Question 1 (30 marks) (a) Tomobusan Gold Ltd wanted to fund its new project by issuing unsecured bond with a face value of $1,000.

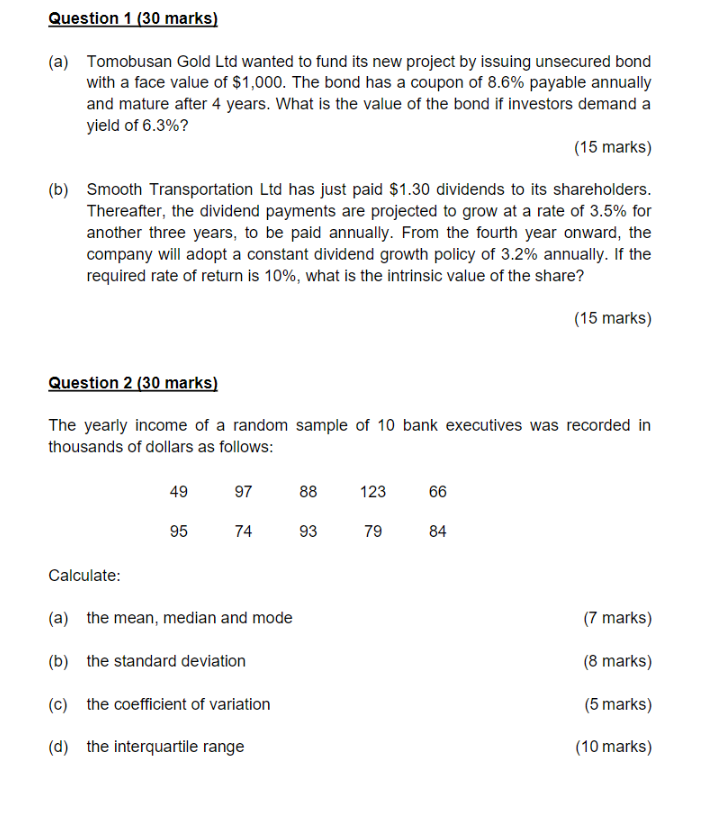

Question 1 (30 marks) (a) Tomobusan Gold Ltd wanted to fund its new project by issuing unsecured bond with a face value of $1,000. The bond has a coupon of 8.6% payable annually and mature after 4 years. What is the value of the bond if investors demand a yield of 6.3%? (15 marks) (b) Smooth Transportation Ltd has just paid $1.30 dividends to its shareholders. Thereafter, the dividend payments are projected to grow at a rate of 3.5% for another three years, to be paid annually. From the fourth year onward, the company will adopt a constant dividend growth policy of 3.2% annually. If the required rate of return is 10%, what is the intrinsic value of the share? (15 marks) Question 2 (30 marks) The yearly income of a random sample of 10 bank executives was recorded in thousands of dollars as follows: 49 97 88 123 66 95 74 93 79 84 Calculate: (a) the mean, median and mode (b) the standard deviation (7 marks) (8 marks) (c) the coefficient of variation (5 marks) (d) the interquartile range (10 marks)

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Sure based on the image you sent it appears to be a question about calculating the yearly income and some statistics for a sample of 10 bank executive...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started