Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 3 Which of the following is a disadvantage of the LIFO inventory method? The company pays higher income taxes when inventory costs are

Question

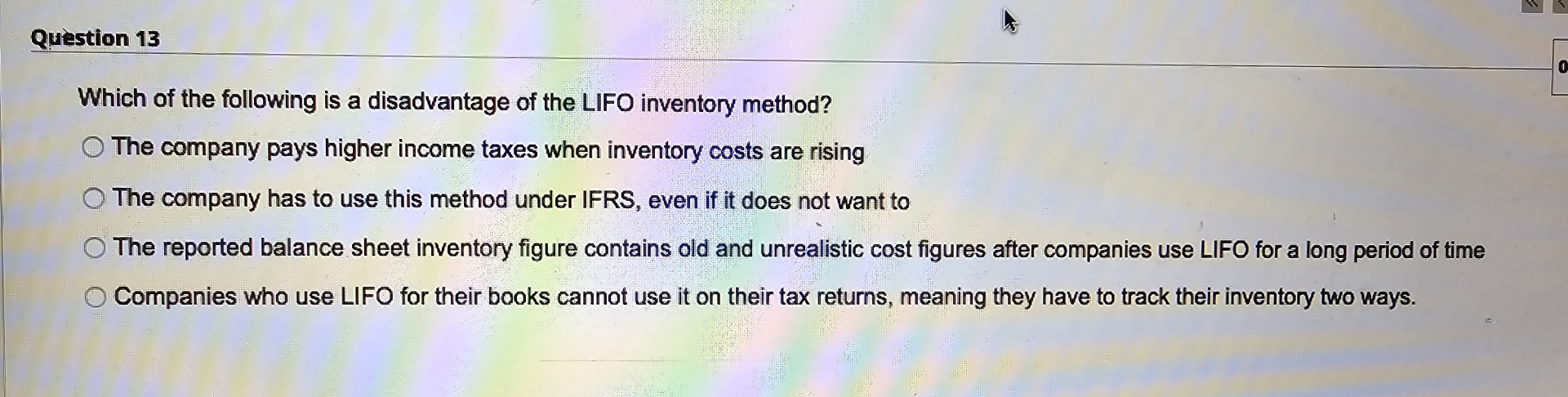

Which of the following is a disadvantage of the LIFO inventory method?

The company pays higher income taxes when inventory costs are rising

The company has to use this method under IFRS, even if it does not want to

The reported balance sheet inventory figure contains old and unrealistic cost figures after companies use LIFO for a long period of time

Companies who use LIFO for their books cannot use it on their tax returns, meaning they have to track their inventory two ways.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started