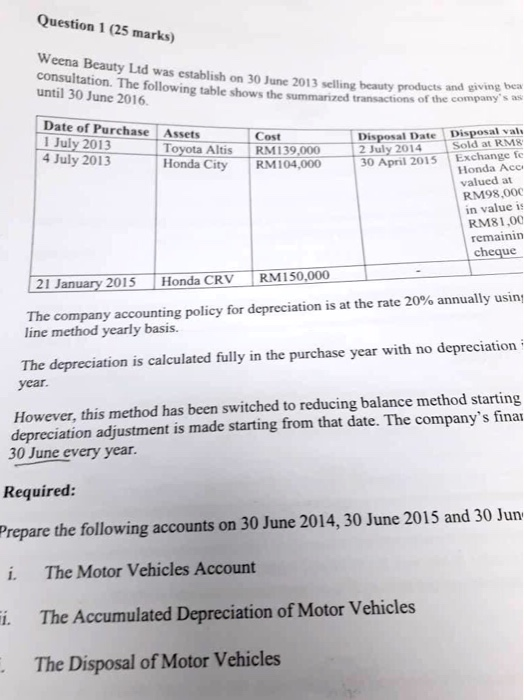

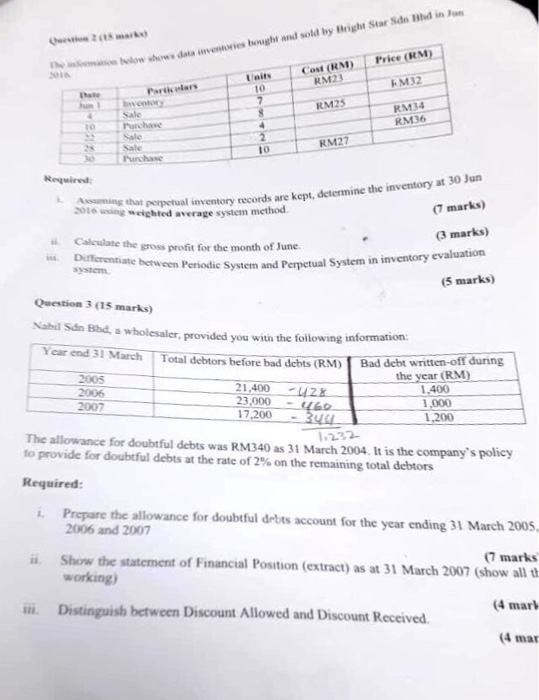

Question 1 (25 marks) Weena Beauty Ltd was establish on 30 June 2013 selling beauty prouscth and consultation. The following table shows the summarized transactions of the company until 30 June 2016. and giving bea Date of Purchase 1 July 2013 4 July 2013 Assets Disposal Date Disposal val Cost July 2014 Sold at RM8 30 April 2015 Exchange te Altis RM139 Honda City RM104,000 Honda Acc valued at RM98,000 in value is RM81,00 remainin cheque 21 January 2015 Honda CRV RM150,000 The company accounting policy for depreciation is at the rate 20% annually usin line method yearly basis. The depreciation is calculated fully in the purchase year with no depreciation year. However, this method has been switched to reducing balance method starting 30 June every year. depreciation adjustment is made starting from that date. The company's fina Required: Prepare the following accounts on 30 June 2014, 30 June 2015 and 30 Jun i. The Motor Vehicles Account i. The Accumulated Depreciation of Motor Vehicles The Disposal of Motor Vehicles weton 2(8 mar shows data inventories bought and sold by Bright Star Sdn 1hd in u Cost (RMPrice (RM) 2016 RM23 k M32 10 hate RM34 RM36 RM25 sale Purchase to Sale 10 hase g tha ptual inventory records are kept, determine the inventory at 30 Jun (7 marks) 2o16 weighted average system method 3 marks) Caleulate Difterentiate between the gross profit for the month of June. Periodie System and Perpetual System in inventory evaluation (5 marks) Question 3 (15 marks) Nabl Sdn Bhd, a wholesaler, provided you with the foilowing information Ycar end 31 March Total debtors before bad debts (RM) Bad debt written-off during 2005 2006 2007 21.400 2 23,00046o 17.200-3u the year (RM) 1,400 1,000 1,200 The allowance for doubtful debts was RM340 as 31 March 2004. It is the company's policy to provide for doubtful debts at the rate of 2% on the remaining total debtors 232 Required: i. Prepare the allowance for doubtful drbts account for the year ending 31 March 2009 2006 and 2007 ii. Show the statement of Financial Postion (extract) as at 31 March 2007 (show all t 4 mark 4 mar (7 marks working) im Distinguish between Discount Allowed and Discount Received. Question 1 (25 marks) Weena Beauty Ltd was establish on 30 June 2013 selling beauty prouscth and consultation. The following table shows the summarized transactions of the company until 30 June 2016. and giving bea Date of Purchase 1 July 2013 4 July 2013 Assets Disposal Date Disposal val Cost July 2014 Sold at RM8 30 April 2015 Exchange te Altis RM139 Honda City RM104,000 Honda Acc valued at RM98,000 in value is RM81,00 remainin cheque 21 January 2015 Honda CRV RM150,000 The company accounting policy for depreciation is at the rate 20% annually usin line method yearly basis. The depreciation is calculated fully in the purchase year with no depreciation year. However, this method has been switched to reducing balance method starting 30 June every year. depreciation adjustment is made starting from that date. The company's fina Required: Prepare the following accounts on 30 June 2014, 30 June 2015 and 30 Jun i. The Motor Vehicles Account i. The Accumulated Depreciation of Motor Vehicles The Disposal of Motor Vehicles weton 2(8 mar shows data inventories bought and sold by Bright Star Sdn 1hd in u Cost (RMPrice (RM) 2016 RM23 k M32 10 hate RM34 RM36 RM25 sale Purchase to Sale 10 hase g tha ptual inventory records are kept, determine the inventory at 30 Jun (7 marks) 2o16 weighted average system method 3 marks) Caleulate Difterentiate between the gross profit for the month of June. Periodie System and Perpetual System in inventory evaluation (5 marks) Question 3 (15 marks) Nabl Sdn Bhd, a wholesaler, provided you with the foilowing information Ycar end 31 March Total debtors before bad debts (RM) Bad debt written-off during 2005 2006 2007 21.400 2 23,00046o 17.200-3u the year (RM) 1,400 1,000 1,200 The allowance for doubtful debts was RM340 as 31 March 2004. It is the company's policy to provide for doubtful debts at the rate of 2% on the remaining total debtors 232 Required: i. Prepare the allowance for doubtful drbts account for the year ending 31 March 2009 2006 and 2007 ii. Show the statement of Financial Postion (extract) as at 31 March 2007 (show all t 4 mark 4 mar (7 marks working) im Distinguish between Discount Allowed and Discount Received