(Product line) Online Toy Co.s operations are separated into two geographical divisions: United States and Mexico. The...

Question:

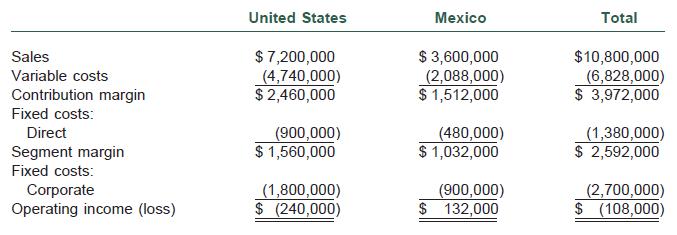

(Product line) Online Toy Co.’s operations are separated into two geographical divisions: United States and Mexico. The operating results of each division for 2001 are shown below:

Corporate fixed costs are allocated to the divisions based on relative sales.

Assume that all direct fixed costs of a division could be avoided if the division were eliminated. Because the U.S. Division is operating at a loss, the president is considering eliminating it.

a. If the U.S. Division had been eliminated at the beginning of the year, what would pretax income have been for Online Toy Co.?

b. Recast the income statements into a more meaningful format than the one given. Why would total corporate operating results go from a $108,000 loss to the results determined in part (a)?

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780324180909

5th Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney