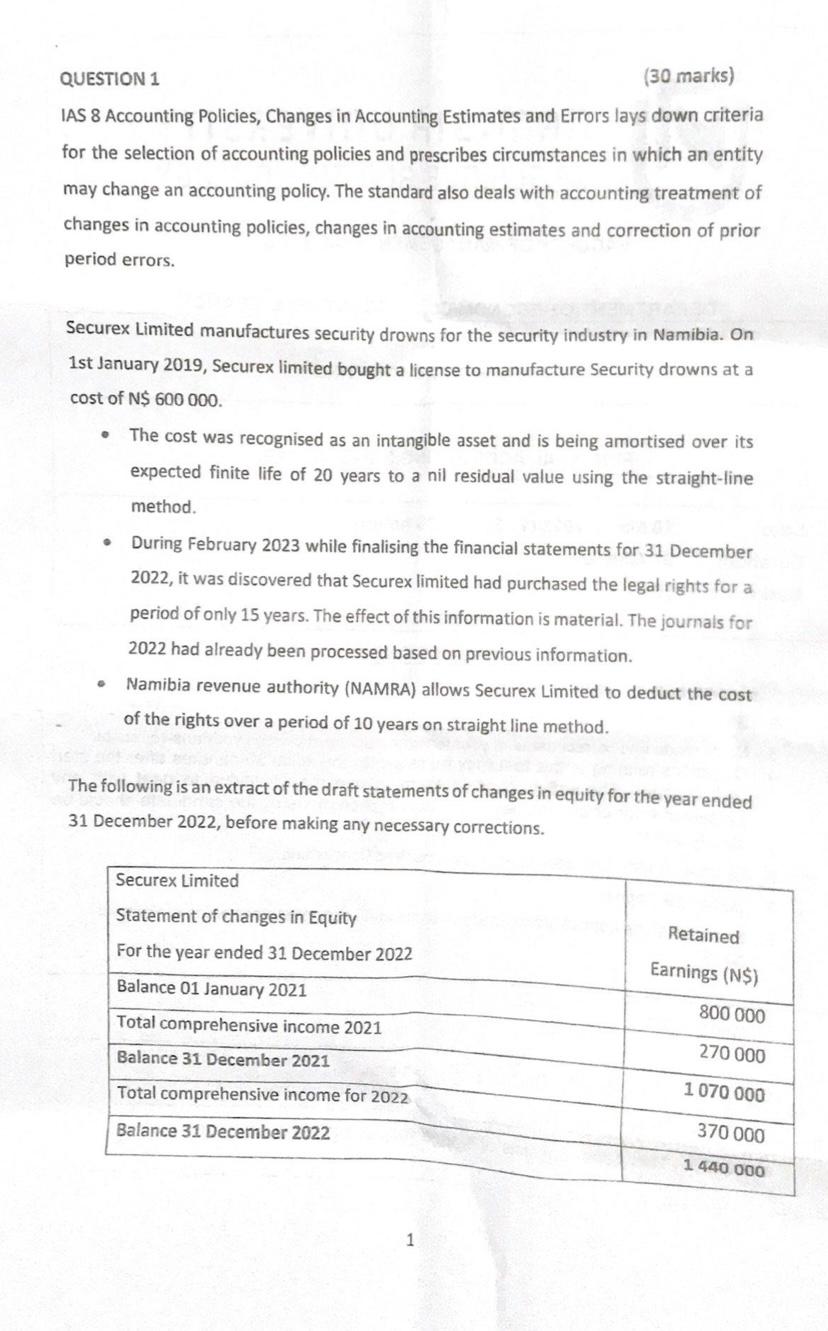

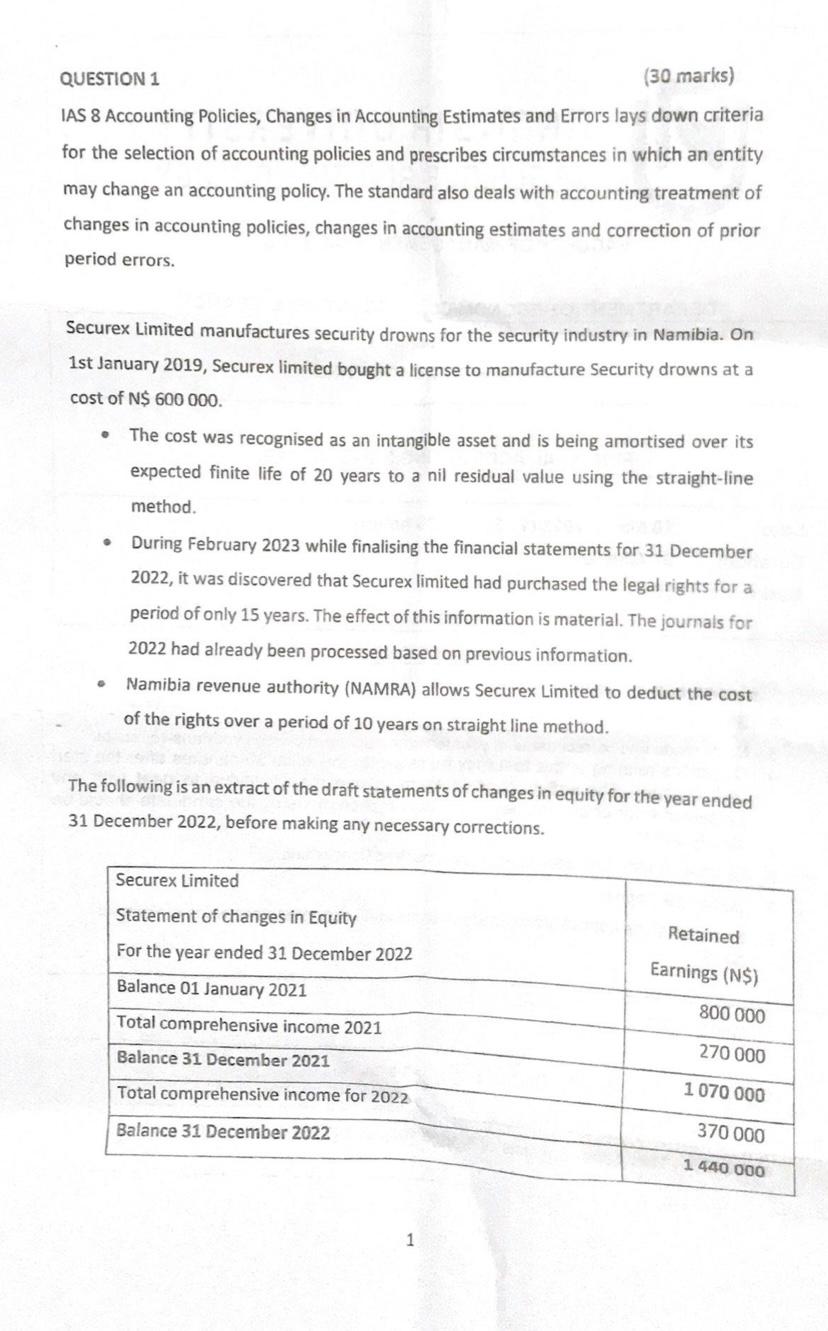

QUESTION 1 ( 30 mariks) IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors lays down criteria for the selection of accounting policies and prescribes circumstances in which an entity may change an accounting policy. The standard also deals with accounting treatment of changes in accounting policies, changes in accounting estimates and correction of prior period errors. Securex Limited manufactures security drowns for the security industry in Namibia. On 1st January 2019, Securex limited bought a license to manufacture Security drowns at a cost of N$600000. - The cost was recognised as an intangible asset and is being amortised over its expected finite life of 20 years to a nil residual value using the straight-line method. - During February 2023 while finalising the financial statements for 31 December 2022, it was discovered that Securex limited had purchased the legal rights for a period of only 15 years. The effect of this information is material. The journals for 2022 had already been processed based on previous information. - Namibia revenue authority (NAMRA) allows Securex Limited to deduct the cost of the rights over a period of 10 years on straight line method. QUESTION 1 ( 30 mariks) IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors lays down criteria for the selection of accounting policies and prescribes circumstances in which an entity may change an accounting policy. The standard also deals with accounting treatment of changes in accounting policies, changes in accounting estimates and correction of prior period errors. Securex Limited manufactures security drowns for the security industry in Namibia. On 1st January 2019, Securex limited bought a license to manufacture Security drowns at a cost of N$600000. - The cost was recognised as an intangible asset and is being amortised over its expected finite life of 20 years to a nil residual value using the straight-line method. - During February 2023 while finalising the financial statements for 31 December 2022, it was discovered that Securex limited had purchased the legal rights for a period of only 15 years. The effect of this information is material. The journals for 2022 had already been processed based on previous information. - Namibia revenue authority (NAMRA) allows Securex Limited to deduct the cost of the rights over a period of 10 years on straight line method