Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (30 marks) The Botswana Bond Market has the following issuers and issues of fixed income securities in 2022: 1. Botswana Housing Corporation (BHC)

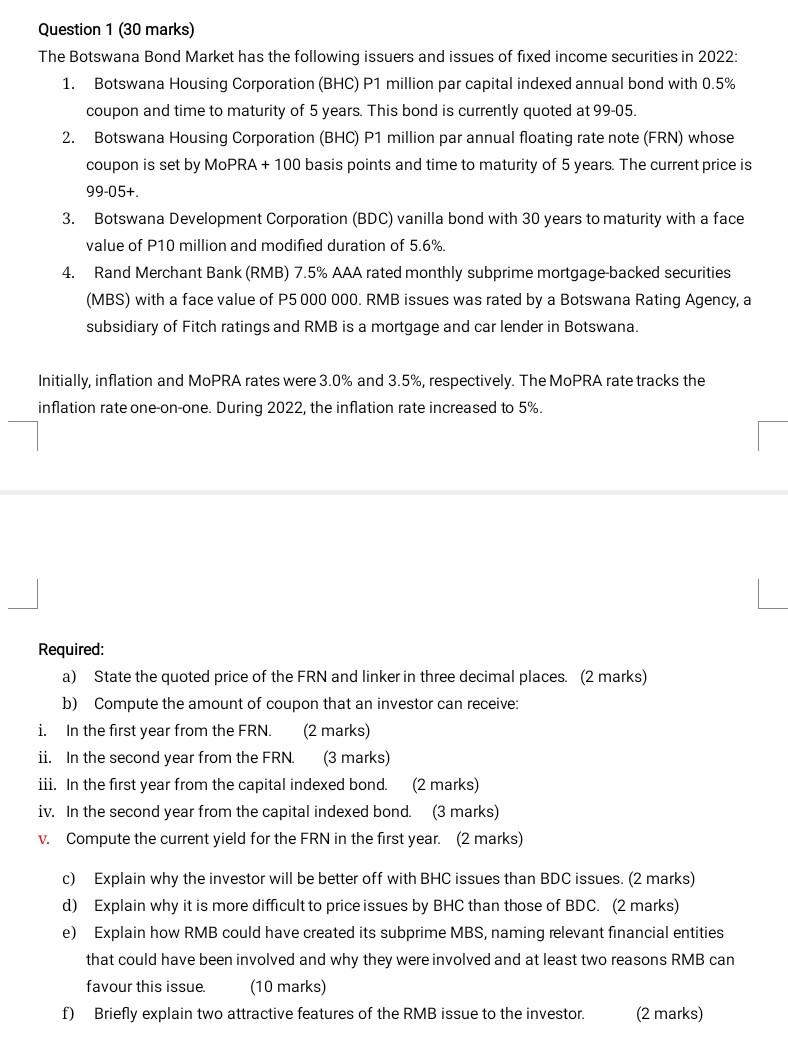

Question 1 (30 marks) The Botswana Bond Market has the following issuers and issues of fixed income securities in 2022: 1. Botswana Housing Corporation (BHC) P1 million par capital indexed annual bond with 0.5% coupon and time to maturity of 5 years. This bond is currently quoted at 99-05. 2. Botswana Housing Corporation (BHC) P1 million par annual floating rate note (FRN) whose coupon is set by MoPRA +100 basis points and time to maturity of 5 years. The current price is 99-05t. 3. Botswana Development Corporation (BDC) vanilla bond with 30 years to maturity with a face value of P10 million and modified duration of 5.6%. 4. Rand Merchant Bank (RMB) 7.5\% AAA rated monthly subprime mortgage-backed securities (MBS) with a face value of P5 000 000. RMB issues was rated by a Botswana Rating Agency, a subsidiary of Fitch ratings and RMB is a mortgage and car lender in Botswana. Initially, inflation and MoPRA rates were 3.0% and 3.5%, respectively. The MoPRA rate tracks the inflation rate one-on-one. During 2022 , the inflation rate increased to 5%. Required: a) State the quoted price of the FRN and linker in three decimal places. (2 marks) b) Compute the amount of coupon that an investor can receive: i. In the first year from the FRN. (2 marks) ii. In the second year from the FRN. (3 marks) iii. In the first year from the capital indexed bond. (2 marks) iv. In the second year from the capital indexed bond. (3 marks) v. Compute the current yield for the FRN in the first year. (2 marks) c) Explain why the investor will be better off with BHC issues than BDC issues. (2 marks) d) Explain why it is more difficult to price issues by BHC than those of BDC. (2 marks) e) Explain how RMB could have created its subprime MBS, naming relevant financial entities that could have been involved and why they were involved and at least two reasons RMB can favour this issue. (10 marks) f) Briefly explain two attractive features of the RMB issue to the investor. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started